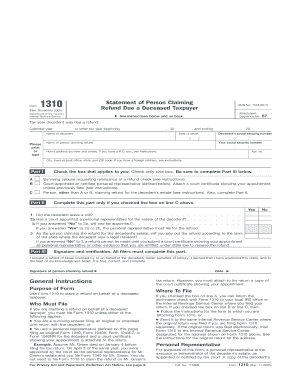

Form 1310 Rev November Statement of Person Claiming Refund Due a Deceased Taxpayer Irs Ustreas

What is Form 1310?

The Form 1310, officially known as the Statement of Person Claiming Refund Due a Deceased Taxpayer, is a document used by individuals who are claiming a tax refund on behalf of a deceased taxpayer. This form is essential for ensuring that the rightful person receives any refund owed to the deceased individual. It is particularly relevant in situations where the deceased taxpayer was entitled to a refund for the tax year prior to their passing. The form must be filed with the IRS along with the deceased taxpayer's final income tax return.

Steps to Complete Form 1310

Filling out Form 1310 requires careful attention to detail. Here are the key steps involved:

- Gather necessary information: Collect the deceased taxpayer's personal information, including their Social Security number and date of death.

- Complete the form: Fill in your own information as the claimant, along with the deceased's details. Ensure all sections are accurately completed.

- Attach supporting documents: Include a copy of the death certificate and any other required documents that verify your relationship to the deceased.

- Review for accuracy: Double-check all entries for correctness to avoid delays in processing.

- Submit the form: File Form 1310 along with the final tax return of the deceased taxpayer, either electronically or by mail.

Legal Use of Form 1310

The legal use of Form 1310 is crucial for ensuring compliance with IRS regulations. This form serves as a declaration that the claimant is entitled to the refund due to the deceased taxpayer. It must be signed and dated by the claimant, affirming their relationship to the deceased and their right to claim the refund. Properly completing and submitting this form helps prevent potential disputes or complications regarding the refund.

IRS Guidelines for Form 1310

The IRS provides specific guidelines for the use of Form 1310. These guidelines outline the eligibility criteria for claimants, the required documentation, and the filing process. It is essential to follow these guidelines closely to ensure that the claim is processed smoothly. The IRS may request additional information or documentation if the submitted form does not meet their requirements.

Filing Deadlines for Form 1310

Filing deadlines for Form 1310 coincide with the deadlines for submitting the final tax return of the deceased taxpayer. Generally, the final return is due on April 15 of the year following the taxpayer's death. If the deceased passed away in the previous year, the Form 1310 must be filed by this deadline to ensure timely processing of the refund. Extensions may be available, but they must be requested appropriately.

Required Documents for Form 1310

When filing Form 1310, certain documents are required to support the claim. These typically include:

- A copy of the death certificate to confirm the taxpayer's passing.

- The final income tax return of the deceased taxpayer.

- Any documentation that verifies the claimant's relationship to the deceased, such as marriage certificates or legal documents.

Having these documents ready will facilitate a smoother filing process and reduce the likelihood of delays.

Quick guide on how to complete form 1310 rev november statement of person claiming refund due a deceased taxpayer irs ustreas

Effortlessly complete Form 1310 Rev November Statement Of Person Claiming Refund Due A Deceased Taxpayer Irs Ustreas on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without delays. Handle Form 1310 Rev November Statement Of Person Claiming Refund Due A Deceased Taxpayer Irs Ustreas on any platform using airSlate SignNow's Android or iOS applications and simplify any document-based process today.

How to edit and eSign Form 1310 Rev November Statement Of Person Claiming Refund Due A Deceased Taxpayer Irs Ustreas effortlessly

- Locate Form 1310 Rev November Statement Of Person Claiming Refund Due A Deceased Taxpayer Irs Ustreas and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or an invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 1310 Rev November Statement Of Person Claiming Refund Due A Deceased Taxpayer Irs Ustreas and ensure outstanding communication at any step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1310 rev november statement of person claiming refund due a deceased taxpayer irs ustreas

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1310 form and why is it important?

The 1310 form is used to claim a refund for overpaid taxes, making it an essential tool for taxpayers. It helps you receive your rightful refund from the IRS and ensures proper documentation of your claims.

-

How can airSlate SignNow assist with the 1310 form?

airSlate SignNow streamlines the process of completing and eSigning the 1310 form. With its user-friendly interface, you can quickly fill out your form and securely transmit it, simplifying the tax refund process.

-

Is there a cost associated with using airSlate SignNow to submit the 1310 form?

airSlate SignNow offers competitive pricing that caters to varying business needs, including free trials to explore the service. By using this affordable solution, you can efficiently handle your 1310 form and other documents.

-

What features does airSlate SignNow offer for the 1310 form?

Key features of airSlate SignNow for the 1310 form include easy document editing, cloud storage, and collaborative eSigning. These tools enhance your experience and ensure accuracy when handling critical tax documents.

-

Are there any integrations available with airSlate SignNow for the 1310 form?

Yes, airSlate SignNow seamlessly integrates with various applications like Google Drive and Salesforce. This integration allows you to manage your documents, including the 1310 form, within your preferred workflow.

-

How does airSlate SignNow ensure my data is secure when using the 1310 form?

airSlate SignNow prioritizes security with features like encryption and secure cloud storage. When handling sensitive information on the 1310 form, you can trust that your data is protected and compliant with regulations.

-

Can I use airSlate SignNow on mobile devices for the 1310 form?

Absolutely! airSlate SignNow is mobile-friendly, allowing you to complete and eSign the 1310 form on-the-go. Whether you're in the office or traveling, you can manage your documents anytime, anywhere.

Get more for Form 1310 Rev November Statement Of Person Claiming Refund Due A Deceased Taxpayer Irs Ustreas

- Health and welfare fee childhood vaccinations assessment form

- About us river valley ambulatory surgical center in norwich form

- Dc medicaid application pdf form

- High prescribing health clinic form

- Free file fillable forms misc problems with forms

- Landlord questionnaire form

- 470 1632 landlord questionnaire form

- What is my microsoft account server address on windows phone form

Find out other Form 1310 Rev November Statement Of Person Claiming Refund Due A Deceased Taxpayer Irs Ustreas

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe