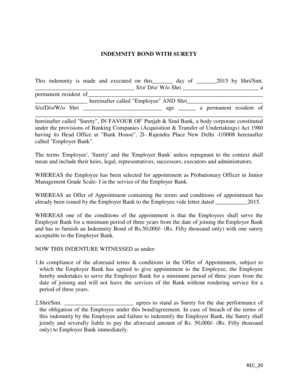

Indemnity Bond with Surety Form

What is the indemnity bond with surety?

An indemnity bond with surety is a legally binding agreement that protects one party from potential losses or damages incurred by another party. This type of bond typically involves three parties: the principal (the party required to obtain the bond), the obligee (the party requiring the bond), and the surety (the company that issues the bond). The surety guarantees that the principal will fulfill their obligations, and if they fail to do so, the surety will compensate the obligee for any losses. This bond is commonly used in various industries, including construction, finance, and real estate, to ensure compliance with legal and contractual obligations.

How to obtain the indemnity bond with surety

Obtaining an indemnity bond with surety involves several steps. First, identify the specific requirements set by the obligee, as these can vary depending on the industry and state regulations. Next, gather the necessary documentation, which may include financial statements, credit history, and information about the project or obligation. Once you have the required documents, approach a surety company or broker to discuss your needs. They will assess your application and determine the bond amount and premium based on your financial stability and risk factors. After approval, you will receive the bond, which you can then present to the obligee.

Steps to complete the indemnity bond with surety

Completing the indemnity bond with surety requires careful attention to detail. Follow these steps to ensure proper completion:

- Read the bond form thoroughly to understand all terms and conditions.

- Fill in the principal's information accurately, including name, address, and contact details.

- Provide the obligee's information, ensuring it matches the requirements specified.

- Enter the bond amount, which should reflect the value required by the obligee.

- Ensure that all signatures are obtained from the principal and surety representatives.

- Review the completed bond for accuracy before submission.

Legal use of the indemnity bond with surety

The legal use of an indemnity bond with surety is essential for protecting the rights of all parties involved. This bond is often required by government agencies or private entities to ensure that the principal adheres to specific regulations or contractual obligations. Failure to comply can result in penalties, including financial loss for the obligee. It is crucial to understand the legal implications of the bond, including the conditions under which claims can be made and the responsibilities of each party. Consulting with a legal professional can help clarify these aspects and ensure compliance with applicable laws.

Required documents for the indemnity bond with surety

When applying for an indemnity bond with surety, several documents are typically required to facilitate the process. These may include:

- Completed bond application form.

- Financial statements, such as balance sheets and income statements.

- Personal and business credit reports.

- Details about the project or obligation that necessitates the bond.

- Identification documents for the principal, such as a driver's license or passport.

Providing accurate and complete documentation can expedite the approval process and increase the likelihood of obtaining the bond.

State-specific rules for the indemnity bond with surety

State-specific rules regarding indemnity bonds with surety can vary significantly. Each state may have its own regulations governing the bond amount, the types of projects that require a bond, and the process for filing claims. It is important to research the specific requirements in your state to ensure compliance. This may involve checking with state regulatory agencies or consulting with a surety bond expert who understands local laws. Being aware of these rules can help avoid potential legal issues and ensure that the bond is valid and enforceable.

Quick guide on how to complete indemnity bond with surety

Effortlessly Prepare Indemnity Bond With Surety on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents rapidly without delays. Handle Indemnity Bond With Surety on any device with airSlate SignNow’s Android or iOS applications and streamline any form-related tasks today.

How to Modify and Electronically Sign Indemnity Bond With Surety with Ease

- Obtain Indemnity Bond With Surety and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive details using tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or download it directly to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Indemnity Bond With Surety, ensuring effective communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the indemnity bond with surety

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an indemnity bond with surety?

An indemnity bond with surety is a legally binding agreement that protects a party by ensuring that a specified obligation will be fulfilled. If a party fails to meet their obligations, the surety will step in and compensate the party suffering loss. This bond is particularly useful in various industries, providing peace of mind and coverage against financial liabilities.

-

How does airSlate SignNow facilitate indemnity bond with surety transactions?

airSlate SignNow simplifies the process of managing indemnity bonds with surety by allowing businesses to easily send, eSign, and store documents electronically. The platform's user-friendly interface ensures that all parties can quickly access and execute the necessary agreements. This efficiency helps streamline the bond approval process, saving time and effort for everyone involved.

-

What are the pricing options for using airSlate SignNow for indemnity bond with surety?

airSlate SignNow offers flexible pricing plans suited for businesses of all sizes looking to manage indemnity bonds with surety efficiently. Users can choose from monthly or annual subscription options, with features tailored to support their specific needs. This cost-effective solution makes it easier for companies to budget for their documentation processes.

-

What features does airSlate SignNow provide for managing indemnity bonds with surety?

airSlate SignNow provides a range of features for managing indemnity bonds with surety, including customizable templates, secure eSignature capabilities, and real-time tracking of document status. These features ensure that the signing and approval processes are not only secure but also quick and efficient. Additionally, the software integrates seamlessly with other tools, enhancing overall workflow.

-

What benefits does an indemnity bond with surety offer to businesses?

An indemnity bond with surety offers numerous benefits to businesses, including protection against financial loss, enhanced credibility, and compliance with legal requirements. It assures clients and stakeholders that the business has the financial backing to fulfill its obligations. This bond is essential in building trust and securing contracts in various industries.

-

Can I customize my indemnity bond with surety documents using airSlate SignNow?

Yes, airSlate SignNow allows users to customize their indemnity bond with surety documents according to their specific needs. With the platform's template creation tools, businesses can tailor wording and agreements to meet individual requirements. This flexibility ensures that all documents are relevant and applicable to each unique situation.

-

How does airSlate SignNow ensure the security of indemnity bonds with surety?

airSlate SignNow prioritizes security, implementing advanced encryption and authentication measures to protect all indemnity bonds with surety. All documents are stored securely in compliance with industry standards, minimizing the risk of unauthorized access. This commitment to security helps businesses manage sensitive information confidently and transparently.

Get more for Indemnity Bond With Surety

Find out other Indemnity Bond With Surety

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template