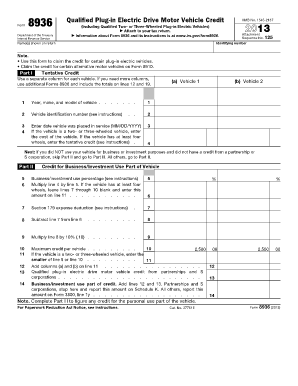

Form 8936 Identifying Number

What is the Form 8936 Identifying Number

The Form 8936 identifying number is a crucial element used to track and report specific tax credits related to electric vehicles. This number is typically assigned to the taxpayer and is essential for ensuring that the IRS accurately processes the claim for the electric vehicle credit. It helps to identify the vehicle and the taxpayer's eligibility for the associated benefits. Understanding this number is vital for individuals and businesses looking to maximize their tax credits when filing their returns.

How to use the Form 8936 Identifying Number

To effectively use the Form 8936 identifying number, taxpayers must include it on the form when applying for the electric vehicle tax credit. This number must match the vehicle identification number (VIN) of the qualifying electric vehicle. Accurate entry of the identifying number is essential to avoid delays or complications during the tax filing process. Taxpayers should ensure that all information aligns with IRS guidelines to facilitate a smooth submission.

Steps to complete the Form 8936 Identifying Number

Completing the Form 8936 identifying number involves several key steps:

- Gather necessary documentation, including the vehicle's VIN and proof of purchase.

- Access the Form 8936 and locate the section for the identifying number.

- Enter the VIN accurately, ensuring it corresponds with the vehicle's registration.

- Double-check all entries for accuracy to prevent errors that could lead to rejection.

- Submit the completed form along with your tax return to the IRS.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Form 8936 identifying number. Taxpayers must ensure that the number is used only for qualifying electric vehicles and that it is correctly matched with the VIN. The IRS outlines eligibility criteria, including vehicle type and purchase date, which must be adhered to in order to claim the credit successfully. Familiarizing oneself with these guidelines can help in avoiding common pitfalls during the filing process.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8936 are typically aligned with the standard tax return deadlines. For most taxpayers, this means the form should be submitted by April 15 each year. However, extensions may apply, and it is important to stay informed about any changes to tax laws or deadlines that could affect the submission of the form. Keeping track of these dates ensures that taxpayers do not miss out on potential tax credits.

Required Documents

When completing the Form 8936, several documents are required to support the claim for the electric vehicle tax credit. These documents include:

- The vehicle's purchase agreement or invoice.

- Proof of the vehicle's VIN.

- Documentation proving the vehicle qualifies for the electric vehicle credit.

Having these documents readily available can streamline the process and ensure that all necessary information is submitted accurately.

Quick guide on how to complete form 8936 identifying number

Easily Complete Form 8936 Identifying Number on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can locate the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Manage Form 8936 Identifying Number on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and eSign Form 8936 Identifying Number with Ease

- Obtain Form 8936 Identifying Number and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive details using tools that airSlate SignNow offers specifically for that function.

- Generate your eSignature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to store your changes.

- Select how you wish to share your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors necessitating the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 8936 Identifying Number and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8936 identifying number

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8936 and why is it important?

Form 8936 is used to claim a credit for qualified plug-in electric drive motor vehicles. Filling out this form accurately can lead to signNow tax benefits, making it essential for qualifying individuals. Understanding a 'form 8936 filled out example' can help you navigate the process effectively.

-

How can airSlate SignNow help with Form 8936?

airSlate SignNow provides a user-friendly platform to eSign and manage your documents, including Form 8936. By utilizing our service, you can streamline the process, ensuring that your form is completed accurately and submitted on time. Look for 'form 8936 filled out example' templates available within our platform.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow offers a variety of features including templates, document tracking, and secure cloud storage. These functionalities make it easy to manage important documents like Form 8936. Our tool also allows you to review a 'form 8936 filled out example' to understand how to prepare your submission properly.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and CRM systems. This enables you to manage your documents more efficiently, including any related to Form 8936. Our integrations can simplify the process of accessing a 'form 8936 filled out example' for your needs.

-

Is airSlate SignNow a cost-effective solution for businesses?

Absolutely! airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. By utilizing our platform, you can save on printing, mailing, and document storage costs, especially for forms like Form 8936, which can be handled digitally. Consider checking out a 'form 8936 filled out example' to see the savings potential.

-

How secure is my information with airSlate SignNow?

Security is a priority at airSlate SignNow. We utilize industry-leading encryption and compliance standards to ensure your documents, including Form 8936, are protected. Knowing how to manage a 'form 8936 filled out example' securely can help you feel confident in sharing sensitive information.

-

Can I save a filled out Form 8936 for future use?

Yes, you can save your filled out Form 8936 within the airSlate SignNow platform for future reference or modifications. This allows for easy retrieval of your documents at any time. A 'form 8936 filled out example' can act as a reference when you need to update your saved versions.

Get more for Form 8936 Identifying Number

Find out other Form 8936 Identifying Number

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself