MW507 MW507 the Comptroller of Maryland Form

What is the MW507 MW507 The Comptroller Of Maryland

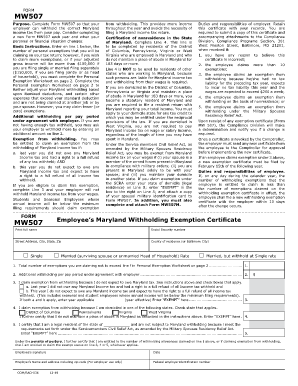

The MW507 is a form issued by the Comptroller of Maryland, primarily used for withholding tax purposes. It serves as a declaration for employees to report their residency status and claim exemptions from state income tax withholding. This form is essential for both employers and employees to ensure accurate tax withholding and compliance with Maryland tax regulations.

How to use the MW507 MW507 The Comptroller Of Maryland

To effectively use the MW507, individuals must first obtain the form from the Comptroller of Maryland's official website or through their employer. After filling out the necessary information regarding residency status and exemptions, the completed form should be submitted to the employer. This ensures that the correct amount of state income tax is withheld from the employee's paycheck.

Steps to complete the MW507 MW507 The Comptroller Of Maryland

Completing the MW507 involves several key steps:

- Obtain the MW507 form from a reliable source.

- Fill in your personal details, including name, address, and Social Security number.

- Indicate your residency status and any applicable exemptions.

- Review the information for accuracy.

- Submit the completed form to your employer for processing.

Legal use of the MW507 MW507 The Comptroller Of Maryland

The MW507 is legally recognized as a valid document for tax withholding purposes in Maryland. It complies with state regulations, ensuring that both employers and employees fulfill their tax obligations. Proper completion and submission of this form help prevent issues related to under-withholding or over-withholding of state income tax.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the MW507. Typically, employees should submit the form to their employer at the start of their employment or whenever there is a change in residency status. Employers must ensure that they update their records promptly to reflect any changes in withholding exemptions as indicated on the MW507.

Form Submission Methods (Online / Mail / In-Person)

The MW507 can be submitted in various ways, depending on the employer's preferences. Generally, employees can provide the completed form directly to their employer in person or via email. Some employers may also allow submission through an online payroll system. It is advisable to confirm the preferred submission method with the employer to ensure proper processing.

Quick guide on how to complete mw507 mw507 the comptroller of maryland

Complete MW507 MW507 The Comptroller Of Maryland seamlessly on any device

Managing documents online has gained popularity among firms and individuals. It offers a perfect sustainable substitute to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, alter, and eSign your documents quickly and efficiently. Handle MW507 MW507 The Comptroller Of Maryland on any device using airSlate SignNow Android or iOS applications and enhance any document-centered process today.

How to alter and eSign MW507 MW507 The Comptroller Of Maryland with ease

- Find MW507 MW507 The Comptroller Of Maryland and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which only takes a few seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Decide how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Bid farewell to lost or misplaced files, cumbersome form hunting, or errors requiring the printing of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign MW507 MW507 The Comptroller Of Maryland and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mw507 mw507 the comptroller of maryland

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MW507 form from The Comptroller Of Maryland?

The MW507 form is a withholding exemption certificate issued by The Comptroller Of Maryland. It allows individuals to claim exemptions from state income tax withholding. Understanding how to properly fill out this form can signNowly impact your tax filing process.

-

How does airSlate SignNow help with the MW507 MW507 The Comptroller Of Maryland?

airSlate SignNow simplifies the process of completing and submitting the MW507 form. With easy eSignature features, users can seamlessly sign and send the MW507 document without the hassle of printing and scanning, saving time and resources.

-

Is there a cost associated with using airSlate SignNow for the MW507 form?

Yes, there are subscription plans available for using airSlate SignNow, which provide access to various features including eSigning the MW507 form. However, the overall cost is often lower compared to traditional methods of document handling, making it a more cost-effective solution.

-

What features does airSlate SignNow provide for handling the MW507 MW507 The Comptroller Of Maryland?

airSlate SignNow offers features such as secure eSigning, document templates, and automated workflows. These tools are specifically designed to streamline the process of handling the MW507 form, ensuring compliance with The Comptroller Of Maryland regulations.

-

Can I integrate airSlate SignNow with other platforms for managing the MW507 form?

Absolutely! airSlate SignNow offers integrations with various third-party applications. This means you can easily connect with other platforms you use, enhancing your workflow and simplifying the management of the MW507 MW507 form.

-

What benefits can I expect from using airSlate SignNow for the MW507 MW507 The Comptroller Of Maryland?

By using airSlate SignNow, you can expect increased efficiency and accuracy in managing the MW507 form. The ease of electronic signing and document management reduces errors and speeds up processing, helping you meet deadlines set by The Comptroller Of Maryland.

-

Is airSlate SignNow user-friendly for completing the MW507 form?

Yes, airSlate SignNow is designed with user experience in mind. Its intuitive interface allows users of all tech levels to quickly navigate the process of filling out and eSigning the MW507 MW507 from The Comptroller Of Maryland.

Get more for MW507 MW507 The Comptroller Of Maryland

- 2018 wa mjq0101 form

- 2017 pa dl 143 form

- 2014 mi laracna 500 form

- 2017 tx ilecf scholarship application form

- 2020 au flinders university accidentincident report form

- 2020 canada pars notification for canada bound shipments form

- Canada md of bonnyville 87 plumbing permit form

- 2017 ph hqp pff 285 formerly hqp pff 040

Find out other MW507 MW507 The Comptroller Of Maryland

- Sign Georgia Banking Affidavit Of Heirship Myself

- Sign Hawaii Banking NDA Now

- Sign Hawaii Banking Bill Of Lading Now

- Sign Illinois Banking Confidentiality Agreement Computer

- Sign Idaho Banking Rental Lease Agreement Online

- How Do I Sign Idaho Banking Limited Power Of Attorney

- Sign Iowa Banking Quitclaim Deed Safe

- How Do I Sign Iowa Banking Rental Lease Agreement

- Sign Iowa Banking Residential Lease Agreement Myself

- Sign Kansas Banking Living Will Now

- Sign Kansas Banking Last Will And Testament Mobile

- Sign Kentucky Banking Quitclaim Deed Online

- Sign Kentucky Banking Quitclaim Deed Later

- How Do I Sign Maine Banking Resignation Letter

- Sign Maine Banking Resignation Letter Free

- Sign Louisiana Banking Separation Agreement Now

- Sign Maryland Banking Quitclaim Deed Mobile

- Sign Massachusetts Banking Purchase Order Template Myself

- Sign Maine Banking Operating Agreement Computer

- Sign Banking PPT Minnesota Computer