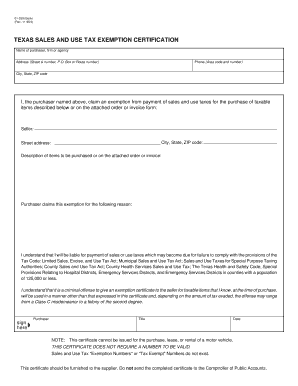

11 953 RESET FORM TEXAS SALES and USE TAX EXEMPTION CERTIFICATION Name of Purchaser, Firm or Agency Address Street &amp Nbis

What is the 11 953 RESET FORM TEXAS SALES AND USE TAX EXEMPTION CERTIFICATION?

The 11 953 RESET FORM TEXAS SALES AND USE TAX EXEMPTION CERTIFICATION is an official document used in Texas to certify that a purchaser is exempt from sales and use tax. This form is essential for businesses and organizations that qualify for tax exemptions under specific circumstances. It includes key information such as the name of the purchaser, firm or agency, and their address. By submitting this form, the purchaser asserts their eligibility for tax exemption, which can lead to significant savings on eligible purchases.

Steps to complete the 11 953 RESET FORM TEXAS SALES AND USE TAX EXEMPTION CERTIFICATION

Completing the 11 953 RESET FORM requires careful attention to detail to ensure accuracy and compliance. Here are the essential steps:

- Begin by entering the name of the purchaser, firm, or agency in the designated field.

- Provide the complete address, including street, city, state, and ZIP code.

- Indicate the specific reason for the tax exemption, referencing the applicable Texas tax code.

- Ensure all information is accurate and up to date to avoid delays in processing.

- Sign and date the form to validate the certification.

Legal use of the 11 953 RESET FORM TEXAS SALES AND USE TAX EXEMPTION CERTIFICATION

The legal use of the 11 953 RESET FORM is governed by Texas tax laws. This form must be completed accurately to be considered valid. It serves as a legal declaration of the purchaser's exempt status and must be presented to sellers to avoid sales tax on eligible transactions. Misuse of the form, such as providing false information, can lead to penalties, including fines and back taxes owed.

How to obtain the 11 953 RESET FORM TEXAS SALES AND USE TAX EXEMPTION CERTIFICATION

The 11 953 RESET FORM can be obtained through the Texas Comptroller's website or directly from local tax offices. It is advisable to download the most current version of the form to ensure compliance with any recent changes in tax regulations. Additionally, some businesses may provide the form upon request for their customers who qualify for tax exemption.

Key elements of the 11 953 RESET FORM TEXAS SALES AND USE TAX EXEMPTION CERTIFICATION

Several key elements must be included on the 11 953 RESET FORM for it to be valid:

- Name of the purchaser, firm, or agency.

- Complete address of the purchaser.

- Reason for exemption, citing the relevant Texas tax code.

- Signature of an authorized representative.

- Date of the certification.

Examples of using the 11 953 RESET FORM TEXAS SALES AND USE TAX EXEMPTION CERTIFICATION

Examples of situations where the 11 953 RESET FORM may be used include:

- A nonprofit organization purchasing supplies for charitable activities.

- A government agency acquiring equipment for public services.

- A school district buying educational materials for classrooms.

Quick guide on how to complete 11 953 reset form texas sales and use tax exemption certification name of purchaser firm or agency address street ampamp nbisd

Prepare 11 953 RESET FORM TEXAS SALES AND USE TAX EXEMPTION CERTIFICATION Name Of Purchaser, Firm Or Agency Address Street & Nbis effortlessly on any device

Web-based document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, since you can obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents promptly without delays. Manage 11 953 RESET FORM TEXAS SALES AND USE TAX EXEMPTION CERTIFICATION Name Of Purchaser, Firm Or Agency Address Street & Nbis on any platform using airSlate SignNow Android or iOS applications and enhance any document-related task today.

Effortlessly modify and eSign 11 953 RESET FORM TEXAS SALES AND USE TAX EXEMPTION CERTIFICATION Name Of Purchaser, Firm Or Agency Address Street & Nbis

- Locate 11 953 RESET FORM TEXAS SALES AND USE TAX EXEMPTION CERTIFICATION Name Of Purchaser, Firm Or Agency Address Street & Nbis and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about missing or lost files, laborious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign 11 953 RESET FORM TEXAS SALES AND USE TAX EXEMPTION CERTIFICATION Name Of Purchaser, Firm Or Agency Address Street & Nbis to ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 11 953 reset form texas sales and use tax exemption certification name of purchaser firm or agency address street ampamp nbisd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 11 953 RESET FORM TEXAS SALES AND USE TAX EXEMPTION CERTIFICATION?

The 11 953 RESET FORM TEXAS SALES AND USE TAX EXEMPTION CERTIFICATION is a document required in Texas to signNow that a purchaser is exempt from sales and use tax. By filling out this form accurately, businesses and organizations can exempt their purchases from tax liabilities. It simplifies the tax-exempt purchasing process for eligible entities.

-

How do I complete the 11 953 RESET FORM TEXAS SALES AND USE TAX EXEMPTION CERTIFICATION?

To complete the 11 953 RESET FORM TEXAS SALES AND USE TAX EXEMPTION CERTIFICATION, gather necessary information such as the name of the purchaser, firm or agency, and their address. Follow the instructions on the form carefully to ensure all required fields are filled out correctly. airSlate SignNow provides tools to streamline this process with electronic signing capabilities.

-

What features does airSlate SignNow offer for managing the 11 953 RESET FORM TEXAS SALES AND USE TAX EXEMPTION CERTIFICATION?

airSlate SignNow offers a range of features including electronic signatures, document templates, and secure cloud storage. For the 11 953 RESET FORM TEXAS SALES AND USE TAX EXEMPTION CERTIFICATION, you can create reusable templates, ensuring consistency and efficiency for each transaction. The platform also allows for real-time document tracking and notifications.

-

Is airSlate SignNow cost-effective for filing the 11 953 RESET FORM TEXAS SALES AND USE TAX EXEMPTION CERTIFICATION?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses managing documents like the 11 953 RESET FORM TEXAS SALES AND USE TAX EXEMPTION CERTIFICATION. With affordable pricing plans, users can save time and reduce administrative costs related to document management. The platform's efficiency can lead to signNow cost savings over time.

-

Can I integrate airSlate SignNow with other systems for the 11 953 RESET FORM TEXAS SALES AND USE TAX EXEMPTION CERTIFICATION?

Absolutely! airSlate SignNow supports various integrations with popular business applications, allowing you to streamline your workflow when handling the 11 953 RESET FORM TEXAS SALES AND USE TAX EXEMPTION CERTIFICATION. This includes integrations with CRM systems, accounting software, and other productivity tools that enhance your document management process.

-

What are the benefits of using airSlate SignNow for the 11 953 RESET FORM TEXAS SALES AND USE TAX EXEMPTION CERTIFICATION?

Using airSlate SignNow for the 11 953 RESET FORM TEXAS SALES AND USE TAX EXEMPTION CERTIFICATION provides numerous benefits including increased efficiency, enhanced security, and convenience. Users can send, receive, and sign documents digitally from anywhere, eliminating the need for paper forms. This modern approach helps businesses stay organized and compliant with tax exemption regulations.

-

How does airSlate SignNow ensure the security of the 11 953 RESET FORM TEXAS SALES AND USE TAX EXEMPTION CERTIFICATION?

airSlate SignNow employs robust security measures to protect documents such as the 11 953 RESET FORM TEXAS SALES AND USE TAX EXEMPTION CERTIFICATION. This includes encryption, secure access controls, and compliance with industry standards. Users can rest assured that their sensitive information remains confidential and secure throughout the transaction.

Get more for 11 953 RESET FORM TEXAS SALES AND USE TAX EXEMPTION CERTIFICATION Name Of Purchaser, Firm Or Agency Address Street &amp Nbis

- Prof application for licensureindd form

- Application for licensure professional counselorrehabilitation form

- Pel reinst app for coaindd form

- Fillable pharmacy permit application form

- Chha initial certification process attorney general form

- Division of consumer affairsnew jersey division of consumer affairs newark njnew jersey division of consumer affairs newark form

- Instructions for reinstatement of a lapsed license division of njconsumeraffairs form

- 1brequestsforproposalrfppurpose form

Find out other 11 953 RESET FORM TEXAS SALES AND USE TAX EXEMPTION CERTIFICATION Name Of Purchaser, Firm Or Agency Address Street &amp Nbis

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form