PT 455 the South Carolina Department of Revenue Sctax Form

What is the PT 455 The South Carolina Department Of Revenue Sctax

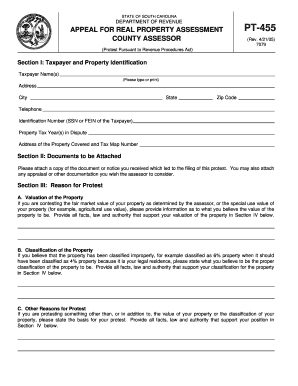

The PT 455 form, issued by the South Carolina Department of Revenue, is a critical document used for reporting property taxes. This form is specifically designed for taxpayers who need to report their personal property, including machinery, equipment, and other tangible assets. Understanding the purpose of this form is essential for compliance with state tax regulations and ensuring accurate reporting of personal property values.

How to use the PT 455 The South Carolina Department Of Revenue Sctax

Using the PT 455 form involves several key steps. First, gather all necessary information regarding your personal property, including purchase dates, costs, and current values. Next, accurately fill out the form by providing detailed descriptions of each asset. Ensure that you follow the instructions provided by the South Carolina Department of Revenue to avoid errors. Once completed, submit the form by the designated deadline to maintain compliance with state tax laws.

Steps to complete the PT 455 The South Carolina Department Of Revenue Sctax

Completing the PT 455 form requires careful attention to detail. Start by downloading the form from the South Carolina Department of Revenue website or obtaining a physical copy. Follow these steps:

- Provide your personal information, including name, address, and tax identification number.

- List each piece of personal property, including a description, purchase date, and cost.

- Calculate the total value of all reported assets.

- Review the completed form for accuracy.

- Submit the form by mail or electronically, as per the instructions.

Key elements of the PT 455 The South Carolina Department Of Revenue Sctax

The PT 455 form contains several key elements that are vital for proper completion. These include:

- Taxpayer Information: Your name, address, and identification number.

- Property Description: Detailed information about each asset, including type and condition.

- Valuation: The assessed value of the property, which impacts tax calculations.

- Signature: A declaration that the information provided is accurate and complete.

Legal use of the PT 455 The South Carolina Department Of Revenue Sctax

The PT 455 form is legally binding when completed and submitted according to the guidelines set forth by the South Carolina Department of Revenue. It is essential to ensure that all information is accurate and that the form is filed by the specified deadlines to avoid penalties. Compliance with state tax laws not only protects you from legal issues but also ensures that you are contributing your fair share to local services and infrastructure.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is crucial for timely submission of the PT 455 form. Typically, the deadline for filing is set annually, often coinciding with the end of the tax year. It is advisable to check the South Carolina Department of Revenue's official announcements for any changes to deadlines or important dates related to the PT 455 form to ensure compliance.

Quick guide on how to complete pt 455 the south carolina department of revenue sctax

Prepare PT 455 The South Carolina Department Of Revenue Sctax effortlessly on any device

Managing documents online has surged in popularity with businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely keep it online. airSlate SignNow equips you with the necessary tools to create, edit, and electronically sign your documents promptly without delays. Handle PT 455 The South Carolina Department Of Revenue Sctax on any device with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to edit and eSign PT 455 The South Carolina Department Of Revenue Sctax with ease

- Obtain PT 455 The South Carolina Department Of Revenue Sctax and click Get Form to get started.

- Utilize the tools provided to fill out your form.

- Highlight important sections of the documents or redact sensitive information using the features that airSlate SignNow has specifically designed for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it onto your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign PT 455 The South Carolina Department Of Revenue Sctax and ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pt 455 the south carolina department of revenue sctax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is PT 455 The South Carolina Department Of Revenue Sctax?

PT 455 The South Carolina Department Of Revenue Sctax is a form required for property tax filings in South Carolina. It provides essential information to ensure compliance with state tax regulations. By using airSlate SignNow, businesses can easily eSign and submit this form quickly and efficiently.

-

How can airSlate SignNow help with PT 455 The South Carolina Department Of Revenue Sctax submissions?

airSlate SignNow offers an intuitive platform for businesses to send, sign, and manage PT 455 The South Carolina Department Of Revenue Sctax forms electronically. This streamlines the filing process, reduces paperwork, and minimizes the risk of errors. Users can also track document status in real time.

-

Is there a cost associated with using airSlate SignNow for PT 455 The South Carolina Department Of Revenue Sctax?

Yes, airSlate SignNow provides various pricing plans tailored to fit different business needs, including options for handling PT 455 The South Carolina Department Of Revenue Sctax documents. The cost-effectiveness of our solution helps businesses save time and money, making it an invaluable choice for electronic document management.

-

What features does airSlate SignNow offer for PT 455 The South Carolina Department Of Revenue Sctax users?

With airSlate SignNow, users can enjoy features such as customizable templates, secure eSigning, and document tracking specifically for PT 455 The South Carolina Department Of Revenue Sctax. These features enhance user experience, ensuring that the filing process is efficient and secure.

-

Can I integrate airSlate SignNow with other software for handling PT 455 The South Carolina Department Of Revenue Sctax?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, enhancing your workflow for PT 455 The South Carolina Department Of Revenue Sctax submissions. This means you can streamline processes and automate document management without disrupting your existing systems.

-

What are the benefits of using airSlate SignNow for PT 455 The South Carolina Department Of Revenue Sctax?

Using airSlate SignNow for PT 455 The South Carolina Department Of Revenue Sctax offers numerous benefits, including reduced turnaround times for document handling, improved accuracy, and the convenience of electronic submission. It is designed to simplify the filing process while ensuring compliance with state regulations.

-

How does eSigning work for PT 455 The South Carolina Department Of Revenue Sctax in airSlate SignNow?

eSigning in airSlate SignNow for PT 455 The South Carolina Department Of Revenue Sctax is straightforward and user-friendly. After preparing the document, you can invite signers to eSign the form electronically, ensuring a quick and legally binding signature process without the hassle of physical paperwork.

Get more for PT 455 The South Carolina Department Of Revenue Sctax

- Download forms pakistan institute of development economics

- Form 425979571

- F 1 student change of nameaddress formhunter college

- Driveway application city council form

- Qau application form

- Piloting innovative ideas to address key issues of kpk form

- Hyderabad electric supply company form

- Ciarb forms chartered institute of arbitrators

Find out other PT 455 The South Carolina Department Of Revenue Sctax

- Sign Tennessee Joint Venture Agreement Template Free

- How Can I Sign South Dakota Budget Proposal Template

- Can I Sign West Virginia Budget Proposal Template

- Sign Alaska Debt Settlement Agreement Template Free

- Help Me With Sign Alaska Debt Settlement Agreement Template

- How Do I Sign Colorado Debt Settlement Agreement Template

- Can I Sign Connecticut Stock Purchase Agreement Template

- How Can I Sign North Dakota Share Transfer Agreement Template

- Sign Oklahoma Debt Settlement Agreement Template Online

- Can I Sign Oklahoma Debt Settlement Agreement Template

- Sign Pennsylvania Share Transfer Agreement Template Now

- Sign Nevada Stock Purchase Agreement Template Later

- Sign Arkansas Indemnity Agreement Template Easy

- Sign Oklahoma Stock Purchase Agreement Template Simple

- Sign South Carolina Stock Purchase Agreement Template Fast

- Sign California Stock Transfer Form Template Online

- How Do I Sign California Stock Transfer Form Template

- How Can I Sign North Carolina Indemnity Agreement Template

- How Do I Sign Delaware Stock Transfer Form Template

- Help Me With Sign Texas Stock Purchase Agreement Template