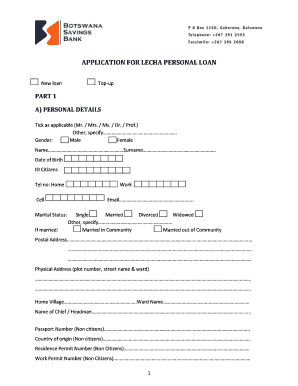

APPLICATION for LECHA PERSONAL LOAN Form

What is the application for lecha personal loan?

The application for a lecha personal loan is a formal document that individuals submit to request financial assistance from a lending institution. This application typically requires detailed information about the applicant's financial status, including income, employment history, and credit score. The purpose of the application is to assess the borrower's eligibility for a personal loan and determine the amount that can be borrowed. Understanding the specifics of this application is crucial for anyone considering a personal loan.

Eligibility criteria for the lecha personal loan

To qualify for a lecha personal loan, applicants must meet certain eligibility criteria. These may include:

- Age: Applicants must be at least eighteen years old.

- Residency: Must be a legal resident of the United States.

- Credit Score: A minimum credit score is often required to demonstrate creditworthiness.

- Income: Proof of stable income is necessary to show the ability to repay the loan.

- Debt-to-Income Ratio: Lenders typically evaluate the ratio of monthly debt payments to gross monthly income.

Required documents for the application

When applying for a lecha personal loan, several documents are typically required to verify the information provided. Commonly required documents include:

- Government-issued ID (e.g., driver's license or passport).

- Proof of income (e.g., pay stubs, tax returns, or bank statements).

- Social Security number for identity verification.

- Employment verification documents, if applicable.

- Details of any existing debts or loans.

Steps to complete the application for lecha personal loan

Completing the application for a lecha personal loan involves several key steps:

- Gather all necessary documents, including proof of income and identification.

- Visit the lender's website or physical location to access the application form.

- Fill out the application form with accurate personal and financial information.

- Review the application for any errors or missing information before submission.

- Submit the application electronically or in person, depending on the lender's process.

Legal use of the application for lecha personal loan

The application for a lecha personal loan must comply with various legal requirements to be considered valid. This includes adherence to federal and state regulations governing lending practices. The application must also ensure that all provided information is accurate and truthful to avoid potential legal issues, such as fraud or misrepresentation. Understanding these legal aspects is essential for applicants to protect themselves and ensure a smooth borrowing process.

Form submission methods

Applicants can typically submit the lecha personal loan application through various methods, including:

- Online submission via the lender's website, which is often the most convenient option.

- In-person submission at a local branch, allowing for direct interaction with a loan officer.

- Mailing a physical copy of the application, though this may delay processing times.

Quick guide on how to complete application for lecha personal loan

Prepare APPLICATION FOR LECHA PERSONAL LOAN effortlessly on any device

Digital document management has gained traction among firms and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly and without complications. Manage APPLICATION FOR LECHA PERSONAL LOAN on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric processes today.

How to modify and eSign APPLICATION FOR LECHA PERSONAL LOAN with ease

- Locate APPLICATION FOR LECHA PERSONAL LOAN and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or hide sensitive information with features that airSlate SignNow specifically offers for that purpose.

- Produce your eSignature with the Sign feature, which takes moments and holds the same legal validity as a conventional wet signature.

- Review the details and click the Done button to preserve your changes.

- Select how you want to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing out new versions. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Modify and eSign APPLICATION FOR LECHA PERSONAL LOAN and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for lecha personal loan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the basic bsb lecha personal loan requirements?

The basic bsb lecha personal loan requirements typically include proof of identity, income verification, and a good credit score. Applicants may also need to provide their employment details and financial history. Meeting these criteria ensures a smoother application process.

-

How can I improve my chances of meeting bsb lecha personal loan requirements?

To improve your chances, focus on maintaining a good credit score by paying bills on time and reducing debt. Additionally, ensuring stable employment and a reliable income will strengthen your application. Providing clear documentation can also help you meet bsb lecha personal loan requirements efficiently.

-

Are there any fees associated with bsb lecha personal loans?

Yes, there may be fees associated with bsb lecha personal loans, such as origination fees or early repayment fees. It's essential to review all related costs upfront before applying, as they can affect the overall affordability of the loan. Understanding these fees will help you make an informed financial decision.

-

What features should I look for in a bsb lecha personal loan?

When evaluating a bsb lecha personal loan, consider features such as competitive interest rates, flexible repayment terms, and the availability of customer support. Additionally, look for options that allow for direct integrations with financial management tools. These features will enhance your borrowing experience.

-

What benefits come with bsb lecha personal loans?

bsb lecha personal loans offer several benefits, including quick access to funds, and the ability to consolidate debt or cover emergencies. They typically come with straightforward application processes and flexible repayment options. These benefits make them an appealing choice for many borrowers.

-

Can I apply for a bsb lecha personal loan online?

Yes, many lenders offer the option to apply for bsb lecha personal loans online, making the process quick and convenient. Online applications usually require you to upload essential documents digitally. This ease of access allows you to manage your application at your own pace.

-

Do bsb lecha personal loans require collateral?

Most bsb lecha personal loans do not require collateral, making them unsecured loans. This means you are not risking any assets by taking out the loan. However, some lenders may offer secured options for better rates if collateral is provided.

Get more for APPLICATION FOR LECHA PERSONAL LOAN

- Nova graduate application promo code form

- Visiting scholar agreement umass dartmouth form

- Radiologic technologyhow to applyswosu at sayre form

- Nike student discount form

- Dependent verification form

- Verification enrollment request form

- Customized training center alexandria technical ampamp community form

- Registries ampampamp research centersts form

Find out other APPLICATION FOR LECHA PERSONAL LOAN

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation

- Can I Sign Pennsylvania Resignation Letter

- How To Sign Rhode Island Resignation Letter

- Sign Texas Resignation Letter Easy

- Sign Maine Alternative Work Offer Letter Later

- Sign Wisconsin Resignation Letter Free

- Help Me With Sign Wyoming Resignation Letter

- How To Sign Hawaii Military Leave Policy

- How Do I Sign Alaska Paid-Time-Off Policy