Ptax 343 a Form Cook County

What is the Ptax 343 A Form Cook County

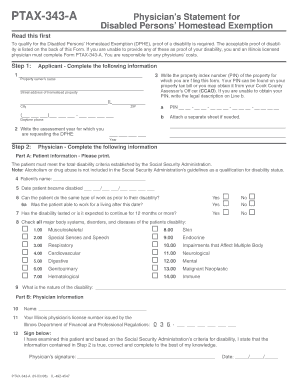

The Ptax 343 A Form Cook County is a property tax exemption application specifically designed for homeowners in Cook County, Illinois. This form allows eligible individuals to apply for various property tax exemptions that can significantly reduce their tax burden. The exemptions may include general homestead exemptions, senior citizen exemptions, and other specific relief programs aimed at assisting homeowners in managing their property taxes.

How to use the Ptax 343 A Form Cook County

Using the Ptax 343 A Form Cook County involves several steps to ensure that the application is completed accurately. Begin by gathering all necessary information, including property details, ownership information, and any documentation required to support your eligibility for exemptions. Once the form is filled out, it can be submitted electronically or via mail, depending on your preference and the specific requirements of the Cook County Assessor's Office.

Steps to complete the Ptax 343 A Form Cook County

Completing the Ptax 343 A Form Cook County requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the Cook County Assessor's Office.

- Fill in your personal information, including name, address, and contact details.

- Provide property information, including the property's parcel number and address.

- Indicate the specific exemptions you are applying for and provide any required documentation.

- Review the form for accuracy before submission.

Legal use of the Ptax 343 A Form Cook County

The legal use of the Ptax 343 A Form Cook County is governed by Illinois property tax laws. When completed correctly, the form serves as a formal request for tax exemptions, which can be legally binding. It is crucial to ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or denial of the exemption request.

Key elements of the Ptax 343 A Form Cook County

Key elements of the Ptax 343 A Form Cook County include:

- Property owner information: Name, address, and contact details.

- Property details: Parcel number, property type, and location.

- Exemption types: Specific exemptions being applied for, such as homestead or senior citizen exemptions.

- Supporting documentation: Any required proof of eligibility, such as income statements or age verification.

Form Submission Methods

The Ptax 343 A Form Cook County can be submitted through various methods to accommodate different preferences:

- Online submission via the Cook County Assessor's website, ensuring a quick and efficient process.

- Mailing the completed form to the appropriate office address as indicated on the form.

- In-person submission at designated Cook County Assessor's Office locations for those who prefer face-to-face assistance.

Quick guide on how to complete ptax 343 a form cook county

Complete Ptax 343 A Form Cook County effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, as you can obtain the correct version and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without complications. Manage Ptax 343 A Form Cook County on any device using the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to adjust and eSign Ptax 343 A Form Cook County with ease

- Acquire Ptax 343 A Form Cook County and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to retain your changes.

- Choose your preferred method to share your form: via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searching, or mistakes that require fresh document prints. airSlate SignNow caters to all your document management needs with just a few clicks from any device you choose. Alter and eSign Ptax 343 A Form Cook County and ensure excellent communication throughout the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ptax 343 a form cook county

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ptax 343 a form cook county used for?

The ptax 343 a form cook county is utilized for property tax assessment appeals in Cook County, Illinois. It enables property owners to challenge their property tax valuations effectively. Understanding this form's purpose is crucial for anyone looking to manage their property taxes efficiently.

-

How do I complete the ptax 343 a form cook county?

Completing the ptax 343 a form cook county involves gathering necessary documentation related to your property and following the instructions provided on the form. Make sure to accurately fill in your property details and the reasons for your appeal. Using airSlate SignNow can streamline this process signNowly by allowing you to securely eSign and send your documents.

-

What are the benefits of using airSlate SignNow for the ptax 343 a form cook county?

Using airSlate SignNow for the ptax 343 a form cook county offers numerous benefits, including ease of use and enhanced efficiency. With its user-friendly interface, you can quickly prepare, eSign, and submit your forms without the hassle of paperwork. Additionally, it ensures your documents are secure and compliant with legal standards.

-

Is there a cost associated with the ptax 343 a form cook county?

While there is no direct fee for filing the ptax 343 a form cook county itself, there may be associated costs for legal assistance or services provided to help prepare your appeal. Using airSlate SignNow can minimize these expenses by simplifying the process. Explore our affordable pricing options to find the best plan for your needs.

-

Can I track the status of my ptax 343 a form cook county submission?

Yes, by utilizing airSlate SignNow, you can easily track the status of your ptax 343 a form cook county submission. The platform provides real-time updates, allowing you to see when your documents are viewed, signed, or completed. This feature adds an extra layer of confidence in your submission process.

-

Are there any integrations available with airSlate SignNow for managing my ptax 343 a form cook county?

AirSlate SignNow offers various integrations that streamline document management for forms like the ptax 343 a form cook county. These integrations can connect with popular applications and services to enhance workflow efficiency and organization. Check our integration options to find the best fit for your requirements.

-

How secure is the airSlate SignNow platform for submitting the ptax 343 a form cook county?

The security of your documents is a top priority at airSlate SignNow. When submitting the ptax 343 a form cook county, the platform employs advanced encryption methods and security protocols to protect your sensitive information. You can feel confident knowing that your data is safe throughout the entire process.

Get more for Ptax 343 A Form Cook County

Find out other Ptax 343 A Form Cook County

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form