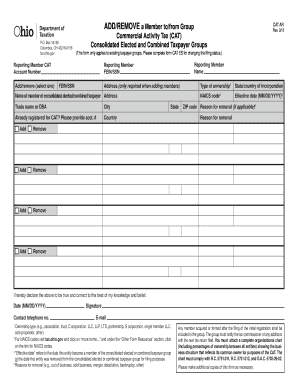

Ohio Cat Ar Form

What is the Ohio Cat AR?

The Ohio Cat AR form is a state-specific document used for reporting and assessing property values for tax purposes in Ohio. This form is essential for individuals and businesses that own property, as it helps determine the taxable value of real estate. Understanding the Ohio Cat AR is crucial for compliance with state tax regulations and ensuring accurate property assessments.

How to use the Ohio Cat AR

Using the Ohio Cat AR involves several steps to ensure accurate completion and submission. First, gather all necessary information about the property, including location, size, and any improvements made. Next, fill out the form with accurate details regarding the property's assessed value. Once completed, the form must be submitted to the appropriate local tax authority, either online or via mail, depending on local regulations. It is vital to keep a copy for your records.

Steps to complete the Ohio Cat AR

Completing the Ohio Cat AR requires careful attention to detail. Follow these steps:

- Gather property information, including tax identification numbers and prior assessment values.

- Fill out the form accurately, ensuring all sections are completed.

- Review the form for any errors or omissions.

- Submit the completed form to your local tax authority by the specified deadline.

Taking these steps will help ensure that your property is assessed correctly, which can affect your tax liability.

Legal use of the Ohio Cat AR

The Ohio Cat AR is legally binding when completed and submitted according to state regulations. It is important to ensure that all information provided is accurate, as any discrepancies can lead to penalties or legal issues. The form must be submitted within the designated time frame to comply with Ohio tax laws. Proper use of the form helps maintain transparency and accountability in property taxation.

Key elements of the Ohio Cat AR

Key elements of the Ohio Cat AR include:

- Property identification details, including address and parcel number.

- Assessment value of the property, which impacts tax obligations.

- Owner information, including name and contact details.

- Signature of the property owner or authorized representative.

Each of these elements plays a critical role in the assessment process and must be completed accurately to avoid complications.

Filing Deadlines / Important Dates

Filing deadlines for the Ohio Cat AR vary by county but are generally set annually. It is essential to be aware of these dates to ensure timely submission. Missing a deadline can result in penalties or delays in property assessments. Check with your local tax authority for specific deadlines relevant to your area.

Form Submission Methods (Online / Mail / In-Person)

The Ohio Cat AR can be submitted through various methods, including:

- Online submission via the local tax authority's website, if available.

- Mailing the completed form to the designated tax office.

- In-person submission at the local tax authority office.

Choosing the appropriate submission method can help streamline the process and ensure that your form is received on time.

Quick guide on how to complete ohio state tax forms printable cat ar form

Prepare ohio state tax forms printable cat ar form effortlessly on any device

Online document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can acquire the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage ohio cat ar on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to alter and eSign cat ar form ohio effortlessly

- Obtain ohio cat ar form and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to preserve your modifications.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your preference. Modify and eSign ohio form cat ar and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to ohio cat ar

Create this form in 5 minutes!

How to create an eSignature for the cat ar form ohio

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask ohio form cat ar

-

What is airSlate SignNow's ohio cat ar feature?

The ohio cat ar feature in airSlate SignNow allows businesses to utilize augmented reality for enhanced document interactions. This innovative feature enables users to visualize and sign documents in a more engaging way. With ohio cat ar, you can streamline your approval processes and make remote interactions more effective.

-

How much does airSlate SignNow with ohio cat ar cost?

Pricing for airSlate SignNow with the ohio cat ar feature varies based on subscription plans. We offer competitive pricing tailored to fit the needs of small and large businesses alike. Whether you opt for a monthly or annual plan, you can be assured of receiving great value for an easy-to-use eSigning solution.

-

What are the benefits of using airSlate SignNow's ohio cat ar?

Utilizing airSlate SignNow’s ohio cat ar feature helps improve engagement and efficiency in document signing. It offers a unique, interactive experience that can enhance customer satisfaction. By combining traditional eSigning with augmented reality, businesses can stand out and simplify the signing process.

-

Can I integrate airSlate SignNow with existing tools using ohio cat ar?

Yes, airSlate SignNow seamlessly integrates with various tools and platforms while utilizing the ohio cat ar feature. This includes popular software such as CRM systems, cloud storage, and more. Integrating these tools enhances your workflow, making document management and eSigning even more efficient.

-

Is airSlate SignNow secure for eSigning documents in ohio cat ar?

Absolutely! Security is a priority for airSlate SignNow, especially when using the ohio cat ar feature. Our platform employs industry-standard encryption and complies with legal regulations to ensure that your documents and signatures are safe and secure at all times.

-

How does airSlate SignNow's ohio cat ar differ from other eSigning solutions?

What sets airSlate SignNow’s ohio cat ar apart is its innovative use of augmented reality to enhance the signing experience. Unlike traditional eSigning platforms, our solution provides an interactive environment that improves user engagement. This unique approach helps to simplify signatures and approvals while standing out in a crowded marketplace.

-

Can I try airSlate SignNow with ohio cat ar before committing?

Yes, we offer a free trial of airSlate SignNow that allows you to explore the features, including ohio cat ar. This enables potential users to assess the platform’s effectiveness and see firsthand how it can enhance your document signing processes. Sign up today to experience the benefits before making a commitment.

Get more for ohio state tax forms printable cat ar form

- Warning notice due to complaint from neighbors wyoming form

- Lease subordination agreement wyoming form

- Apartment rules and regulations wyoming form

- Agreed cancellation of lease wyoming form

- Amendment of residential lease wyoming form

- Agreement for payment of unpaid rent wyoming form

- Commercial lease assignment from tenant to new tenant wyoming form

- Tenant consent to background and reference check wyoming form

Find out other oh cat ar form

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile