Form 7202 PDF

What is the Form 7202 PDF?

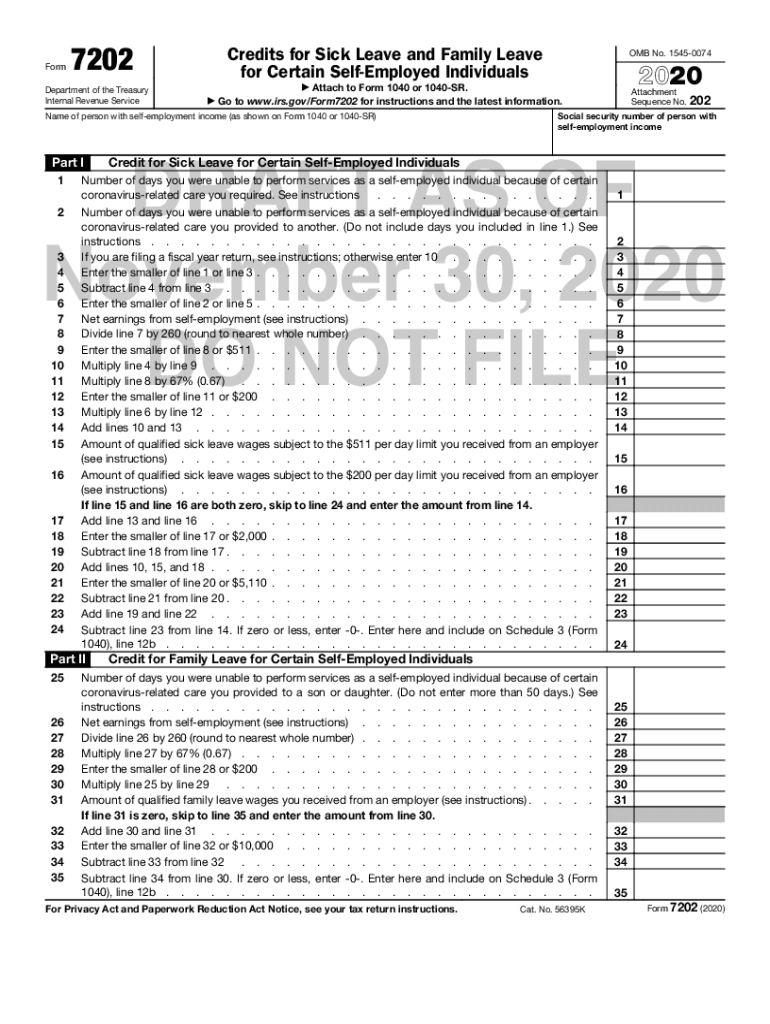

The Form 7202 PDF is an official document issued by the Internal Revenue Service (IRS) that allows eligible taxpayers to claim certain credits related to qualified sick and family leave wages. This form is particularly relevant for self-employed individuals who have been affected by the COVID-19 pandemic and are seeking to receive credits for wages paid to themselves during periods of illness or caregiving. Understanding the purpose and structure of the Form 7202 is essential for accurate completion and compliance with IRS regulations.

Steps to Complete the Form 7202 PDF

Completing the Form 7202 PDF involves several key steps that ensure accuracy and compliance. First, gather all necessary documentation, including records of sick leave and family leave wages. Next, accurately fill out the personal information section, including your name, Social Security number, and business details. Then, complete the sections that pertain to the specific credits you are claiming. It is important to follow the IRS instructions carefully to avoid mistakes. Finally, review the form for any errors before submission.

How to Obtain the Form 7202 PDF

The Form 7202 PDF can be easily obtained from the IRS website. Simply navigate to the forms section and search for "Form 7202." The PDF version is available for download free of charge. Additionally, you may find printed copies at local IRS offices or request one through the mail. Ensure that you are using the most current version of the form to comply with the latest IRS guidelines.

IRS Guidelines for Form 7202

The IRS provides specific guidelines for completing and submitting the Form 7202. These guidelines include eligibility criteria for claiming credits, detailed instructions on how to fill out each section, and information on the required documentation needed to support your claims. It is crucial to review these guidelines thoroughly to ensure that you meet all requirements and submit the form correctly. Non-compliance with IRS guidelines can lead to delays in processing or potential penalties.

Legal Use of the Form 7202 PDF

The legal use of the Form 7202 PDF hinges on its compliance with IRS regulations. To be considered valid, the form must be completed accurately and submitted within the designated time frames. Additionally, the information provided must be truthful and supported by appropriate documentation. Misuse of the form, such as falsifying information or submitting it outside of the allowed timeframe, can result in penalties or legal repercussions.

Filing Deadlines for Form 7202

Filing deadlines for the Form 7202 PDF are critical for ensuring timely processing of your claims. Generally, the form must be submitted with your annual tax return. However, if you are claiming credits for specific periods, it is important to check the IRS website for any updates on deadlines related to COVID-19 relief measures. Staying informed about these deadlines helps avoid late submissions and potential penalties.

Quick guide on how to complete form 7202 pdf

Complete Form 7202 Pdf seamlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly with no delays. Manage Form 7202 Pdf on any device with the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

How to edit and eSign Form 7202 Pdf effortlessly

- Obtain Form 7202 Pdf and click on Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Mark relevant sections of the documents or redact sensitive data using tools that airSlate SignNow especially offers for that purpose.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you select. Edit and eSign Form 7202 Pdf and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 7202 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form 7202 example used for?

A form 7202 example is commonly used by self-employed individuals to calculate and claim certain tax credits. It helps illustrate how to report tax information effectively. Understanding a form 7202 example can guide you on maximizing your potential tax benefits.

-

How can airSlate SignNow simplify filling out a form 7202 example?

With airSlate SignNow, you can easily import and fill out a form 7202 example digitally. Our intuitive platform streamlines the document filling experience, allowing for quick edits and secure storage. This means you can focus on what matters most while we handle the paperwork.

-

Is there a cost associated with using airSlate SignNow for a form 7202 example?

Yes, airSlate SignNow offers competitive pricing plans that make it accessible for businesses of all sizes. There are tiered options to fit various needs, and the cost is justified by the efficiency and security provided in managing a form 7202 example. You can compare our plans to find the one that best suits you.

-

What features does airSlate SignNow offer for managing a form 7202 example?

AirSlate SignNow provides a range of features perfect for managing a form 7202 example, including eSigning, template creation, and document sharing. Users can also track the status of their documents in real-time. This functionality ensures that your tax-related documents are handled smoothly and securely.

-

Can airSlate SignNow integrate with other software for handling a form 7202 example?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications such as accounting software and CRMs. This integration allows users to manage their form 7202 example with their existing tools, enhancing productivity and ensuring data consistency.

-

What are the benefits of using airSlate SignNow for a form 7202 example?

Using airSlate SignNow for a form 7202 example offers substantial benefits, including increased efficiency and reduced paper usage. You can enjoy the ease of digital document management and improve compliance with tax regulations. Our platform also prioritizes security, so your sensitive information remains protected.

-

How secure is airSlate SignNow when handling a form 7202 example?

AirSlate SignNow employs advanced security measures, such as encryption and secure server environments, to protect your form 7202 example and other documents. We ensure full compliance with various regulations to safeguard your data. You can trust that your documents are in safe hands throughout the process.

Get more for Form 7202 Pdf

- Practice site application amp declaration of intent form

- Prep provider toolkit form

- Auto adjustment rfp state of michigan form

- Michigan nursing school certification form

- Michigan nursing school certification state of michigan form

- Michigan nursing school certification michigangov form

- Sf mslrp application form provider application form and declaration of intent

- Ocal 4603 incident accident illness death or fire report cwl 4603 form

Find out other Form 7202 Pdf

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast