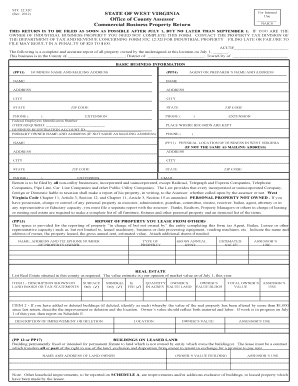

West Virginia Commercial Business Property Return Form

What is the West Virginia Commercial Business Property Return

The West Virginia Commercial Business Property Return is a tax form used by businesses to report their commercial property holdings to the state. This form is essential for determining property taxes owed by businesses operating within West Virginia. It requires detailed information about the type, location, and value of the commercial properties owned by the business. Accurate completion of this form ensures compliance with state tax regulations and helps avoid potential penalties.

Steps to complete the West Virginia Commercial Business Property Return

Completing the West Virginia Commercial Business Property Return involves several key steps:

- Gather necessary documentation, including property deeds, appraisal reports, and previous tax returns.

- Provide accurate property descriptions, including location, size, and current market value.

- List any exemptions or deductions applicable to your properties.

- Review the completed form for accuracy and completeness.

- Sign and date the form, ensuring all required signatures are included.

Following these steps will help ensure that the return is filed correctly and on time.

Legal use of the West Virginia Commercial Business Property Return

The legal use of the West Virginia Commercial Business Property Return is critical for businesses to maintain compliance with state tax laws. This form must be filed annually to report any changes in property ownership, value, or use. Failure to submit the form can result in penalties, including fines and increased property tax assessments. Additionally, the information provided in this form may be subject to audits by state tax authorities, making accuracy crucial.

Form Submission Methods

The West Virginia Commercial Business Property Return can be submitted through various methods:

- Online: Businesses can file electronically through the West Virginia State Tax Department's online portal.

- Mail: Completed forms can be printed and mailed to the appropriate tax office.

- In-Person: Businesses may also choose to submit their forms in person at designated tax office locations.

Choosing the right submission method can facilitate a smoother filing process and ensure timely receipt by the tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the West Virginia Commercial Business Property Return are essential for compliance. Typically, the return must be filed by July first of each year. However, businesses should verify specific deadlines for their circumstances, as extensions may be available under certain conditions. Keeping track of these dates helps avoid late fees and penalties.

Key elements of the West Virginia Commercial Business Property Return

Key elements of the West Virginia Commercial Business Property Return include:

- Property Identification: Details about each commercial property owned, including address and type.

- Market Value: Current assessed value of the property, which affects tax calculations.

- Exemptions: Any applicable tax exemptions or deductions that may reduce the taxable value.

- Signature: Required signatures from authorized representatives of the business.

Each of these elements plays a vital role in ensuring the form is complete and compliant with state regulations.

Quick guide on how to complete west virginia commercial business property return

Effortlessly Prepare West Virginia Commercial Business Property Return on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to design, modify, and eSign your documents quickly and without delays. Manage West Virginia Commercial Business Property Return on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The Easiest Way to Modify and eSign West Virginia Commercial Business Property Return with Ease

- Obtain West Virginia Commercial Business Property Return and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to secure your modifications.

- Choose your preferred method of sending your form: via email, SMS, invitation link, or download it directly to your PC.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that require new copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign West Virginia Commercial Business Property Return to ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the west virginia commercial business property return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the west virginia commercial business property return?

The west virginia commercial business property return is a document that businesses in West Virginia must file to report property used for commercial purposes. This return helps ensure that property taxes are accurately assessed and collected. Understanding this process is vital for businesses to maintain compliance with state regulations.

-

How can airSlate SignNow assist with the west virginia commercial business property return?

airSlate SignNow provides a user-friendly platform for businesses to electronically sign and send documents related to their west virginia commercial business property return. With our solution, you can streamline the document creation and submission process, saving time and reducing the risk of errors. Ensuring that your property returns are submitted efficiently can help keep your business compliant.

-

Are there any costs associated with using airSlate SignNow for my west virginia commercial business property return?

airSlate SignNow offers a range of pricing plans to suit different business needs, including features relevant to managing your west virginia commercial business property return. Pricing is designed to be cost-effective, allowing businesses to choose a plan based on their document signing frequency and needs. Visit our pricing page to explore the best options for your business.

-

What features does airSlate SignNow offer for managing property returns?

airSlate SignNow includes features such as templates for documents, audit trails, and secure storage, specifically beneficial for handling west virginia commercial business property return. Our platform enables easy customization of documents and ensures that you can track the status of each return, helping you stay organized and compliant. Integration with other tools further enhances your workflow.

-

Is airSlate SignNow compliant with West Virginia regulations for business property returns?

Yes, airSlate SignNow is designed to comply with federal and state regulations, including those pertinent to the west virginia commercial business property return. Our platform is built to support businesses in adhering to legal standards for document handling and eSigning. You can trust us to help you navigate the complexities of compliance effectively.

-

Can I integrate airSlate SignNow with other software I use for my business?

Absolutely! airSlate SignNow offers integrations with various software solutions that can help streamline your workflow for managing the west virginia commercial business property return. These integrations make it easier to share relevant documents and data without manual data entry. Check our integrations page to see the full list of compatible applications.

-

How does eSigning benefit my west virginia commercial business property return process?

E-signing through airSlate SignNow expedites the process of filing your west virginia commercial business property return by eliminating the need for printing and physical signatures. This not only saves time but also enhances the security and accessibility of your documents. With e-signing, your consent is legally binding and can be completed from anywhere.

Get more for West Virginia Commercial Business Property Return

- Pdf payroll expense tax employersole proprietorpartner form

- Business discontinuation form local tax forms parking tax

- Ptt 175 form

- Shareholders instructions for schedule k 1 form 1120 s irs

- Corporate income tax vermont department of taxes form

- Current year income assessment form 202122 current year income assessment form 202122

- 2021 instructions for form ftb 3522 llc tax voucher

- California form 540 es estimated tax for individuals

Find out other West Virginia Commercial Business Property Return

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile