Ngif Latest Four Wheeler Loan Form

What is the Ngif Latest Four Wheeler Loan

The Ngif Latest Four Wheeler Loan is a financial product designed to assist individuals in purchasing new or used vehicles. This loan typically offers competitive interest rates and flexible repayment terms, making it accessible for a wide range of borrowers. It is specifically tailored for those looking to finance their automotive needs while ensuring manageable monthly payments.

How to obtain the Ngif Latest Four Wheeler Loan

To obtain the Ngif Latest Four Wheeler Loan, potential borrowers should follow a structured process. First, gather necessary documentation, including proof of income, credit history, and identification. Next, research various lenders to compare interest rates and terms. Once a suitable lender is chosen, complete the loan application, providing accurate information. After submission, the lender will review the application and may request additional documentation before approving the loan.

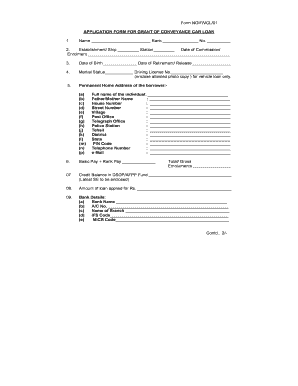

Steps to complete the Ngif Latest Four Wheeler Loan

Completing the Ngif Latest Four Wheeler Loan involves several key steps. Start by filling out the loan application form with accurate details. Ensure all required documents, such as income verification and identification, are attached. After submitting the application, monitor its status and respond promptly to any requests from the lender. Once approved, review the loan agreement carefully before signing, ensuring you understand all terms and conditions.

Legal use of the Ngif Latest Four Wheeler Loan

The legal use of the Ngif Latest Four Wheeler Loan requires compliance with federal and state regulations. This includes adhering to lending laws that protect consumers, such as the Truth in Lending Act, which mandates clear disclosure of loan terms. Additionally, borrowers must use the funds for purchasing a vehicle, as specified in the loan agreement. Misuse of the loan can lead to legal repercussions and potential penalties.

Key elements of the Ngif Latest Four Wheeler Loan

Key elements of the Ngif Latest Four Wheeler Loan include the loan amount, interest rate, repayment period, and any associated fees. Understanding these components is crucial for borrowers to make informed decisions. The interest rate may vary based on creditworthiness, while the repayment period typically ranges from three to seven years. Borrowers should also be aware of any origination fees or penalties for early repayment.

Eligibility Criteria

Eligibility for the Ngif Latest Four Wheeler Loan generally includes factors such as credit score, income level, and employment status. Most lenders require a minimum credit score to qualify, which can vary by institution. Additionally, a stable income and employment history are essential to demonstrate the ability to repay the loan. Some lenders may also consider debt-to-income ratios when assessing eligibility.

Quick guide on how to complete ngif latest four wheeler loan

Complete Ngif Latest Four Wheeler Loan seamlessly on any gadget

Digital document handling has gained traction with enterprises and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to locate the proper form and safely store it online. airSlate SignNow provides you with all the features necessary to create, alter, and eSign your documents quickly without delays. Manage Ngif Latest Four Wheeler Loan on any gadget using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Ngif Latest Four Wheeler Loan effortlessly

- Find Ngif Latest Four Wheeler Loan and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant portions of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to preserve your changes.

- Select how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Ngif Latest Four Wheeler Loan and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ngif latest four wheeler loan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an ngif loan?

An ngif loan is a financial product that allows businesses to access funds quickly and efficiently. It is designed for organizations seeking to finance various operational needs, making it a versatile solution for improving cash flow.

-

How does the ngif loan work?

The ngif loan process is straightforward, enabling businesses to apply online and receive approval often within a day. After approval, funds are disbursed quickly, allowing for immediate access to capital.

-

What are the benefits of an ngif loan?

One of the main benefits of an ngif loan is its flexibility in funding, which can be used for a range of business expenses. Additionally, the application process is typically faster and more convenient than traditional loans, helping businesses meet urgent financial needs.

-

What features does the ngif loan offer?

The ngif loan includes features such as flexible repayment terms, competitive interest rates, and minimal paperwork. These features make it a preferred choice for businesses looking for a hassle-free borrowing experience.

-

Is the ngif loan suitable for small businesses?

Yes, the ngif loan is particularly suitable for small businesses that may face challenges accessing traditional financing. Its flexible terms and quicker approvals cater to the unique financial needs of smaller enterprises.

-

What are the integration options for ngif loan?

The ngif loan integrates seamlessly with various business management tools, enhancing financial tracking and management. This ensures that businesses can align their loan management with their overall financial systems and processes.

-

What are the costs associated with an ngif loan?

Costs associated with an ngif loan typically include interest rates and possible origination fees. However, the overall cost remains competitive, making it an attractive option for businesses looking to manage their finances effectively.

Get more for Ngif Latest Four Wheeler Loan

Find out other Ngif Latest Four Wheeler Loan

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation