Instructions for Form 720 Rev June Instructions for Form 720, Quarterly Federal Excise Tax Return 2022

What is the Instructions For Form 720?

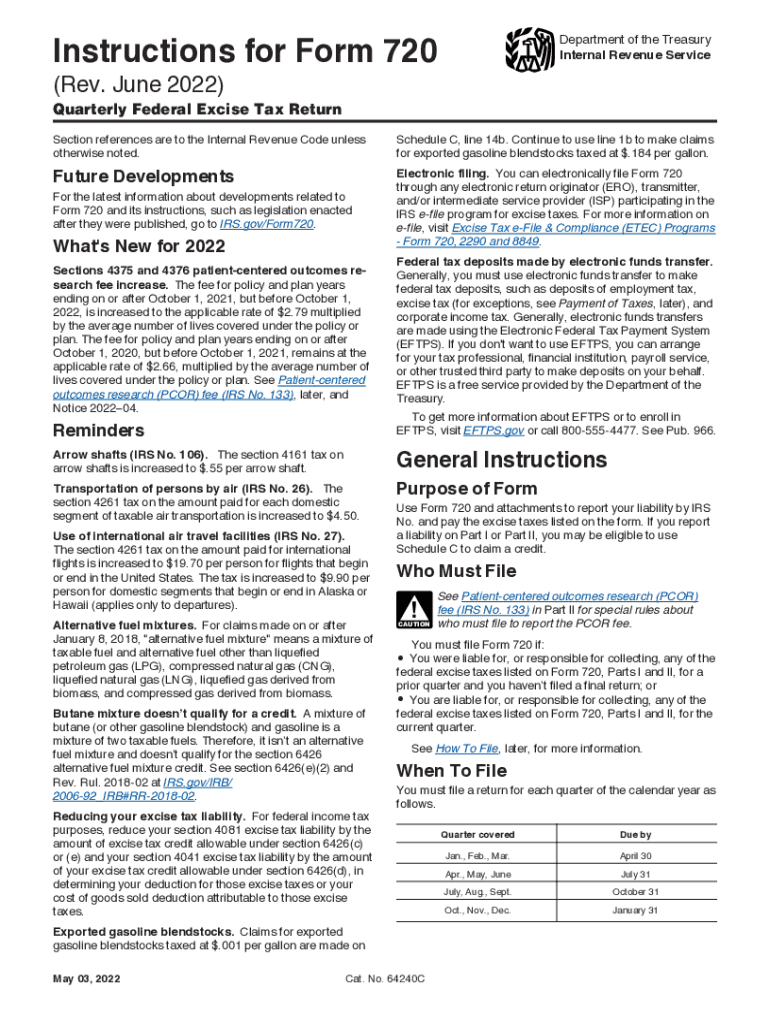

The Instructions for Form 720, also known as the Quarterly Federal Excise Tax Return, provide guidelines for businesses to report and pay federal excise taxes. This form is essential for entities engaged in specific activities, such as manufacturing or selling certain products, and is filed quarterly. Understanding the purpose and requirements of this form is crucial for compliance with federal tax regulations.

Steps to Complete the Instructions For Form 720

Completing the Instructions for Form 720 involves several key steps:

- Gather Necessary Information: Collect all relevant financial data, including sales figures and applicable excise tax rates.

- Fill Out the Form: Input the gathered data accurately into the designated fields of Form 720.

- Review for Accuracy: Double-check all entries to ensure compliance and correctness.

- Submit the Form: File the completed form by the due date, either electronically or via mail.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for Form 720 to avoid penalties. The form is due quarterly, with specific dates set by the IRS. Typically, the deadlines fall on the last day of the month following each quarter:

- First Quarter: April 30

- Second Quarter: July 31

- Third Quarter: October 31

- Fourth Quarter: January 31 of the following year

Legal Use of the Instructions For Form 720

The Instructions for Form 720 serve as a legal document for reporting excise taxes to the IRS. Proper completion and timely submission ensure compliance with federal tax laws. Failure to adhere to these guidelines may result in penalties or legal repercussions.

Key Elements of the Instructions For Form 720

Several key elements are crucial when filling out the Instructions for Form 720:

- Taxpayer Information: Accurate identification details of the business or individual filing.

- Excise Tax Calculation: Correctly calculating the excise tax owed based on applicable rates.

- Signatures: Required signatures to validate the form.

Form Submission Methods

Form 720 can be submitted through various methods, including:

- Online: E-filing through the IRS e-File system.

- Mail: Sending a paper form to the appropriate IRS address.

- In-Person: Delivering the form directly to an IRS office, if applicable.

Quick guide on how to complete instructions for form 720 rev june 2022 instructions for form 720 quarterly federal excise tax return

Complete Instructions For Form 720 Rev June Instructions For Form 720, Quarterly Federal Excise Tax Return effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly without any delays. Handle Instructions For Form 720 Rev June Instructions For Form 720, Quarterly Federal Excise Tax Return on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The easiest method to revise and eSign Instructions For Form 720 Rev June Instructions For Form 720, Quarterly Federal Excise Tax Return without hassle

- Find Instructions For Form 720 Rev June Instructions For Form 720, Quarterly Federal Excise Tax Return and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a standard wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method to submit your form: via email, SMS, or an invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign Instructions For Form 720 Rev June Instructions For Form 720, Quarterly Federal Excise Tax Return to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 720 rev june 2022 instructions for form 720 quarterly federal excise tax return

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 720 rev june 2022 instructions for form 720 quarterly federal excise tax return

The best way to create an e-signature for a PDF online

The best way to create an e-signature for a PDF in Google Chrome

The best way to create an e-signature for signing PDFs in Gmail

How to generate an electronic signature from your smartphone

The way to generate an e-signature for a PDF on iOS

How to generate an electronic signature for a PDF file on Android

People also ask

-

What are the basic instructions for completing the 720 federal form?

The instructions for the 720 federal form include step-by-step guidance on how to fill out the form accurately. It breaks down each section, ensuring you report your information correctly. Following these instructions is crucial to avoid delays or rejections from the IRS.

-

How can airSlate SignNow help with the 720 federal form?

airSlate SignNow streamlines the eSigning process for your 720 federal form, making it faster and more efficient. You can easily fill out the form, gather signatures, and send it securely, all in one place. The user-friendly interface minimizes mistakes and fosters swift submissions.

-

Is there a cost associated with using airSlate SignNow for the 720 federal form?

Yes, there is a pricing structure for using airSlate SignNow, but it offers a cost-effective solution for handling documents like the 720 federal form. Depending on your needs, you can choose from various plans that include additional features that enhance productivity and compliance.

-

What features are available in airSlate SignNow that assist with the 720 federal form?

airSlate SignNow provides features such as document templates, real-time tracking, and customizable workflows to aid in completing the 720 federal form. These features ensure that every step of the process is efficient and error-free, contributing to a smoother filing experience with the IRS.

-

Are there integrations available with airSlate SignNow for managing the 720 federal form?

Yes, airSlate SignNow offers various integrations with popular applications that can help simplify managing the 720 federal form. You can connect with services like Google Drive, Dropbox, and more to import or export data seamlessly. This integration capability enhances your overall workflow while preparing your form.

-

What are the benefits of using airSlate SignNow for the 720 federal form?

Using airSlate SignNow for the 720 federal form offers several benefits, including faster processing times and secure document management. The platform ensures compliance with IRS standards, reducing the likelihood of errors. Moreover, the ease of use enables anyone in your organization to handle the form confidently.

-

Can I access the 720 federal form on mobile using airSlate SignNow?

Yes, airSlate SignNow is mobile-friendly, allowing you to access and manage your 720 federal form from any device. This mobility lets you work on your documents on the go, making it convenient to collect signatures and submit forms without being tied to a desktop.

Get more for Instructions For Form 720 Rev June Instructions For Form 720, Quarterly Federal Excise Tax Return

Find out other Instructions For Form 720 Rev June Instructions For Form 720, Quarterly Federal Excise Tax Return

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast