Texas Form Ap 231

What is the Texas Form AP 231

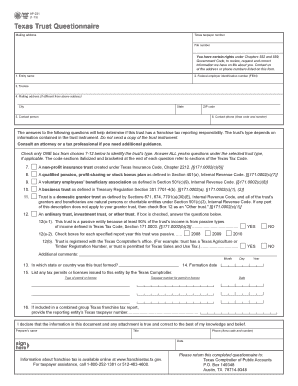

The Texas Form AP 231 is a crucial document used in various legal and administrative processes within the state of Texas. This form is primarily utilized for the purpose of claiming exemptions from certain taxes, specifically for entities that qualify under Texas law. Understanding the purpose and implications of this form is essential for individuals and businesses looking to navigate the tax landscape effectively.

How to use the Texas Form AP 231

Using the Texas Form AP 231 involves several key steps to ensure proper completion and submission. First, gather all necessary information, including details about the entity seeking the exemption and the specific tax categories applicable. Next, accurately fill out the form, ensuring that all required fields are completed. Once the form is filled out, review it for accuracy before submission. It can be submitted electronically or via traditional mail, depending on the preferences of the filing entity.

Steps to complete the Texas Form AP 231

Completing the Texas Form AP 231 requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from a reliable source.

- Fill in the entity's name, address, and relevant identification numbers.

- Specify the type of exemption being claimed and provide supporting documentation.

- Review the completed form for accuracy and completeness.

- Submit the form through the appropriate channel, ensuring that it is sent to the correct authority.

Legal use of the Texas Form AP 231

The legal use of the Texas Form AP 231 is governed by state tax laws and regulations. To be considered valid, the form must be completed in accordance with the specific guidelines set forth by the Texas Comptroller of Public Accounts. This includes ensuring that all claims for exemptions are legitimate and supported by appropriate documentation. Failure to comply with these legal requirements may result in penalties or denial of the exemption.

Key elements of the Texas Form AP 231

Several key elements must be included in the Texas Form AP 231 to ensure its validity. These elements include:

- The name and address of the entity applying for the exemption.

- A clear description of the exemption being claimed.

- Supporting documentation that verifies eligibility for the exemption.

- The signature of an authorized representative of the entity.

Form Submission Methods

The Texas Form AP 231 can be submitted through various methods, providing flexibility for users. The available submission methods include:

- Online submission through the Texas Comptroller's website.

- Mailing the completed form to the appropriate tax office.

- In-person submission at designated state offices.

Quick guide on how to complete texas form ap 231

Effortlessly prepare Texas Form Ap 231 on any device

The management of online documents has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides all the necessary tools to swiftly create, edit, and eSign your documents without any delays. Manage Texas Form Ap 231 from any device using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to edit and eSign Texas Form Ap 231 with ease

- Find Texas Form Ap 231 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Texas Form Ap 231 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the texas form ap 231

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Texas Form AP 231 and why is it important?

The Texas Form AP 231 is a petition used by businesses in Texas to apply for specific permits and licenses. It is crucial for compliance with state regulations and ensures that your business operates legally. Understanding this form can streamline your application process and save time.

-

How can airSlate SignNow assist with Texas Form AP 231?

airSlate SignNow simplifies the process of completing and signing the Texas Form AP 231. With its easy-to-use platform, you can fill out the form, add necessary signatures, and send it for approval all in one place. This efficiency can expedite your permit application.

-

What are the pricing options for using airSlate SignNow with Texas Form AP 231?

airSlate SignNow offers various pricing plans that cater to different business needs, ensuring affordability when dealing with documents like the Texas Form AP 231. You can choose from monthly or annual subscriptions, and there’s even a free trial available to test the service. This makes it a cost-effective solution for businesses.

-

What features does airSlate SignNow provide for managing Texas Form AP 231?

With airSlate SignNow, users benefit from features such as customizable templates, secure cloud storage, and automated reminders. These features are particularly useful when managing the Texas Form AP 231, as they help ensure that you never miss a deadline and maintain all your important documents in one place.

-

Is airSlate SignNow compliant with Texas regulations for the Texas Form AP 231?

Yes, airSlate SignNow maintains compliance with Texas regulations, ensuring that all signatures and documents processed, including the Texas Form AP 231, are legally binding. This compliance provides peace of mind for businesses as they navigate through the state’s requirements.

-

Can I integrate airSlate SignNow with other applications while working on the Texas Form AP 231?

Absolutely! airSlate SignNow offers integrations with numerous applications, including CRM systems and project management tools. This flexibility allows you to streamline workflows and manage the Texas Form AP 231 efficiently alongside your other business processes.

-

How does eSigning work for the Texas Form AP 231 on airSlate SignNow?

eSigning on airSlate SignNow is user-friendly and secure, allowing you to sign the Texas Form AP 231 electronically. Once you’ve completed the form, you can invite others to sign through a simple link, which saves time and reduces paper usage, making the process environmentally friendly.

Get more for Texas Form Ap 231

- Form m99 credit for military service in a combat zone 2014 revenue state mn

- Rev185b authorization to release business tax information

- Rpd 41379 form

- 21760886 form

- E services faqs for business registration form

- Schedule m15 underpayment of estimated income tax form

- Minnesota fillable tax forms

- Rev184 b business power of attorney form

Find out other Texas Form Ap 231

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple