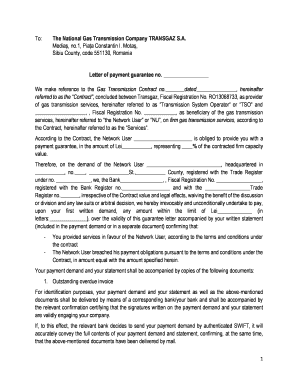

Payment Guarantee Form

What is the Payment Guarantee

A payment guarantee is a formal document that assures a creditor that a debtor will fulfill their financial obligations. This form serves as a commitment from a third party, often a bank or financial institution, to cover the payment if the primary debtor defaults. It is commonly used in various business transactions, including loans, leases, and contracts, providing security to the creditor while facilitating smoother financial dealings.

Key Elements of the Payment Guarantee

Understanding the essential components of a payment guarantee form is crucial for its effective use. Key elements include:

- Parties Involved: Clearly identify the debtor, creditor, and guarantor.

- Payment Amount: Specify the exact amount guaranteed.

- Conditions of Guarantee: Outline the circumstances under which the guarantee is valid.

- Duration: State the time frame for which the guarantee is effective.

- Signature Requirements: Include necessary signatures from all parties to validate the agreement.

Steps to Complete the Payment Guarantee

Filling out a payment guarantee form involves several straightforward steps:

- Gather necessary information about all parties involved.

- Clearly define the payment amount and terms of the guarantee.

- Ensure all parties understand the conditions outlined in the form.

- Obtain signatures from the guarantor, debtor, and creditor.

- Store the completed form securely for future reference.

Legal Use of the Payment Guarantee

To ensure that a payment guarantee is legally binding, certain requirements must be met. The document should comply with applicable laws, such as the Uniform Commercial Code (UCC) in the United States. It is essential to ensure that all signatures are authentic and that the form is executed in accordance with state laws. Additionally, using a reliable electronic signature platform can enhance the legal standing of the document.

How to Use the Payment Guarantee

A payment guarantee can be utilized in various scenarios, including:

- Securing loans from financial institutions.

- Facilitating lease agreements where a landlord requires assurance of payment.

- Supporting contracts in business transactions to ensure financial obligations are met.

When using the payment guarantee, it is important to communicate clearly with all parties involved to avoid misunderstandings and ensure compliance with the terms outlined in the document.

Examples of Using the Payment Guarantee

Payment guarantees can be applied in numerous real-world situations. For instance:

- A small business seeking a loan may provide a payment guarantee from a larger corporation to secure funding.

- A landlord might request a payment guarantee from a tenant's employer to ensure rent will be paid on time.

- In construction contracts, a contractor may require a payment guarantee from a subcontractor to ensure project completion without financial issues.

Quick guide on how to complete payment guarantee

Complete Payment Guarantee effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your papers quickly and without delays. Handle Payment Guarantee on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

How to modify and eSign Payment Guarantee with ease

- Find Payment Guarantee and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the document or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Payment Guarantee and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the payment guarantee

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a guarantee of payment form and how does it work?

A guarantee of payment form is a legally binding document that ensures a payment will be made for goods or services provided. With airSlate SignNow, users can easily create, customize, and send this form for electronic signatures, streamlining the payment assurance process.

-

How can airSlate SignNow help my business with guarantee of payment forms?

airSlate SignNow offers features like customizable templates and secure eSigning to help businesses manage their guarantee of payment forms efficiently. This solution reduces paperwork, saves time, and enhances the overall management of payment processes.

-

What are the pricing options for using airSlate SignNow with a guarantee of payment form?

airSlate SignNow provides flexible pricing plans that cater to businesses of all sizes. Each plan includes access to features for managing guarantee of payment forms, ensuring that you find a cost-effective solution that fits your needs.

-

Can I integrate other software with airSlate SignNow for guarantee of payment forms?

Yes, airSlate SignNow supports integrations with various software platforms, allowing you to seamlessly connect other tools you use to manage guarantee of payment forms. This flexibility improves your workflow and boosts productivity.

-

What are the benefits of using an electronic guarantee of payment form?

Using an electronic guarantee of payment form provides several benefits, including increased efficiency, enhanced security, and lower costs. With airSlate SignNow, you can ensure that your payment guarantees are handled quickly and professionally.

-

Is there a mobile app available for managing guarantee of payment forms?

Yes, airSlate SignNow offers a mobile app that allows you to create, send, and manage guarantee of payment forms on the go. This portability ensures that you can handle your payment processes anytime, anywhere.

-

How can I track the status of my guarantee of payment forms?

airSlate SignNow provides real-time tracking for all guarantee of payment forms you send out. You can easily monitor whether a document has been viewed, signed, or is still pending, ensuring you’re always informed about payment agreements.

Get more for Payment Guarantee

Find out other Payment Guarantee

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim