Oregon Form 132 PDF

What is the Oregon Form 132 PDF?

The Oregon Form 132 is a crucial document used for reporting employee details and state unemployment contributions. This form is essential for employers in Oregon, as it helps ensure compliance with state regulations regarding unemployment insurance. The form provides a structured way to report wages, employee information, and other pertinent data required by the Oregon Employment Department. It is available in PDF format, making it easy to download, fill out, and submit electronically or by mail.

Steps to Complete the Oregon Form 132 PDF

Completing the Oregon Form 132 involves several key steps to ensure accuracy and compliance. First, download the blank form from a reliable source. Next, gather all necessary employee information, including names, Social Security numbers, and wages paid during the reporting period. Fill in the required fields carefully, ensuring that all data is accurate and up-to-date. After completing the form, review it for any errors or omissions. Finally, submit the form either electronically via an approved platform or by mailing it to the designated address provided by the Oregon Employment Department.

Legal Use of the Oregon Form 132 PDF

The Oregon Form 132 is legally binding when completed and submitted according to state guidelines. To ensure its legal validity, employers must comply with the relevant eSignature laws, which include the ESIGN Act and UETA. These laws recognize electronic signatures as legally equivalent to handwritten signatures, provided that certain conditions are met. Using a reliable electronic signing solution can enhance the legal standing of the form by providing an audit trail and ensuring compliance with security standards.

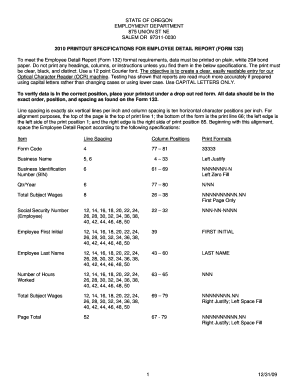

Key Elements of the Oregon Form 132 PDF

Several key elements must be included in the Oregon Form 132 to ensure it is complete and accurate. These elements include:

- Employer Information: Name, address, and employer identification number.

- Employee Details: Names, Social Security numbers, and total wages paid.

- Reporting Period: The specific time frame for which the wages are reported.

- Signature: The signature of the employer or authorized representative, confirming the accuracy of the information.

Ensuring that all these elements are correctly filled out is essential for compliance with state regulations.

Form Submission Methods

Employers in Oregon have several options for submitting the Form 132. The form can be submitted electronically through a secure online platform, which is often the preferred method for its speed and efficiency. Alternatively, employers may choose to mail the completed form to the Oregon Employment Department or submit it in person at a local office. Each submission method has specific guidelines, so it is important to follow the instructions provided to ensure timely and accurate processing.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Oregon Form 132 is critical for employers to avoid penalties. Typically, the form must be submitted quarterly, with specific due dates depending on the end of the reporting period. Employers should keep track of these deadlines, as late submissions may result in fines or other penalties. It is advisable to consult the Oregon Employment Department's official resources for the most current deadlines and any changes that may occur.

Quick guide on how to complete oregon form 132 pdf

Complete Oregon Form 132 Pdf effortlessly on any device

The management of documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the correct form and securely keep it stored online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without any delays. Handle Oregon Form 132 Pdf on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

How to edit and electronically sign Oregon Form 132 Pdf with ease

- Locate Oregon Form 132 Pdf and then click Get Form to begin.

- Make use of the tools available to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which only takes a few seconds and carries the same legal significance as a traditional handwritten signature.

- Review all details and then click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Oregon Form 132 Pdf to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oregon form 132 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 132 and how can airSlate SignNow assist in its completion?

Form 132 is a document often used for specific applications and reporting. airSlate SignNow offers an efficient solution to complete and eSign Form 132 quickly, ensuring that your documents are prepared accurately and securely.

-

Is there a fee to use airSlate SignNow for signing Form 132?

Yes, airSlate SignNow offers competitive pricing plans tailored for businesses needing to sign documents like Form 132. You can choose a plan that best fits your budget, allowing for easy management of eSignatures.

-

What features does airSlate SignNow provide for managing Form 132?

airSlate SignNow provides various features for managing Form 132, including customizable templates, real-time tracking, and automated workflows. These tools enhance productivity and ensure that your documents are processed efficiently.

-

Can I integrate other applications with airSlate SignNow while managing Form 132?

Absolutely! airSlate SignNow supports integrations with a variety of applications, allowing you to manage Form 132 alongside your favorite tools. This streamlines your workflows and enhances your operational efficiency.

-

How secure is the processing of Form 132 in airSlate SignNow?

airSlate SignNow prioritizes security with industry-standard encryption for all documents, including Form 132. Your data is safe, ensuring that your sensitive information is protected during the signing process.

-

What are the benefits of using airSlate SignNow for Form 132?

Using airSlate SignNow for Form 132 simplifies the signing process, reduces turnaround times, and minimizes paperwork. This allows businesses to focus on core operations while ensuring legal compliance and efficient document management.

-

Can I get support for any issues related to Form 132 in airSlate SignNow?

Yes, airSlate SignNow offers robust customer support to assist with any issues related to Form 132. Whether you need help with eSigning or managing your documents, our support team is available to guide you.

Get more for Oregon Form 132 Pdf

- Vehicle accident information application form

- Form 17 application for a family law matter consent order

- Preparing an application for a famiy law matter consent order 052019 pfa723pdf family law matter consent order preparing an form

- Developing workplace form

- Accessible unit evaluation form calgary housing company

- Plan member confirmation of illness form

- Animal health centre province of british columbia form

- Carna employer complaint form

Find out other Oregon Form 132 Pdf

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template