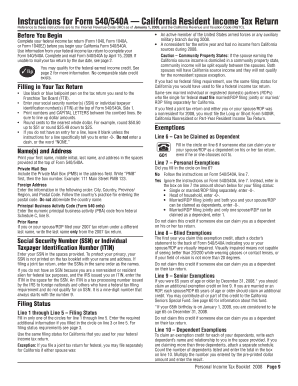

Form 540 California Resident Income Tax Return Scannable California Form 540 Scannable and Instructions 2012

What is the Form 540 California Resident Income Tax Return?

The Form 540 is the California Resident Income Tax Return, used by individuals who are residents of California to report their income, claim deductions, and calculate their tax liability. This form is essential for residents to fulfill their state tax obligations. The scannable version of Form 540 allows for easier processing by the California Franchise Tax Board, ensuring that submitted forms can be quickly and accurately read by their systems.

How to Use the Form 540 California Resident Income Tax Return

To effectively use the Form 540, individuals should first gather all necessary financial documents, including W-2s, 1099s, and any relevant receipts for deductions. The form must be completed with accurate personal information, income details, and applicable deductions. Once completed, the form can be submitted electronically or via mail, depending on the taxpayer's preference. Utilizing digital tools can streamline this process, making it easier to fill out and sign the form securely.

Steps to Complete the Form 540 California Resident Income Tax Return

Completing the Form 540 involves several key steps:

- Gather all necessary financial documents, including income statements and deduction receipts.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income, ensuring accurate totals are calculated.

- Claim any allowable deductions and credits to reduce taxable income.

- Calculate the total tax owed or refund due.

- Sign and date the form, ensuring all information is accurate before submission.

Legal Use of the Form 540 California Resident Income Tax Return

The Form 540 is legally binding when completed accurately and submitted according to California tax laws. To ensure its legal validity, the form must be signed by the taxpayer, either physically or electronically. Compliance with state regulations, including proper filing methods and deadlines, is essential to avoid penalties or issues with the California Franchise Tax Board.

Filing Deadlines for the Form 540 California Resident Income Tax Return

The filing deadline for the Form 540 typically aligns with the federal tax deadline, which is April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should be aware of any specific extensions or changes announced by the California Franchise Tax Board to ensure timely submission.

Required Documents for the Form 540 California Resident Income Tax Return

When preparing to file the Form 540, taxpayers should have the following documents ready:

- W-2 forms from employers

- 1099 forms for additional income sources

- Receipts for deductible expenses, such as medical or educational costs

- Last year's tax return for reference

- Any relevant documentation for credits or adjustments

Quick guide on how to complete form 540 california resident income tax return scannable california form 540 scannable and instructions

Manage Form 540 California Resident Income Tax Return Scannable California Form 540 Scannable And Instructions effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly without any lag. Handle Form 540 California Resident Income Tax Return Scannable California Form 540 Scannable And Instructions on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related operation today.

How to modify and eSign Form 540 California Resident Income Tax Return Scannable California Form 540 Scannable And Instructions with ease

- Obtain Form 540 California Resident Income Tax Return Scannable California Form 540 Scannable And Instructions and click on Access Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the details and click on the Finalize button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and eSign Form 540 California Resident Income Tax Return Scannable California Form 540 Scannable And Instructions to guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 540 california resident income tax return scannable california form 540 scannable and instructions

Create this form in 5 minutes!

How to create an eSignature for the form 540 california resident income tax return scannable california form 540 scannable and instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 540 California Resident Income Tax Return Scannable?

The Form 540 California Resident Income Tax Return Scannable is a streamlined tax form designed for California residents to file their income taxes. It provides clear instructions and can be easily completed and submitted using various platforms, enhancing the filing process for all users.

-

How can I obtain the California Form 540 Scannable and Instructions?

You can download the California Form 540 Scannable and Instructions directly from the California Franchise Tax Board's website or use our service at airSlate SignNow to fill and sign the form digitally. This ensures all your data is securely stored and easily accessible.

-

What are the benefits of using airSlate SignNow for Form 540?

Using airSlate SignNow for your Form 540 California Resident Income Tax Return Scannable offers several benefits, including the ability to eSign documents securely and the convenience of accessing forms on any device. This digital platform is user-friendly and cost-effective, making it easier for individuals to manage their tax returns.

-

Is it cost-effective to use airSlate SignNow for filing Form 540?

Yes, airSlate SignNow provides a cost-effective solution for filing your Form 540 California Resident Income Tax Return Scannable. With competitive pricing and various subscription options, users can choose a plan that suits their needs while simplifying the tax filing process.

-

What features are included with the airSlate SignNow service for Form 540?

AirSlate SignNow includes features such as document templates, automated workflows, and secure eSigning capabilities for your Form 540 California Resident Income Tax Return Scannable. These features streamline the process, ensuring efficiency and compliance during tax season.

-

Can I integrate airSlate SignNow with other software programs for tax filing?

Yes, airSlate SignNow seamlessly integrates with various software programs that facilitate tax filing, enhancing your ability to manage finances efficiently. By integrating with your preferred tools, you can make the process of completing your Form 540 California Resident Income Tax Return Scannable even smoother.

-

What support options are available if I need help with Form 540?

AirSlate SignNow offers comprehensive customer support to assist you with your Form 540 California Resident Income Tax Return Scannable. You can access FAQs, chat support, or detailed guides to help navigate the process, ensuring you have the resources you need when filing your taxes.

Get more for Form 540 California Resident Income Tax Return Scannable California Form 540 Scannable And Instructions

- To use this form place your mouse cursor beside the quotclick herequot and click

- Lifeline eligibility verification system data sharing agreement form

- Illinois department of human services idhs form

- Application for waiver of cants indication to allow employment in a community development disabilities services agency form

- Illinois medical cannabis verification form

- Illinois medical cannibis verification form

- State of illinois unemployment formampquot keyword found

- State identity proofing request form dhs

Find out other Form 540 California Resident Income Tax Return Scannable California Form 540 Scannable And Instructions

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney