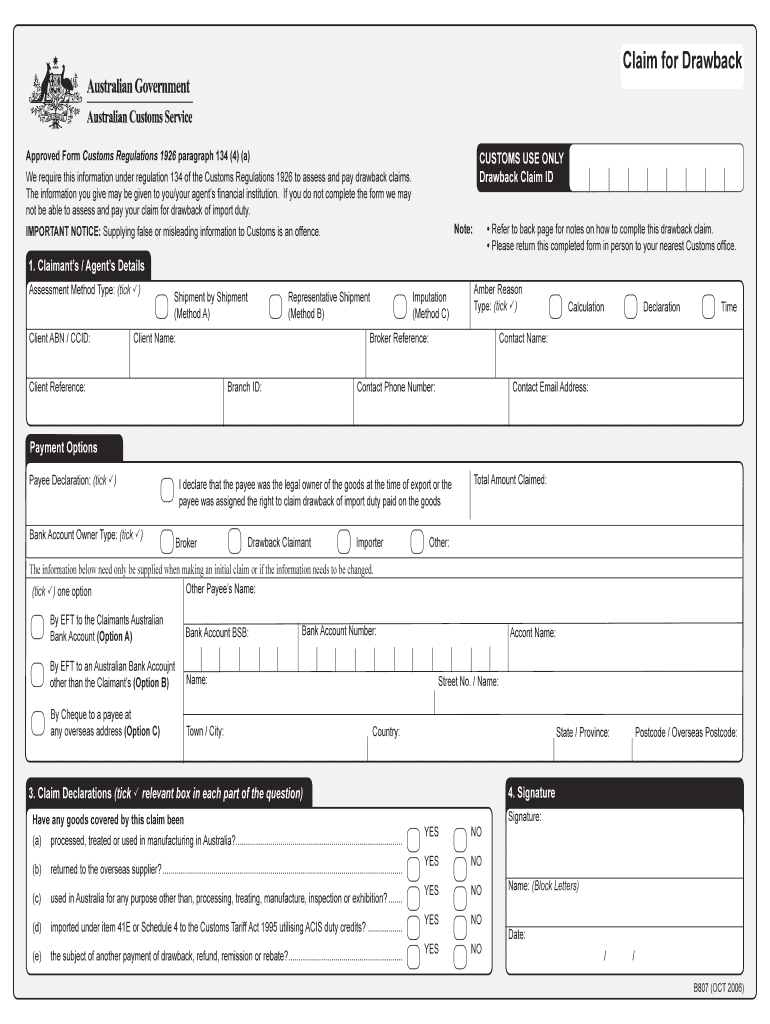

Claim for Drawback Form

What is the Claim For Drawback

The Claim For Drawback is a formal request used by businesses to recover duties paid on imported goods that are subsequently exported or destroyed. This process is governed by U.S. Customs and Border Protection (CBP) regulations. It allows companies to reclaim a portion of the duties, taxes, and fees they initially paid when importing products. Understanding the nuances of this claim is essential for businesses looking to optimize their financial operations and ensure compliance with federal regulations.

Steps to Complete the Claim For Drawback

Completing the Claim For Drawback involves several key steps to ensure accuracy and compliance:

- Gather Required Information: Collect all necessary documentation, including import and export records, invoices, and proof of payment of duties.

- Fill Out the Claim Form: Accurately complete the Claim For Drawback form, ensuring all information is correct and matches your supporting documents.

- Submit the Claim: File the completed form with the appropriate CBP office, either electronically or via mail, depending on your preference and requirements.

- Follow Up: Monitor the status of your claim and be prepared to provide additional information if requested by CBP.

Legal Use of the Claim For Drawback

The legal framework surrounding the Claim For Drawback is critical for ensuring that businesses can reclaim duties without facing penalties. The claim must be filed within three years from the date of importation, and all information provided must be accurate and truthful. Non-compliance with the regulations set forth by CBP can result in penalties, including denial of the claim and potential fines. It is advisable for businesses to familiarize themselves with the legal requirements to avoid complications.

Required Documents

To successfully file a Claim For Drawback, businesses must prepare and submit several key documents:

- Import Documentation: This includes the original bill of lading, entry summary, and any other relevant import records.

- Export Documentation: Proof of export, such as export bills of lading or shipping documents, must be included.

- Proof of Payment: Documentation showing that duties were paid at the time of importation is essential for verification.

- Claim Form: The completed Claim For Drawback form must be submitted as part of the application package.

Filing Deadlines / Important Dates

Timeliness is crucial when submitting a Claim For Drawback. The claim must be filed within three years from the date of importation. Additionally, businesses should be aware of any specific deadlines related to their particular circumstances, such as export timelines or changes in regulations. Keeping track of these dates ensures that claims are filed promptly, maximizing the potential for duty recovery.

Examples of Using the Claim For Drawback

Businesses can utilize the Claim For Drawback in various scenarios. For instance, a manufacturer that imports raw materials to produce goods and later exports the finished products can reclaim the duties paid on the materials. Similarly, a retailer that imports merchandise but later decides to export unsold items can also file a claim. These examples illustrate how the drawback process can significantly benefit companies by reducing overall costs associated with international trade.

Quick guide on how to complete claim for drawback

Effortlessly Prepare Claim For Drawback on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers a fantastic eco-friendly substitute for conventional printed and signed files, as you can obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Handle Claim For Drawback on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

The Easiest Method to Modify and Electronically Sign Claim For Drawback with Ease

- Find Claim For Drawback and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive data using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Claim For Drawback and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the claim for drawback

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Claim For Drawback?

A Claim For Drawback is a request for a refund on duties paid for imported goods that are later exported. This process can signNowly reduce your overall costs on international transactions, making it a crucial element for businesses involved in trade.

-

How does airSlate SignNow help with the Claim For Drawback process?

airSlate SignNow streamlines the Claim For Drawback process by providing easy-to-use eSignature functionalities. You can quickly prepare, sign, and send necessary documents, ensuring that your claims are submitted promptly and efficiently.

-

Is there a cost associated with filing a Claim For Drawback using airSlate SignNow?

While airSlate SignNow offers a cost-effective solution for document management, the costs related to filing a Claim For Drawback will depend on the specific plan you choose. Our pricing is transparent, and you can select a plan that suits your budget and filing needs.

-

What features does airSlate SignNow offer for handling Claims For Drawback?

airSlate SignNow includes features like customizable templates, bulk sending, and automatic reminders to help manage your Claim For Drawback documents effectively. Additionally, it provides secure storage and compliance to keep your information safe.

-

Can I integrate airSlate SignNow with other systems for the Claim For Drawback process?

Yes, airSlate SignNow offers seamless integrations with various business applications, enhancing your ability to manage the Claim For Drawback process. This allows for smoother workflows and better data management across your tech stack.

-

How secure is airSlate SignNow when filing a Claim For Drawback?

Security is a priority for airSlate SignNow, especially when handling sensitive documents like those for a Claim For Drawback. We employ advanced encryption methods and secure data storage to ensure your information is protected at all times.

-

What benefits can businesses expect from using airSlate SignNow for a Claim For Drawback?

Businesses can expect increased efficiency, faster processing times, and improved accuracy when using airSlate SignNow for their Claim For Drawback needs. Our platform helps reduce paperwork and streamline communication, leading to better overall performance.

Get more for Claim For Drawback

- 2019 2020 statement of degree information federal student

- Mjc petition form

- Mso middle school only activity waiver and release of liability form

- Your 2018 2019 free application for federal student aid fafsa was selected for review in a federal process called form

- Application requirements oklahoma city community college form

- Famu verification form

- Applicationresidential life ampamp housingvirginia commonwealth form

- Robert wikipedia form

Find out other Claim For Drawback

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word