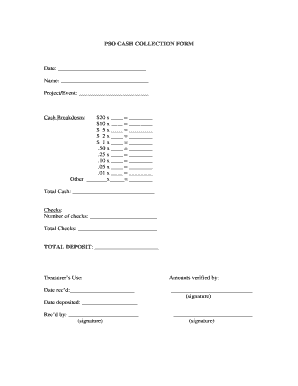

Cash Collection Form

What is the money collection sheet?

The money collection sheet is a document used to track and manage the collection of funds from various sources. This form is essential for businesses and individuals who need to maintain accurate financial records. It typically includes details such as the amount collected, the date of collection, the source of the funds, and any relevant notes. By using a money collection sheet, users can ensure transparency and accountability in their financial transactions.

How to use the money collection sheet

Using a money collection sheet involves several straightforward steps. First, gather all necessary information regarding the funds being collected. This includes the amount, the payer's details, and the purpose of the collection. Next, enter this information into the designated fields of the sheet. It's important to keep the sheet updated with each transaction to maintain accurate records. Regularly reviewing the sheet can help identify any discrepancies and ensure all funds are accounted for.

Steps to complete the money collection sheet

Completing the money collection sheet requires attention to detail. Start by entering the date of the transaction in the appropriate section. Then, list the name of the individual or organization from whom the money is being collected. Next, input the amount collected and specify the method of payment, such as cash, check, or electronic transfer. Finally, include any notes that may be relevant, such as payment terms or follow-up actions. After filling out the sheet, review it for accuracy before saving or sharing it.

Legal use of the money collection sheet

The money collection sheet can serve as a legally binding document when properly completed. To ensure its legal validity, it is crucial to include accurate information and signatures where required. In the United States, electronic signatures are recognized under the ESIGN and UETA Acts, provided that specific conditions are met. Using a reliable eSignature platform can enhance the legal standing of your money collection sheet by providing an electronic certificate of authenticity.

Key elements of the money collection sheet

A well-structured money collection sheet contains several key elements. These typically include:

- Date: The date when the funds were collected.

- Payer Information: The name and contact details of the individual or organization making the payment.

- Amount Collected: The total amount of money received.

- Payment Method: The method used for the transaction, such as cash, check, or credit card.

- Notes: Any additional remarks or instructions related to the collection.

Examples of using the money collection sheet

Money collection sheets can be utilized in various scenarios. For instance, a small business may use it to track customer payments for services rendered. Non-profit organizations often employ these sheets to manage donations from supporters. Additionally, schools might use a money collection sheet to record fees collected from students for events or activities. Each of these examples highlights the versatility and importance of maintaining accurate financial records.

Quick guide on how to complete cash collection form 327748755

Easily Prepare Cash Collection Form on Any Device

The management of documents online has become increasingly favored by both businesses and individuals. It offers an excellent eco-friendly alternative to traditional paper documents that require printing and signing, as you can access the proper format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Cash Collection Form on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

Edit and Electronically Sign Cash Collection Form with Ease

- Find Cash Collection Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize signNow sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Cash Collection Form and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cash collection form 327748755

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a cash collection form?

A cash collection form is a document used by businesses to formally request payment from customers. This form streamlines the payment process by detailing the amount owed and the payment method, making it easier to track transactions.

-

How can airSlate SignNow help with cash collection forms?

airSlate SignNow simplifies the creation and management of cash collection forms. Through our platform, you can design customized forms, send them for eSignature, and automate payment reminders to ensure timely collections.

-

Is there a cost associated with using airSlate SignNow for cash collection forms?

Yes, airSlate SignNow offers competitive pricing plans to cater to businesses of all sizes. Each plan grants access to features like cash collection form templates, advanced analytics, and bulk sending options, ensuring great value.

-

Can I track the status of my cash collection forms sent through airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking of all your cash collection forms. You will receive notifications when a form is viewed, signed, or if there are any pending actions needed from your customers.

-

Are cash collection forms customizable in airSlate SignNow?

Yes, airSlate SignNow allows you to fully customize your cash collection forms. You can add your branding, adjust fields to fit your business needs, and include specific payment instructions, enhancing your customer experience.

-

What integrations are available for cash collection forms with airSlate SignNow?

airSlate SignNow seamlessly integrates with various applications such as CRM systems, payment processors, and accounting software. These integrations make it easy to sync your cash collection forms and improve your overall workflow.

-

What benefits does using a cash collection form provide?

Using a cash collection form streamlines the payment process, reduces errors, and ensures that your transactions are documented. This method not only enhances cash flow management but also improves customer transparency and trust.

Get more for Cash Collection Form

- Instructions for form 662sf alaska mining license tax return 6967263

- Tax alaska 6967266 form

- Veteran employment tax credit instructions form

- Tax alaska 6967142 form

- Application for sales and use tax certificate of formupack

- Application for replacement credentials alabama department of revenue alabama form

- Al 8453 c form

- Alabama a4 form

Find out other Cash Collection Form

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation