Brass Payroll Deduction Form 2013-2026

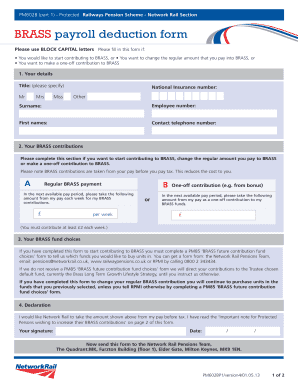

What is the brass payroll deduction form?

The brass payroll deduction form is a document used by employers to authorize deductions from an employee's paycheck for various purposes, such as health insurance, retirement contributions, or other benefits. This form ensures that both the employer and employee have a clear understanding of the deductions being made, and it serves as a legal agreement between the two parties. By completing this form, employees can manage their payroll deductions effectively, ensuring that they receive the benefits they have chosen.

How to use the brass payroll deduction form

Using the brass payroll deduction form involves several steps to ensure accuracy and compliance. First, employees must obtain the form from their employer or the company’s HR department. Once they have the form, they should carefully read the instructions and fill in the required information, including personal details and the specific deductions they wish to authorize. After completing the form, it should be submitted to the HR department for processing. Employers will then implement the deductions as specified in the form during the payroll cycle.

Steps to complete the brass payroll deduction form

Completing the brass payroll deduction form involves a systematic approach to ensure all necessary information is accurately provided. Follow these steps:

- Obtain the form from your employer or HR department.

- Read the instructions carefully to understand the requirements.

- Fill in your personal information, including your name, employee ID, and contact details.

- Select the deductions you wish to authorize, such as health insurance or retirement contributions.

- Review the completed form for accuracy.

- Submit the form to your HR department for processing.

Legal use of the brass payroll deduction form

The brass payroll deduction form is legally binding once it has been signed by both the employee and employer. It must comply with relevant labor laws and regulations to ensure that the deductions are lawful. Employers are required to maintain records of these forms to provide transparency and accountability. In the event of disputes regarding deductions, this form serves as a critical piece of evidence in resolving any issues.

Key elements of the brass payroll deduction form

Several key elements must be included in the brass payroll deduction form to ensure its validity and effectiveness. Important components include:

- Employee's full name and identification number.

- Details of the deductions being authorized, including amounts and frequency.

- Signature of the employee, indicating consent.

- Date of signing.

- Employer's acknowledgment or signature, if required.

How to obtain the brass payroll deduction form

Employees can obtain the brass payroll deduction form through various channels. The most common method is by requesting the form from the HR department or payroll administrator within their organization. Many companies also provide these forms on their internal websites or employee portals for easy access. Additionally, some employers may distribute the form during onboarding or annual benefits enrollment periods.

Quick guide on how to complete brass payroll deduction form

Effortlessly prepare Brass Payroll Deduction Form on any device

Digital document management has gained signNow traction among organizations and individuals alike. It offers an ideal sustainable alternative to traditional printed and signed documents, allowing you to access the needed form and securely save it online. airSlate SignNow equips you with all the essential tools to create, edit, and electronically sign your documents promptly and without hassle. Manage Brass Payroll Deduction Form on any device with the airSlate SignNow apps for Android or iOS and enhance any document-focused operation today.

The easiest way to edit and electronically sign Brass Payroll Deduction Form effortlessly

- Obtain Brass Payroll Deduction Form and click on Get Form to begin.

- Use the tools available to complete your document.

- Highlight important sections of your documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method for sending your form—via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, cumbersome form searches, or errors requiring new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign Brass Payroll Deduction Form and maintain effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the brass payroll deduction form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a brass payroll deduction form?

A brass payroll deduction form is a document used by employers to authorize payroll deductions for various purposes, such as benefits or loans. This form is crucial for ensuring that employee deductions are processed accurately and legally. Using airSlate SignNow, you can easily create and eSign your brass payroll deduction form, streamlining the collection process.

-

How does airSlate SignNow enhance the process of creating a brass payroll deduction form?

airSlate SignNow simplifies the creation of your brass payroll deduction form by providing customizable templates that can be filled out electronically. This means you can create, review, and send forms quickly, ensuring that employees do not face unnecessary delays in processing their deductions. The eSigning feature adds an extra layer of convenience, allowing for immediate authorization.

-

Are there any costs associated with using airSlate SignNow for my brass payroll deduction form?

Yes, there are subscription plans for airSlate SignNow that cater to businesses of all sizes. The pricing is designed to be cost-effective, offering various features for managing documents, including the brass payroll deduction form. You can choose a plan that fits your budget while still enjoying the benefits of streamlined document processes.

-

Can I integrate airSlate SignNow with other tools for payroll purposes?

Absolutely! airSlate SignNow offers integrations with popular payroll and HR software, allowing you to manage all your documentation, including the brass payroll deduction form, within your existing systems. This seamless integration improves efficiency and ensures all employee data remains consistent across platforms.

-

What are the benefits of using airSlate SignNow for my brass payroll deduction form?

Using airSlate SignNow for your brass payroll deduction form provides numerous benefits, including time savings and enhanced accuracy. The electronic signing capability reduces paperwork, allowing for faster processing and fewer errors. Additionally, the platform offers secure storage and easy access to all signed documents, thereby improving overall organizational efficiency.

-

Is it safe to eSign my brass payroll deduction form with airSlate SignNow?

Yes, airSlate SignNow prioritizes security, employing encryption and secure data storage protocols. All eSigned documents, including the brass payroll deduction form, are protected against unauthorized access. You can trust that your sensitive payroll information remains confidential and secure throughout the signing process.

-

How can I ensure my employees understand the brass payroll deduction form?

To help your employees understand the brass payroll deduction form, consider providing a brief overview during an onboarding session or through company communications. Additionally, you can include explanatory notes directly on the form itself, outlining each section's purpose. This transparency fosters trust and ensures that employees are fully informed before they sign.

Get more for Brass Payroll Deduction Form

- Instructions for form 720 rev june 2022 instructions for form 720 quarterly federal excise tax return

- Pregnancy notification form pregnancy notification form

- D2l2jhoszs7d12cloudfrontnetstatewisconsinpetitionerjoint petitioner a respondentjoint petitioner b form

- Service now snow jacobs global people services gps form

- Process recording example form

- Healthusnewscomdoctorslisa montelpasse 510724dr lisa m montelpasse mdorland park ilfamily form

- Summerlin hospital pre operative admission orders form

- Masthope mountain community job application pdf form

Find out other Brass Payroll Deduction Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT