Ohio Tax Exempt Form

What is the Ohio Tax Exempt Form

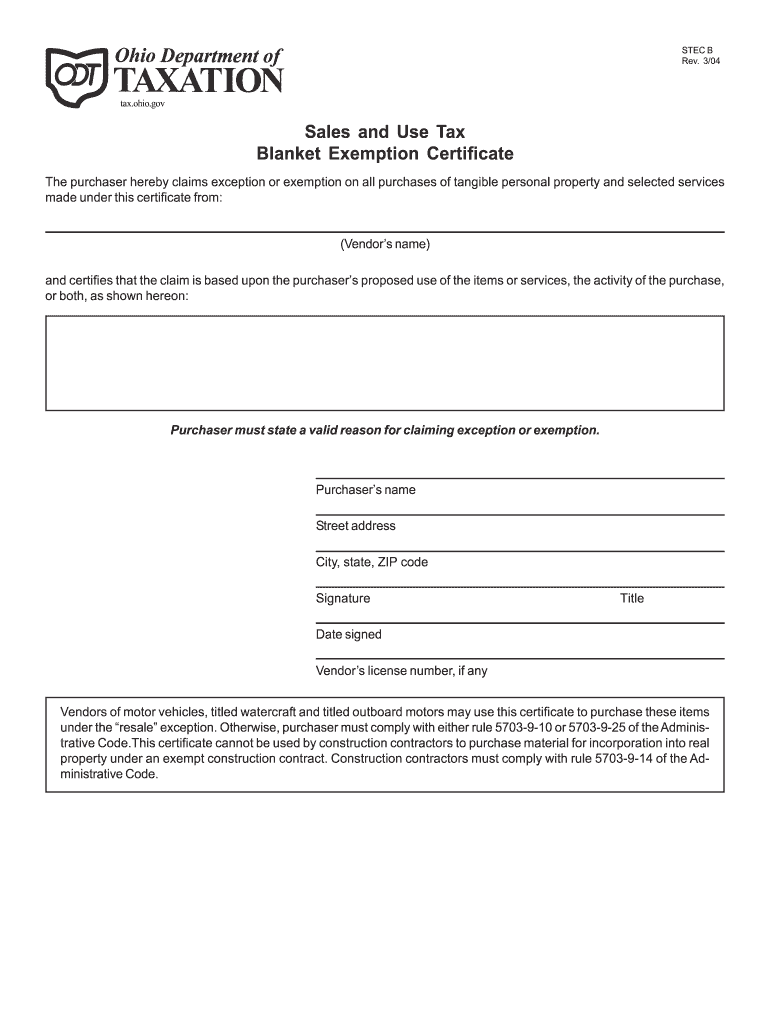

The Ohio Tax Exempt Form is a document used by individuals and businesses to claim exemption from sales tax on certain purchases. This form is essential for qualifying entities, such as non-profit organizations, educational institutions, and government agencies, that are exempt from paying sales tax under Ohio law. The form provides a means for these entities to make tax-exempt purchases without incurring additional costs.

How to use the Ohio Tax Exempt Form

To use the Ohio Tax Exempt Form, the purchaser must present the completed form to the seller at the time of purchase. This allows the seller to verify the purchaser's tax-exempt status. It is important to ensure that the form is filled out accurately, including the name of the exempt organization, the reason for the exemption, and the signature of an authorized representative. Sellers should retain a copy of the form for their records to comply with state regulations.

Steps to complete the Ohio Tax Exempt Form

Completing the Ohio Tax Exempt Form involves several key steps:

- Obtain the correct form from the Ohio Department of Taxation or a trusted source.

- Fill in the name and address of the exempt organization.

- Specify the reason for the exemption, such as non-profit status or government affiliation.

- Provide the signature of an authorized representative of the organization.

- Present the completed form to the seller at the time of purchase.

Key elements of the Ohio Tax Exempt Form

The Ohio Tax Exempt Form includes several critical elements that must be accurately filled out to ensure its validity:

- Organization Name: The legal name of the entity claiming the exemption.

- Address: The physical address of the organization.

- Exemption Reason: A clear statement of why the organization qualifies for tax exemption.

- Authorized Signature: A signature from someone with the authority to act on behalf of the organization.

- Date: The date the form is completed and signed.

Legal use of the Ohio Tax Exempt Form

The legal use of the Ohio Tax Exempt Form is governed by state tax laws. It is important for organizations to understand their eligibility for tax exemption and to use the form correctly to avoid any legal issues. Misuse of the form or failure to comply with the requirements can lead to penalties, including back taxes owed and fines. Therefore, organizations should ensure they meet all criteria before claiming tax-exempt status.

Eligibility Criteria

Eligibility for using the Ohio Tax Exempt Form typically includes the following criteria:

- Non-profit organizations recognized under IRS regulations.

- Government entities at the local, state, or federal level.

- Educational institutions that meet specific requirements.

- Religious organizations that qualify for tax exemption.

Quick guide on how to complete ohio tax exempt form

Complete Ohio Tax Exempt Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents since you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Ohio Tax Exempt Form on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign Ohio Tax Exempt Form without hassle

- Locate Ohio Tax Exempt Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow manages your document handling needs in just a few clicks from any device you prefer. Edit and eSign Ohio Tax Exempt Form and guarantee effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ohio tax exempt form

How to create an e-signature for your PDF file in the online mode

How to create an e-signature for your PDF file in Chrome

The best way to make an e-signature for putting it on PDFs in Gmail

The way to generate an e-signature from your smartphone

How to generate an electronic signature for a PDF file on iOS devices

The way to generate an e-signature for a PDF file on Android

People also ask

-

What is an Ohio resale certificate?

An Ohio resale certificate is a document that allows a buyer to purchase goods without paying sales tax, as they intend to resell the items. This certificate is essential for businesses that sell products in Ohio and wish to avoid unnecessary taxation on inventory purchases.

-

How can I apply for an Ohio resale certificate?

To apply for an Ohio resale certificate, you need to complete the Ohio Department of Taxation's Sales Tax exemption form. This form can typically be obtained online and submitted to your vendors to exempt you from sales tax during your purchases.

-

What information is required to complete the Ohio resale certificate?

When completing the Ohio resale certificate, you will need to provide basic information such as your business name, address, vendor details, and a description of the goods you are purchasing. Ensuring this information is accurate is crucial to prevent any taxation issues.

-

Is there a fee to obtain an Ohio resale certificate?

No, there is no fee associated with obtaining an Ohio resale certificate. However, you may incur costs associated with maintaining your business registration or tax compliance.

-

How does airSlate SignNow help with managing Ohio resale certificates?

airSlate SignNow streamlines the process of managing your Ohio resale certificates by allowing you to easily create, sign, and store these documents electronically. Our solution ensures that you have all essential documentation handy and compliant, making your business operations smoother.

-

Can I use my Ohio resale certificate in other states?

An Ohio resale certificate is specifically valid within Ohio and may not be accepted in other states. Each state has its own regulations and certificate requirements, so it’s important to verify the rules for resale certificates in other locations.

-

What are the benefits of using an Ohio resale certificate?

Using an Ohio resale certificate allows businesses to save on sales tax for items they plan to resell, enhancing profitability. It simplifies accounting and ensures a smoother purchasing process for resalable goods.

Get more for Ohio Tax Exempt Form

- As provided in this agreement and the laws of the state of south dakota form

- The south dakota codified laws section 55 1 4 through 55 1 5 form

- Revocable living trust and is created in accordance with chapter 55 of form

- On this day of in the year before me 490219162 form

- Business law chapter 17 flashcardsquizlet form

- Heshethey executed the same form

- County state of south dakota and described as follows form

- State of south dakota and being described as follows form

Find out other Ohio Tax Exempt Form

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast