Fidelity Transfer Rollover Exchange Form

What is the Fidelity Transfer Rollover Exchange Form

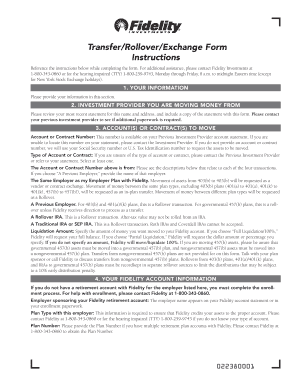

The Fidelity Transfer Rollover Exchange Form is a crucial document used for transferring retirement assets between accounts, particularly within Fidelity's financial services. This form facilitates the movement of funds from one retirement account to another, such as from a 401(k) to an IRA, ensuring that the transfer is executed smoothly and complies with IRS regulations. By using this form, individuals can maintain the tax-deferred status of their retirement savings during the rollover process.

Steps to Complete the Fidelity Transfer Rollover Exchange Form

Completing the Fidelity Transfer Rollover Exchange Form involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, such as account numbers and personal identification details. Next, fill out the form with the required information, including the type of accounts involved in the transfer. It is essential to review the form for any errors before submission. Finally, sign and date the form, and choose your preferred submission method, whether online, by mail, or in person, to ensure timely processing.

How to Obtain the Fidelity Transfer Rollover Exchange Form

The Fidelity Transfer Rollover Exchange Form can be obtained directly from Fidelity's website or by contacting their customer service. Users can access the form in a digital format, which allows for easy completion and submission. Additionally, physical copies may be available at Fidelity branch locations or through financial advisors who assist with retirement planning. It is advisable to ensure you have the most current version of the form to avoid any processing delays.

Legal Use of the Fidelity Transfer Rollover Exchange Form

The legal validity of the Fidelity Transfer Rollover Exchange Form hinges on compliance with federal regulations governing retirement accounts. To be considered legally binding, the form must be accurately completed and signed by the account holder. Furthermore, electronic signatures are recognized under the ESIGN Act, provided that the signer uses a compliant eSignature platform. Adhering to these legal requirements ensures that the transfer of assets is executed without complications.

Key Elements of the Fidelity Transfer Rollover Exchange Form

Several key elements must be included in the Fidelity Transfer Rollover Exchange Form to ensure its effectiveness. These elements typically encompass the account holder's personal information, details of the accounts involved in the transfer, and the specific type of rollover being requested. Additionally, the form should include sections for signatures and dates, as well as any necessary disclosures regarding potential tax implications. Ensuring all these elements are present helps facilitate a smooth transfer process.

Form Submission Methods

There are multiple methods available for submitting the Fidelity Transfer Rollover Exchange Form. Users can choose to complete the form online through Fidelity's secure platform, which often allows for quicker processing. Alternatively, the form can be printed and mailed to the appropriate address provided by Fidelity. For those who prefer face-to-face interactions, submitting the form in person at a Fidelity branch is also an option. Each method has its benefits, so individuals should select the one that best fits their needs.

Quick guide on how to complete fidelity transfer rollover exchange form

Complete Fidelity Transfer Rollover Exchange Form effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed papers, as you can find the necessary form and securely save it online. airSlate SignNow provides all the tools required to create, alter, and electronically sign your documents promptly without delays. Manage Fidelity Transfer Rollover Exchange Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and electronically sign Fidelity Transfer Rollover Exchange Form seamlessly

- Find Fidelity Transfer Rollover Exchange Form and then click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in a few clicks from your device of choice. Edit and electronically sign Fidelity Transfer Rollover Exchange Form and guarantee effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fidelity transfer rollover exchange form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a fidelity transfer form and why is it important?

A fidelity transfer form is a document that allows account holders to transfer their assets from one brokerage to another. It's crucial for ensuring that your investments are correctly moved without delays or penalties. By using a fidelity transfer form, you can maintain your investment strategy while switching financial institutions.

-

How do I fill out a fidelity transfer form using airSlate SignNow?

To fill out a fidelity transfer form using airSlate SignNow, simply upload the document onto our platform, and follow the prompts to enter the required information. Our user-friendly interface will guide you through the process step by step, ensuring that all details are completed accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for fidelity transfer forms?

airSlate SignNow offers a variety of pricing plans, making it a cost-effective solution for handling fidelity transfer forms. Whether you're an individual or a business, you'll find a plan that suits your needs without breaking the bank. You can also take advantage of a free trial to explore the platform's features before committing.

-

What features does airSlate SignNow provide for managing fidelity transfer forms?

airSlate SignNow includes features such as customizable templates, real-time collaboration, and secure cloud storage for your fidelity transfer forms. Additionally, our advanced electronic signature capabilities streamline the signing process, allowing for quick and legally binding transfers. These features enhance your efficiency and document management.

-

Are there integrations available for working with fidelity transfer forms?

Yes, airSlate SignNow integrates seamlessly with various platforms including Google Drive, Dropbox, and Salesforce. This allows you to import and export fidelity transfer forms easily, keeping your workflow organized and efficient. By using these integrations, you can manage your documents without switching between multiple applications.

-

How secure are the fidelity transfer forms processed through airSlate SignNow?

All fidelity transfer forms processed through airSlate SignNow are protected with advanced security measures, including encryption and secure data storage. We prioritize your privacy and the integrity of your documents, ensuring that your sensitive information remains confidential. Trust us to handle your fidelity transfer forms safely.

-

Can airSlate SignNow help with multiple fidelity transfer forms at once?

Absolutely! With airSlate SignNow, you can easily manage and process multiple fidelity transfer forms simultaneously. Our bulk send feature allows you to send several documents for signature, saving you time and streamlining your workflow. This efficiency is ideal for businesses managing numerous client accounts.

Get more for Fidelity Transfer Rollover Exchange Form

Find out other Fidelity Transfer Rollover Exchange Form

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself

- Electronic signature Montana Stock Transfer Form Template Computer

- Help Me With Electronic signature Texas Debt Settlement Agreement Template

- How Do I Electronic signature Nevada Stock Transfer Form Template