Bicycle Insurance Online India Form

What is bicycle insurance online in India?

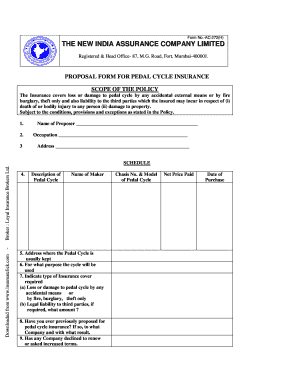

Bicycle insurance online in India provides coverage for theft, damage, and liability associated with cycling. This insurance is designed to protect cyclists against financial losses resulting from accidents or incidents involving their bicycles. Policies can vary in terms of coverage options, including personal accident coverage, third-party liability, and coverage for accessories. Understanding the specifics of bicycle insurance can help cyclists make informed decisions about their coverage needs.

How to obtain bicycle insurance online in India

Obtaining bicycle insurance online in India is a straightforward process. Cyclists can start by researching various insurance providers that offer bicycle insurance. Most companies provide online platforms where users can compare policies, coverage options, and premiums. After selecting a suitable policy, users will need to fill out an application form, providing necessary details such as personal information, bicycle specifications, and coverage preferences. Payment can typically be made online, facilitating a quick and efficient process.

Steps to complete the bicycle insurance online in India

Completing the bicycle insurance online process involves several key steps:

- Research and compare different insurance providers and their policies.

- Select the desired coverage options that meet your needs.

- Fill out the application form with accurate information.

- Review the terms and conditions of the policy carefully.

- Make the payment through the online portal.

- Receive the policy document via email or through the provider's website.

Legal use of bicycle insurance online in India

The legal use of bicycle insurance online in India is governed by specific regulations that ensure the validity of eDocuments. For a policy to be legally binding, it must comply with the Electronic Signature Act and other relevant laws. This includes the use of secure electronic signatures that authenticate the identity of the signer. By adhering to these legal standards, both the insurer and the insured can ensure that the policy is enforceable in a court of law.

Key elements of bicycle insurance online in India

Key elements of bicycle insurance online in India include:

- Coverage Types: Personal accident, theft, and third-party liability.

- Premiums: The cost of the policy can vary based on coverage levels and bicycle value.

- Exclusions: Common exclusions may include wear and tear, racing, and intentional damage.

- Claim Process: Understanding how to file a claim is crucial for receiving benefits.

Examples of using bicycle insurance online in India

Examples of scenarios where bicycle insurance online in India can be beneficial include:

- A cyclist's bike is stolen while parked in a public area, and they file a claim for reimbursement.

- A rider is involved in an accident causing damage to another person's property, leading to a liability claim.

- A cyclist suffers injuries due to an accident and seeks compensation through their personal accident coverage.

Quick guide on how to complete bicycle insurance online india

Effortlessly Prepare Bicycle Insurance Online India on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers a great eco-friendly alternative to conventional printed and signed papers, allowing you to access the necessary form and safely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly and without hassle. Handle Bicycle Insurance Online India on any device with the airSlate SignNow apps for Android or iOS and enhance your document-centric processes today.

Easily Modify and Electronically Sign Bicycle Insurance Online India

- Obtain Bicycle Insurance Online India and click Get Form to begin.

- Use the tools provided to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details using the tools specifically offered by airSlate SignNow for this purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and press the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Modify and electronically sign Bicycle Insurance Online India to guarantee excellent communication at every stage of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bicycle insurance online india

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is bicycle insurance in India?

Bicycle insurance in India is a specialized policy designed to provide financial protection against theft, damage, or accidents involving your bicycle. This insurance not only covers the bicycle itself but can also include liability for damage to third parties. Having bicycle insurance in India is essential for safeguarding your investment and ensuring peace of mind.

-

How much does bicycle insurance cost in India?

The cost of bicycle insurance in India can vary widely based on factors such as the type of bicycle, the coverage amount, and personal details like location and usage. On average, premiums range from a few hundred to several thousand rupees annually. It's advisable to shop around and compare quotes to find the best coverage that fits your budget.

-

What does bicycle insurance in India typically cover?

Bicycle insurance in India typically covers theft, loss, accidental damage, and liability for injury to third parties. Some policies may also include coverage for accessories like helmets and repair costs. It's important to read the policy documents thoroughly to understand the specific inclusions and exclusions.

-

Are there any benefits to having bicycle insurance in India?

Yes, bicycle insurance in India offers several benefits, including financial protection against theft and accidents. It also ensures that you're covered for any liabilities arising from use, which can be particularly important in busy urban areas. Additionally, many insurers offer roadside assistance and coverage for rental bicycles, enhancing your overall riding experience.

-

Can I customize my bicycle insurance policy in India?

Many insurance providers in India allow you to customize your bicycle insurance policy to better fit your needs. You can choose the level of coverage, add-ons for specific events, and adjust your premium based on deductibles. This flexibility enables you to find a policy that aligns with your cycling habits and financial situation.

-

How do I file a claim for bicycle insurance in India?

To file a claim for bicycle insurance in India, you need to contact your insurance provider and provide necessary documentation such as proof of loss, police reports (if applicable), and photographs of the damage. The insurer will guide you through the claims process, which typically requires filling out a form and submitting it along with all required documents. Timely reporting is crucial for a successful claim.

-

Is bicycle insurance necessary for casual riders in India?

While not legally required, bicycle insurance in India is highly recommended even for casual riders. It provides safety against unforeseen events like theft or accidents that can lead to signNow expenses. Having this insurance allows you to enjoy your riding experience without the worry of financial loss.

Get more for Bicycle Insurance Online India

Find out other Bicycle Insurance Online India

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple