Weekly Tax Table Form

What is the Weekly Tax Table

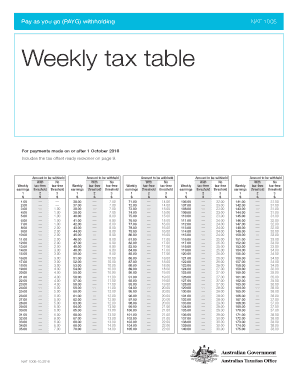

The weekly tax table is a crucial tool for employers and employees in the United States, designed to determine the amount of federal income tax to withhold from an employee's paycheck. This table provides a clear framework based on the employee's earnings, filing status, and the number of allowances claimed on their W-4 form. By using the weekly tax table, businesses can ensure compliance with IRS regulations and help employees understand their tax obligations.

How to use the Weekly Tax Table

Using the weekly tax table involves a few straightforward steps. First, determine the employee's gross pay for the week. Next, identify the employee's filing status and the number of allowances claimed. Locate the appropriate section of the weekly tax table that corresponds to the employee's income level and filing status. The table will indicate the amount of federal income tax that should be withheld from the employee's paycheck. This process helps maintain accurate tax withholding and supports proper financial planning for both employers and employees.

Steps to complete the Weekly Tax Table

Completing the weekly tax table requires careful attention to detail. Follow these steps for accuracy:

- Calculate the employee's gross weekly earnings.

- Review the employee's W-4 form to determine filing status and allowances.

- Consult the weekly tax table to find the corresponding withholding amount based on the gross earnings and filing status.

- Deduct the calculated tax amount from the employee's gross pay to determine the net pay.

Legal use of the Weekly Tax Table

The legal use of the weekly tax table is essential for compliance with federal tax laws. Employers are required to withhold the correct amount of federal income tax from employee wages. Failure to do so can result in penalties for both the employer and the employee. By utilizing the weekly tax table, businesses can ensure they meet IRS guidelines, thereby safeguarding their operations and supporting their employees in fulfilling their tax responsibilities.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the use of the weekly tax table. Employers must adhere to these guidelines to ensure proper tax withholding. This includes using the most current version of the tax table, accurately calculating employee earnings, and maintaining records of tax withholdings. The IRS also updates the tax tables periodically, reflecting changes in tax law or rates, so it is important for employers to stay informed about any updates that may affect their withholding practices.

Filing Deadlines / Important Dates

Understanding filing deadlines and important dates is crucial for both employers and employees. Employers must submit withheld taxes to the IRS on a regular schedule, typically either monthly or semi-weekly, depending on the amount of taxes withheld. Employees should also be aware of tax filing deadlines to avoid penalties. The annual tax return deadline for individuals is usually April 15, unless it falls on a weekend or holiday. Staying informed about these dates helps ensure compliance and prevents unnecessary complications.

Quick guide on how to complete weekly tax table

Complete Weekly Tax Table effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Weekly Tax Table on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The most effective way to modify and eSign Weekly Tax Table with ease

- Locate Weekly Tax Table and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information using features that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Weekly Tax Table and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the weekly tax table

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are tax tables 2023 and how do they impact my business?

Tax tables 2023 are official charts issued by the IRS that outline the tax rates for various income levels. Understanding these tables is essential for accurate tax calculations and compliance. With airSlate SignNow, you can easily integrate tax tables into your document workflows, ensuring your financial documents are always up-to-date.

-

How can airSlate SignNow help me utilize the tax tables 2023 effectively?

airSlate SignNow provides features that allow users to customize and automate document workflows involving tax tables 2023. This facilitates easy data input and calculations, which helps streamline your tax preparation process. By automating these tasks, you can focus on more strategic aspects of your business.

-

Is there a cost associated with accessing tax tables 2023 on airSlate SignNow?

There is no additional fee to access tax tables 2023 through airSlate SignNow; it is included in our pricing plans. Our cost-effective solutions enable businesses to maintain compliance without incurring supplementary charges for updated tax information. This makes airSlate SignNow a budget-friendly choice for managing financial documents.

-

What features does airSlate SignNow offer for handling tax documents related to tax tables 2023?

airSlate SignNow offers e-signature capabilities, customizable templates, and automation tools that simplify managing tax documents using tax tables 2023. These features enhance security and efficiency, allowing users to send, receive, and manage tax-related documents seamlessly. By utilizing these tools, users can ensure their financial records are accurate and legally compliant.

-

Can I integrate airSlate SignNow with other software for managing tax tables 2023?

Yes, airSlate SignNow offers integrations with various accounting and CRM software that can help manage tax tables 2023. This ensures that your team can work within their preferred platforms while leveraging the capabilities of airSlate SignNow. Integration improves workflow efficiency and reduces the risk of errors in tax computations.

-

How does airSlate SignNow ensure compliance with regulations pertaining to tax tables 2023?

airSlate SignNow is committed to maintaining compliance by continually updating its resources, including tax tables 2023. This commitment ensures that users have access to the latest tax information and can generate compliant documents effortlessly. Additionally, our platform adheres to industry standards for data security and privacy.

-

What are the benefits of using airSlate SignNow for e-signing tax documents impacted by tax tables 2023?

Using airSlate SignNow for e-signing tax documents offers greater speed, efficiency, and security than traditional methods. With the integration of tax tables 2023, your documents are not only easy to sign but also pre-filling fields with the latest tax information. This reduces errors and saves time during tax season.

Get more for Weekly Tax Table

Find out other Weekly Tax Table

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast