B2014b Schedule M 3 Form B1065b BIRSbgov Irs

Understanding the M3 Schedule Form

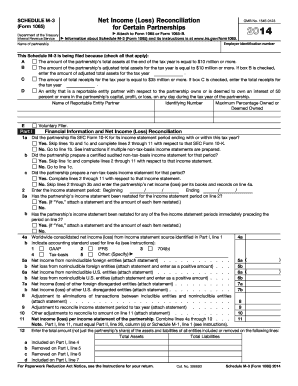

The M3 Schedule is an essential tax form used by partnerships to report their income, deductions, and other relevant financial information. Specifically, it is part of the Form 1065 package, which is required for partnerships filing their annual tax returns with the Internal Revenue Service (IRS). This form helps ensure that the partnership's financial activities are accurately reported and compliant with federal tax regulations.

Steps to Complete the M3 Schedule

Completing the M3 Schedule involves several key steps to ensure accuracy and compliance:

- Gather Necessary Information: Collect all financial records, including income statements, expense reports, and prior year tax returns.

- Fill Out Basic Information: Enter the partnership's name, address, and Employer Identification Number (EIN) at the top of the form.

- Report Income: Accurately report all sources of income, including ordinary business income and other income types.

- Detail Deductions: List all allowable deductions, ensuring they comply with IRS guidelines.

- Complete Additional Sections: Fill out any additional sections that apply to your partnership, such as capital account analysis.

- Review for Accuracy: Double-check all entries for accuracy before submitting the form.

Legal Use of the M3 Schedule

The M3 Schedule is legally binding when completed and submitted according to IRS regulations. It must be signed by a partner or authorized representative of the partnership. The accuracy of the information provided is crucial, as incorrect filings can lead to penalties or audits. Compliance with federal tax laws ensures that partnerships maintain their legal status and avoid potential legal issues.

Filing Deadlines for the M3 Schedule

Partnerships must file the M3 Schedule as part of their Form 1065 by the due date, which is typically March 15 for calendar year partnerships. If additional time is needed, partnerships can file for an extension, allowing them to submit the form by September 15. It is important to adhere to these deadlines to avoid late filing penalties.

Examples of Using the M3 Schedule

The M3 Schedule can be used in various scenarios, including:

- Partnerships with Multiple Income Sources: Partnerships that generate income from different activities must report each source accurately on the M3 Schedule.

- Partnerships with Deductions: Partnerships that incur business expenses can utilize the M3 Schedule to detail these deductions, helping to reduce taxable income.

- Capital Contributions: Partnerships that receive capital contributions from partners must report these transactions on the M3 Schedule to maintain accurate capital accounts.

IRS Guidelines for the M3 Schedule

The IRS provides specific guidelines for completing the M3 Schedule, which include:

- Compliance with Tax Laws: Ensure that all reported income and deductions comply with current tax laws and IRS regulations.

- Accurate Reporting: All figures must be accurate and reflective of the partnership's financial activities for the tax year.

- Documentation: Maintain documentation for all reported items, as the IRS may request supporting documents during an audit.

Quick guide on how to complete schedule m3 1065

Effortlessly Prepare schedule m3 1065 on Any Device

The management of documents online has gained traction among companies and individuals alike. It offers a brilliant eco-friendly substitute to traditional printed and signed documents, allowing you to locate the suitable form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and digitally sign your documents swiftly without setbacks. Manage m3 schedule on any device with airSlate SignNow's Android or iOS applications and streamline any document-focused process today.

Steps to Modify and Digitally Sign what is schedule m 3 with Ease

- Obtain what is a schedule m3 and click on Get Form to begin.

- Utilize the features we offer to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your digital signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from your preferred device. Modify and digitally sign schedule m3 instructions while ensuring clear communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs schedule m 3 example

-

What form do I need to fill out when I’m a self-employee but the business belongs to my sister and mine (IRS question)?

Thanks Bruce. Edited answer below:Ok. It's time you do some reading…and if your business made decent money, get a tax accountant.Self employed / sole proprietor: 1040Self employed / LLC: must file Corp business filing and issue K1 then 1040Self employed / LLC w S Corp option: (you should have been on your own payroll) must file Corp business filing and issue K1, then 1040Self employed / C Corp: (you should have been on your own payroll) must file Corp business filing and issue 1099 DIV, then 1040.Corporate business filing and tax is due March 15. You can extend the filing, but any tax is due the March 15. If you don't pay on or before March 15, fees and interest are applied.Personal filing and tax is due April 15. You can extend the filing, but any tax is due on April 15. If you don't pay on or before April 15, fees and interest are applied.Same for your sister.Don't forget to file/pay the company's sales and use taxes, if applicable (State).You will also have to do corporate and personal filings with your state.

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

I’m being sued and I’m representing myself in court. How do I fill out the form called “answer to complaint”?

You can represent yourself. Each form is different per state or county but generally an answer is simply a written document which presents a synopsis of your story to the court. The answer is not your defense, just written notice to the court that you intend to contest the suit. The blank forms are available at the court clerk’s office and are pretty much self explanatoryThere will be a space calling for the signature of an attorney. You should sign your name on the space and write the words “Pro se” after your signature. This lets the court know you are acting as your own attorney.

-

How do I fill out Form 16 if I'm not eligible for IT returns and just want to receive the TDS cut for the 6 months that I've worked?

use File Income Tax Return Online in India: ClearTax | e-Filing Income Tax in 15 minutes | Tax filing | Income Tax Returns | E-file Tax Returns for 2014-15It is free and simple.

Related searches to schedule m 3 1065

Create this form in 5 minutes!

How to create an eSignature for the schedule m 3

How to make an electronic signature for the B2014b Schedule M 3 Form B1065b Birsbgov Irs online

How to create an eSignature for the B2014b Schedule M 3 Form B1065b Birsbgov Irs in Google Chrome

How to generate an eSignature for signing the B2014b Schedule M 3 Form B1065b Birsbgov Irs in Gmail

How to generate an electronic signature for the B2014b Schedule M 3 Form B1065b Birsbgov Irs from your smartphone

How to make an eSignature for the B2014b Schedule M 3 Form B1065b Birsbgov Irs on iOS

How to make an eSignature for the B2014b Schedule M 3 Form B1065b Birsbgov Irs on Android OS

People also ask m3 form

-

What is the m3 schedule in airSlate SignNow?

The m3 schedule refers to the structured timeline that outlines the stages of document signing and processing within airSlate SignNow. This feature allows businesses to easily track their document workflows and ensure timely execution, making it essential for efficient operations.

-

How does the m3 schedule benefit businesses using airSlate SignNow?

By utilizing the m3 schedule, businesses can streamline their document workflows, reduce delays, and enhance overall productivity. This organized approach helps teams stay on track, ensuring that key documents are signed and processed promptly, thereby improving customer satisfaction and operational efficiency.

-

Is there a cost associated with using the m3 schedule feature?

The m3 schedule feature is included in the various pricing tiers of airSlate SignNow, providing businesses with flexible options. Depending on your chosen plan, you can access a range of features that make managing document timelines both affordable and effective.

-

Can I integrate the m3 schedule with other software tools?

Yes, airSlate SignNow offers a variety of integrations, allowing you to connect the m3 schedule with other software applications your business may be using. This interoperability enhances your workflows and ensures that your document management processes are seamless and efficient.

-

What types of documents can be managed with the m3 schedule?

The m3 schedule can be utilized for a wide range of document types, including contracts, agreements, and forms in airSlate SignNow. This flexibility allows businesses to create structured signing timelines for any document requiring electronic signatures, facilitating easier management and tracking.

-

How do I set up the m3 schedule in airSlate SignNow?

Setting up the m3 schedule in airSlate SignNow is simple and user-friendly. Once you log in, you can create a new document workflow and define the stages and timelines necessary for your signing process, enabling you to customize the experience to fit your business needs.

-

What support is available for using the m3 schedule?

AirSlate SignNow offers extensive customer support for users implementing the m3 schedule. From online resources and tutorials to direct assistance from our support team, businesses can receive guidance on optimizing their document workflows and ensuring successful integration.

Get more for schedule m 3 form 1065

Find out other m 3 form

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile