Municipal Net Profit Tax Net Operating Loss Deduction Worksheet Form

What is the Municipal Net Profit Tax Net Operating Loss Deduction Worksheet

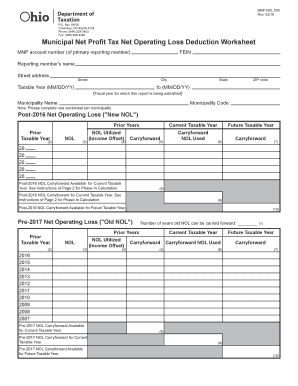

The Municipal Net Profit Tax Net Operating Loss Deduction Worksheet is a specialized form used by businesses to calculate and report their net operating losses for municipal tax purposes. This worksheet allows businesses to determine how much of their net operating loss can be deducted from their taxable income, which can significantly reduce their tax liability. Understanding this form is essential for businesses operating within municipalities that impose a net profit tax, as it helps ensure compliance with local tax regulations.

How to use the Municipal Net Profit Tax Net Operating Loss Deduction Worksheet

Using the Municipal Net Profit Tax Net Operating Loss Deduction Worksheet involves several key steps. First, gather all relevant financial documents, including income statements and expense records. Next, input your total income and expenses into the appropriate sections of the worksheet. The form typically requires you to calculate your net profit or loss by subtracting total expenses from total income. Finally, follow the instructions to determine the allowable deduction based on your net operating loss, ensuring that all calculations are accurate to avoid potential issues with tax authorities.

Steps to complete the Municipal Net Profit Tax Net Operating Loss Deduction Worksheet

Completing the Municipal Net Profit Tax Net Operating Loss Deduction Worksheet involves a systematic approach:

- Collect all necessary financial documents, including profit and loss statements.

- Fill in the total income and total expenses for the reporting period.

- Calculate your net profit or loss by subtracting total expenses from total income.

- Refer to the worksheet instructions to determine the allowable net operating loss deduction.

- Review all entries for accuracy before finalizing the worksheet.

Legal use of the Municipal Net Profit Tax Net Operating Loss Deduction Worksheet

The Municipal Net Profit Tax Net Operating Loss Deduction Worksheet must be completed accurately and submitted in accordance with local tax laws to be considered legally valid. Compliance with relevant regulations ensures that the deductions claimed are legitimate and can withstand scrutiny from tax authorities. It is vital for businesses to keep thorough records and documentation that support the figures reported on the worksheet, as this can be crucial in the event of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the Municipal Net Profit Tax Net Operating Loss Deduction Worksheet can vary by municipality. Generally, businesses are required to submit their worksheets along with their annual tax returns. It is important to be aware of specific due dates to avoid penalties. Businesses should check with their local tax authority for the exact filing deadlines, as missing these dates can result in additional fees or loss of deductions.

Examples of using the Municipal Net Profit Tax Net Operating Loss Deduction Worksheet

Examples of using the Municipal Net Profit Tax Net Operating Loss Deduction Worksheet can clarify its application. For instance, if a business incurred a net operating loss of $50,000 in one year due to unforeseen circumstances, it can use this worksheet to determine how much of that loss can be deducted from its taxable income in the following year. This deduction could significantly lower the business's tax liability, providing financial relief during challenging times.

Quick guide on how to complete municipal net profit tax net operating loss deduction worksheet

Complete Municipal Net Profit Tax Net Operating Loss Deduction Worksheet effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a suitable eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, adjust, and eSign your documents swiftly without any delays. Handle Municipal Net Profit Tax Net Operating Loss Deduction Worksheet on any device using the airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

The easiest way to modify and eSign Municipal Net Profit Tax Net Operating Loss Deduction Worksheet without hassle

- Locate Municipal Net Profit Tax Net Operating Loss Deduction Worksheet and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the issues of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your liking. Modify and eSign Municipal Net Profit Tax Net Operating Loss Deduction Worksheet to ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the municipal net profit tax net operating loss deduction worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Municipal Net Profit Tax Net Operating Loss Deduction Worksheet?

The Municipal Net Profit Tax Net Operating Loss Deduction Worksheet is a tool designed to help businesses calculate and apply deductions related to their net operating losses for municipal tax purposes. Using this worksheet simplifies the process of determining how losses can offset profits, reducing overall tax liabilities. It's essential for compliance and financial planning.

-

How can airSlate SignNow help with the Municipal Net Profit Tax Net Operating Loss Deduction Worksheet?

airSlate SignNow streamlines the process of completing and signing the Municipal Net Profit Tax Net Operating Loss Deduction Worksheet. Our eSigning solution allows you to easily share and collaborate on this document, ensuring that all necessary parties can review and sign off efficiently. This saves time while maintaining accuracy and compliance.

-

Is airSlate SignNow compliant with municipal tax regulations while handling the Municipal Net Profit Tax Net Operating Loss Deduction Worksheet?

Yes, airSlate SignNow complies with regulations related to document handling and electronic signatures, which includes the Municipal Net Profit Tax Net Operating Loss Deduction Worksheet. Our platform provides secure and legally binding eSignatures, ensuring that your documents meet legal requirements and protect sensitive information.

-

What are the pricing options available for airSlate SignNow for businesses needing the Municipal Net Profit Tax Net Operating Loss Deduction Worksheet?

airSlate SignNow offers competitive pricing plans designed for businesses of all sizes. Each plan comes with features that facilitate the management of documents like the Municipal Net Profit Tax Net Operating Loss Deduction Worksheet. By choosing a plan that best suits your needs, you can optimize your workflow while keeping costs low.

-

Can I integrate airSlate SignNow with other software for handling the Municipal Net Profit Tax Net Operating Loss Deduction Worksheet?

Absolutely! airSlate SignNow integrates with various software platforms that may be relevant when dealing with the Municipal Net Profit Tax Net Operating Loss Deduction Worksheet. These integrations enhance your efficiency by allowing seamless data transfer between applications, streamlining your workflow.

-

What features does airSlate SignNow offer for the Municipal Net Profit Tax Net Operating Loss Deduction Worksheet?

airSlate SignNow provides features such as customizable templates, eSignature capabilities, and real-time collaboration tools to facilitate the use of the Municipal Net Profit Tax Net Operating Loss Deduction Worksheet. Additionally, the platform ensures secure document storage and retrieval for all your tax-related forms, enhancing your overall productivity.

-

How does using airSlate SignNow benefit businesses in completing the Municipal Net Profit Tax Net Operating Loss Deduction Worksheet?

Using airSlate SignNow benefits businesses by streamlining the eSigning process and reducing the time spent on document management for the Municipal Net Profit Tax Net Operating Loss Deduction Worksheet. This efficiency helps businesses focus on their core operations while ensuring compliance with tax regulations. Moreover, it minimizes the environmental impact by reducing the need for paper.

Get more for Municipal Net Profit Tax Net Operating Loss Deduction Worksheet

- Patient registration formtops physical therapy llc tops physical therapy llc

- Physical therapy assessment forms

- Outpatient registration form orf 1

- Appointment of financial professional broker of record form

- Anesthesia consent form

- Behavioral health service request form molina

- Medication reconciliation form 41169513

- Faculty student handbook revere public schools form

Find out other Municipal Net Profit Tax Net Operating Loss Deduction Worksheet

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed

- How To Electronic signature Hawaii Warranty Deed

- Electronic signature Oklahoma Warranty Deed Myself

- Can I Electronic signature Texas Warranty Deed

- How To Electronic signature Arkansas Quitclaim Deed

- Electronic signature Washington Toll Manufacturing Agreement Simple

- Can I Electronic signature Delaware Quitclaim Deed

- Electronic signature Iowa Quitclaim Deed Easy

- Electronic signature Kentucky Quitclaim Deed Safe

- Electronic signature Maine Quitclaim Deed Easy

- How Can I Electronic signature Montana Quitclaim Deed