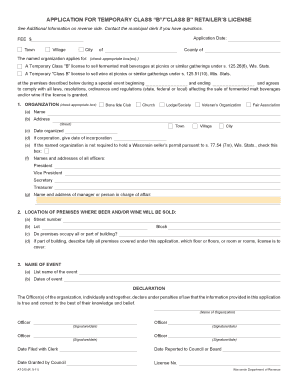

Wisconsin At315 Form

What is the Wisconsin At315 Form

The Wisconsin At315 Form is a tax document used by individuals and businesses in Wisconsin to report various tax-related information. This form is primarily associated with the state's income tax system and is essential for accurately calculating tax liabilities. It is important for taxpayers to understand the specific purpose of this form, as it helps ensure compliance with state tax laws.

How to use the Wisconsin At315 Form

Using the Wisconsin At315 Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and previous tax returns. Next, fill out the form with the required information, ensuring that all figures are accurate and reflect your financial situation. After completing the form, review it for any errors before submitting it to the appropriate state agency.

Steps to complete the Wisconsin At315 Form

Completing the Wisconsin At315 Form requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the Wisconsin Department of Revenue.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income accurately, including wages, dividends, and any other sources of income.

- Calculate your deductions and credits, ensuring you are aware of any state-specific tax benefits.

- Double-check all entries for accuracy before signing and dating the form.

Legal use of the Wisconsin At315 Form

The legal use of the Wisconsin At315 Form is governed by state tax laws. To ensure that the form is legally binding, it must be completed accurately and submitted by the designated deadline. Additionally, eSigning the form through a compliant platform, like signNow, can enhance its legal validity, as it adheres to regulations set forth by the ESIGN Act and UETA.

Filing Deadlines / Important Dates

Filing deadlines for the Wisconsin At315 Form are crucial for compliance. Typically, the form must be submitted by April 15 of each year for individual taxpayers. However, if that date falls on a weekend or holiday, the deadline may be extended. It is essential to stay updated on any changes to these dates to avoid penalties.

Required Documents

When completing the Wisconsin At315 Form, certain documents are required to ensure accurate reporting. These may include:

- W-2 forms from employers

- 1099 forms for additional income

- Documentation for deductions, such as receipts and invoices

- Previous year's tax return for reference

Form Submission Methods

The Wisconsin At315 Form can be submitted through various methods. Taxpayers have the option to file online using the Wisconsin Department of Revenue's e-filing system, which is efficient and secure. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its own processing times, so it is advisable to choose the one that best fits your needs.

Quick guide on how to complete wisconsin at315 form

Complete Wisconsin At315 Form with ease on any device

Web-based document management has become a favorite among companies and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without holdups. Handle Wisconsin At315 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

How to edit and eSign Wisconsin At315 Form effortlessly

- Locate Wisconsin At315 Form and click Get Form to begin.

- Utilize the tools at your disposal to fill in your document.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Wisconsin At315 Form and guarantee outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wisconsin at315 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Wisconsin At315 Form?

The Wisconsin At315 Form is a tax form used by individual taxpayers in Wisconsin to report and pay their tax liability. Using airSlate SignNow, you can easily fill out and eSign this form online, ensuring accurate submission and compliance with state regulations.

-

How can airSlate SignNow help with the Wisconsin At315 Form?

airSlate SignNow simplifies the process of managing the Wisconsin At315 Form by providing an intuitive platform for filling, signing, and sending the document. With our solution, you reduce paperwork clutter and streamline your filing process efficiently.

-

Is there a cost associated with using airSlate SignNow for the Wisconsin At315 Form?

Yes, airSlate SignNow offers various pricing plans that accommodate different business needs. These plans are cost-effective, ensuring you can manage the Wisconsin At315 Form and any other documents without breaking your budget.

-

What features does airSlate SignNow offer for the Wisconsin At315 Form?

airSlate SignNow offers features like legally binding eSignatures, document templates specifically for the Wisconsin At315 Form, and cloud storage for easy access. These tools ensure a hassle-free experience from document creation to submission.

-

Can I integrate airSlate SignNow with other software for managing the Wisconsin At315 Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enabling you to sync data and streamline workflows related to the Wisconsin At315 Form. This enhances productivity and ensures all your documents are managed effectively.

-

Is airSlate SignNow secure for processing the Wisconsin At315 Form?

Yes, airSlate SignNow employs robust security measures, including encryption and secure document storage, to protect your information. You can confidently eSign and submit the Wisconsin At315 Form knowing your data is safe.

-

What are the benefits of using airSlate SignNow for the Wisconsin At315 Form?

Using airSlate SignNow for the Wisconsin At315 Form offers numerous benefits, including increased efficiency, reduced errors, and enhanced compliance with state regulations. This digital approach saves time and eases the overall filing process.

Get more for Wisconsin At315 Form

Find out other Wisconsin At315 Form

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed