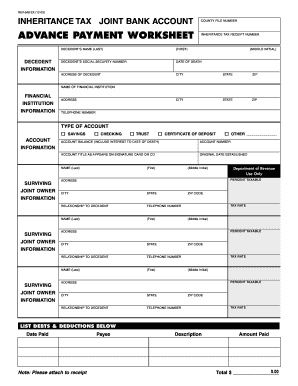

Inheritance Tax Joint Bank Account Advance Payment Worksheet REV 548 FormsPublications

Understanding the Inheritance Document

An inheritance document is a crucial legal form that outlines the distribution of assets and liabilities of a deceased individual. This document serves as a formal record of how the deceased's estate will be divided among heirs or beneficiaries. It is essential for ensuring that the wishes of the deceased are respected and followed according to the law. In the United States, the inheritance document must comply with specific state laws and regulations, which can vary significantly. Understanding these requirements is vital for anyone dealing with estate planning or the probate process.

Key Elements of the Inheritance Document

Several key elements must be included in an inheritance document to ensure its validity. These elements typically consist of:

- Identification of the deceased: Full name, date of birth, and date of death.

- List of assets: Detailed information about all assets, including real estate, bank accounts, and personal property.

- Beneficiaries: Names and contact information of all individuals or entities entitled to inherit.

- Executor information: The person responsible for managing the estate and ensuring the terms of the document are fulfilled.

- Signatures: Required signatures of the deceased (if applicable) and witnesses to validate the document.

Steps to Complete the Inheritance Document

Completing an inheritance document involves several important steps to ensure it is legally binding and accurately reflects the deceased's wishes:

- Gather all necessary information about the deceased's assets and liabilities.

- Identify all beneficiaries and their respective shares in the estate.

- Draft the document, ensuring all key elements are included.

- Have the document reviewed by a legal professional to ensure compliance with state laws.

- Obtain the required signatures from witnesses and the executor.

- Store the document in a safe place, and provide copies to all relevant parties.

Legal Use of the Inheritance Document

The legal use of an inheritance document is paramount in the probate process. This document must be submitted to the probate court to initiate the distribution of the estate. It serves as proof of the deceased's wishes and is essential for resolving any disputes among beneficiaries. In addition, the document must comply with state-specific laws to be considered valid. Failure to adhere to these regulations can result in delays and complications in the probate process.

Obtaining the Inheritance Document

To obtain an inheritance document, individuals can follow these steps:

- Consult with an estate planning attorney to understand the specific requirements in your state.

- Access templates or forms that comply with state laws, which can often be found through legal resources or law firms.

- Ensure that the document is tailored to reflect the unique circumstances of the estate.

Filing Deadlines / Important Dates

Filing deadlines for inheritance documents can vary by state and the complexity of the estate. It is crucial to be aware of these timelines to avoid penalties or complications. Generally, the executor must file the inheritance document with the probate court within a specific period after the death of the individual, often ranging from a few weeks to several months. Keeping track of these deadlines is essential for ensuring a smooth probate process.

Quick guide on how to complete inheritance tax joint bank account advance payment worksheet rev 548 formspublications

Complete Inheritance Tax Joint Bank Account Advance Payment Worksheet REV 548 FormsPublications effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle Inheritance Tax Joint Bank Account Advance Payment Worksheet REV 548 FormsPublications on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign Inheritance Tax Joint Bank Account Advance Payment Worksheet REV 548 FormsPublications effortlessly

- Find Inheritance Tax Joint Bank Account Advance Payment Worksheet REV 548 FormsPublications and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow satisfies all your document management requirements in just a few clicks from any device of your choice. Edit and eSign Inheritance Tax Joint Bank Account Advance Payment Worksheet REV 548 FormsPublications and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the inheritance tax joint bank account advance payment worksheet rev 548 formspublications

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an inheritance document and why is it important?

An inheritance document is a legal form that outlines how a person's assets will be distributed after their passing. It is important because it ensures that the wishes of the deceased are honored and can help prevent disputes among heirs.

-

How does airSlate SignNow facilitate the creation of inheritance documents?

airSlate SignNow provides templates and tools that simplify the process of creating an inheritance document. Users can easily customize their documents and include necessary legal language, ensuring compliance and clarity in asset distribution.

-

Is it secure to store inheritance documents on airSlate SignNow?

Yes, airSlate SignNow employs robust encryption and security measures to protect your inheritance documents. This means that your sensitive information remains confidential and is accessible only to authorized parties.

-

Can multiple parties eSign an inheritance document using airSlate SignNow?

Absolutely! airSlate SignNow allows multiple parties to eSign an inheritance document simultaneously, making the process efficient and ensuring that all necessary signatures are collected promptly.

-

What pricing plans are available for creating inheritance documents with airSlate SignNow?

airSlate SignNow offers several pricing plans, ranging from basic to premium, tailored to different user needs. This flexibility ensures that anyone can afford a reliable solution for managing their inheritance documents.

-

Are there any integrations available for airSlate SignNow to manage inheritance documents?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing you to manage your inheritance documents alongside other business tools. This can streamline your workflow and enhance document management capabilities.

-

What benefits does airSlate SignNow offer for managing inheritance documents?

Benefits of using airSlate SignNow for inheritance documents include ease of use, cost-effectiveness, and quick turnaround times. The platform allows for efficient tracking of document statuses, ensuring that all parties are informed.

Get more for Inheritance Tax Joint Bank Account Advance Payment Worksheet REV 548 FormsPublications

Find out other Inheritance Tax Joint Bank Account Advance Payment Worksheet REV 548 FormsPublications

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement