Il 1023 Ces Form

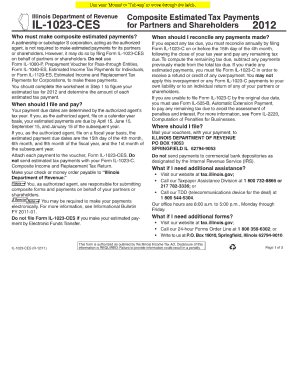

What is the IL 1023 CES?

The IL 1023 CES is a form used in the state of Illinois, specifically designed for certain tax-related purposes. This form is essential for organizations that need to report specific information to the state. It is crucial for compliance with state regulations and ensures that entities fulfill their tax obligations accurately. Understanding the purpose of the IL 1023 CES is vital for any organization operating within Illinois, as it directly impacts their legal standing and tax responsibilities.

How to use the IL 1023 CES

Using the IL 1023 CES involves several steps to ensure compliance with state requirements. First, organizations must gather all necessary information, including financial data and identification details. Once the form is filled out, it must be reviewed for accuracy. After confirming that all information is correct, the form can be submitted either electronically or via mail, depending on the specific instructions provided by the Illinois Department of Revenue. It is important to follow the guidelines carefully to avoid any potential issues.

Steps to complete the IL 1023 CES

Completing the IL 1023 CES requires a systematic approach:

- Gather necessary documents, including financial statements and identification numbers.

- Fill out the form accurately, ensuring all sections are completed.

- Review the form for any errors or omissions.

- Submit the form according to the specified method, either online or by mail.

- Retain a copy of the submitted form for your records.

Following these steps will help ensure that the form is completed correctly and submitted on time.

Legal use of the IL 1023 CES

The legal use of the IL 1023 CES is governed by state regulations that dictate how and when the form should be filed. Organizations must ensure that they are using the most current version of the form and that they are compliant with all relevant tax laws. The form serves as a formal declaration to the state, and any inaccuracies or failures to file can result in penalties. It is advisable to consult with a tax professional to ensure compliance with all legal requirements associated with the IL 1023 CES.

Filing Deadlines / Important Dates

Filing deadlines for the IL 1023 CES are critical to avoid penalties. Typically, organizations must submit the form by a specific date each year, which may vary based on the entity type and fiscal year. It is essential to stay informed about these deadlines to ensure timely compliance. Marking these dates on a calendar can help organizations keep track of their filing obligations and avoid late submissions.

Who Issues the Form

The IL 1023 CES is issued by the Illinois Department of Revenue. This state agency is responsible for overseeing tax compliance and ensuring that organizations adhere to state tax laws. The department provides guidance on how to complete the form and the necessary steps for submission. Organizations can refer to the department’s resources for additional support and clarification regarding the form.

Quick guide on how to complete il 1023 ces

Effortlessly Prepare Il 1023 Ces on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents swiftly and without delays. Manage Il 1023 Ces on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and Electronically Sign Il 1023 Ces with Ease

- Find Il 1023 Ces and then click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize relevant parts of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Choose your preferred method for sending your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form hunting, or errors requiring new printed document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Il 1023 Ces while ensuring effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the il 1023 ces

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is il 1023 ces 2019?

Il 1023 ces 2019 is a specific form used within the realm of electronic signatures and document management. Understanding this form is essential for businesses looking to comply with relevant legal requirements while leveraging airSlate SignNow.

-

How does airSlate SignNow facilitate the use of il 1023 ces 2019?

AirSlate SignNow enables users to seamlessly complete and send il 1023 ces 2019 forms for electronic signature. By streamlining this process, businesses can ensure that all necessary documents are signed promptly and in compliance with electronic signature laws.

-

What pricing options are available for airSlate SignNow in relation to il 1023 ces 2019?

AirSlate SignNow offers competitive pricing plans that enable businesses to efficiently manage documents including il 1023 ces 2019. Each plan provides features tailored to different organizational needs, making it a cost-effective choice for document management.

-

What features does airSlate SignNow offer for managing il 1023 ces 2019 documents?

AirSlate SignNow includes robust features such as customizable templates and efficient workflow automation for managing il 1023 ces 2019 documents. This allows users to easily create, send, and track their documents, enhancing overall productivity.

-

Can airSlate SignNow integrate with other platforms regarding il 1023 ces 2019?

Yes, airSlate SignNow offers integrations with several popular platforms, which can help manage il 1023 ces 2019 forms more effectively. This connectivity ensures that your document processes can be streamlined and coordinated with other business applications.

-

How does using airSlate SignNow benefit businesses dealing with il 1023 ces 2019?

Using airSlate SignNow benefits businesses by simplifying the signing process for il 1023 ces 2019 documents, ultimately leading to faster transactions. Additionally, the user-friendly interface ensures that team members can adapt quickly, enhancing efficiency.

-

Is airSlate SignNow suitable for small businesses that need to handle il 1023 ces 2019 forms?

Absolutely! AirSlate SignNow is designed to accommodate businesses of all sizes, including small enterprises needing to manage il 1023 ces 2019 forms. Its affordability and ease of use make it an ideal solution for small business owners.

Get more for Il 1023 Ces

- Contracted plate search cps application form

- Dmv notice of sale or transfer of a vehicle oregon form

- A guide to services serving senior citizens persons with disabilities and veterans form

- Houston texas 77210 4089 form

- What you should know about illinois accessible parking persons wdisabilities parking chart form

- Illinois funeral home vehicle registration form

- Filing of business information

- 2018 2021 form ga prime contractor application fill online

Find out other Il 1023 Ces

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online