Deposit Claim Form

What is the security deposit claim form?

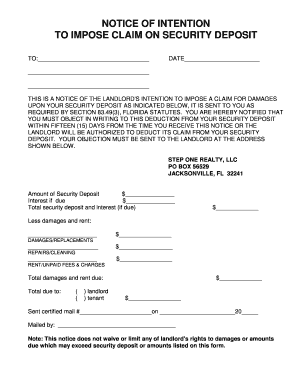

The security deposit claim form is a document used by tenants to request the return of their security deposit from landlords after the end of a lease. This form outlines the reasons for the claim and provides necessary details to facilitate the return process. It serves as a formal request, ensuring that both parties have a clear understanding of the terms regarding the security deposit, including any deductions that may be applicable for damages or unpaid rent.

How to use the security deposit claim form

To effectively use the security deposit claim form, tenants should first ensure they have completed all necessary steps related to their lease termination. This includes cleaning the rental unit and addressing any repairs for which they are responsible. Once these tasks are completed, the tenant can fill out the form, providing accurate information such as the rental address, the amount of the security deposit, and any deductions they believe are unjustified. After filling out the form, it should be submitted to the landlord or property management company, ideally via a method that provides confirmation of receipt.

Steps to complete the security deposit claim form

Completing the security deposit claim form involves several key steps:

- Gather necessary information, including your rental agreement and any documentation of the property's condition.

- Fill out the form with accurate details, including your name, address, and the amount of the security deposit.

- Clearly state any deductions you believe are unfair and provide evidence to support your claims.

- Review the form for accuracy and completeness before submission.

- Submit the form to your landlord or property management, keeping a copy for your records.

Legal use of the security deposit claim form

The security deposit claim form must comply with state laws regarding security deposits. Each state has specific regulations that dictate how security deposits should be handled, including timelines for return and permissible deductions. It is important for tenants to understand their rights and the legal requirements in their state to ensure the claim form is valid and enforceable. Failure to adhere to these regulations could result in delays or denial of the claim.

Key elements of the security deposit claim form

Key elements of the security deposit claim form typically include:

- Tenant Information: Name, address, and contact details of the tenant.

- Property Details: Address of the rental property and lease dates.

- Deposit Amount: Total amount of the security deposit paid at the beginning of the lease.

- Deductions: A detailed list of any deductions the landlord is claiming, along with justifications.

- Signature: The tenant's signature to verify the accuracy of the information provided.

Who issues the security deposit claim form?

The security deposit claim form is typically issued by the tenant, as it serves as a formal request for the return of their deposit. However, landlords or property management companies may provide a standardized version of the form for tenants to fill out. It is advisable for tenants to use the form provided by their landlord if available, as it may include specific instructions or requirements unique to that property or management company.

Quick guide on how to complete deposit claim form

Prepare Deposit Claim Form seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Deposit Claim Form on any platform with airSlate SignNow's Android or iOS apps and enhance any document-driven process today.

How to modify and eSign Deposit Claim Form effortlessly

- Locate Deposit Claim Form and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choosing. Edit and eSign Deposit Claim Form to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the deposit claim form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a security deposit claim form?

A security deposit claim form is a document used by tenants to request the return of their security deposit after vacating a rental property. This form outlines the reasons for the claim and provides necessary details such as the amount requested. Using airSlate SignNow, you can easily create and eSign your security deposit claim form, streamlining the process.

-

How do I fill out a security deposit claim form with airSlate SignNow?

Filling out a security deposit claim form with airSlate SignNow is simple. You can access customizable templates that allow you to input your details quickly. Once completed, you can eSign the form electronically, making submission convenient and efficient.

-

Are there costs associated with using the security deposit claim form template?

Yes, airSlate SignNow offers various pricing plans to fit different needs. The costs associated with creating a security deposit claim form depend on the plan you choose. Each plan provides valuable features like eSignature capabilities and document management tools.

-

What are the benefits of using airSlate SignNow for my security deposit claim form?

Using airSlate SignNow for your security deposit claim form offers several benefits, including enhanced security and streamlined document workflows. You can eSign your forms conveniently, ensuring they are legally binding. Plus, our platform ensures your data is protected through advanced encryption.

-

Can I integrate airSlate SignNow with other platforms for my security deposit claim form?

Absolutely! airSlate SignNow supports integrations with various platforms such as Google Drive, Dropbox, and CRM systems. This allows you to manage your security deposit claim form alongside your other documents seamlessly. You can send, sign, and store all your important documents in one place.

-

Is my security deposit claim form legally enforceable?

Yes, a security deposit claim form signed through airSlate SignNow is legally enforceable. Our eSigning process complies with electronic signature laws, ensuring that your claim has legal weight. Keeping a digital record of your signed form also facilitates smooth communication with landlords.

-

What happens if my security deposit claim form is rejected?

If your security deposit claim form is rejected, it is important to review the reasons for the rejection. You may need to provide additional documentation or clarify any misunderstandings. airSlate SignNow allows you to easily update and resubmit your claim, ensuring quick adjustments can be made.

Get more for Deposit Claim Form

Find out other Deposit Claim Form

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms

- How Can I Electronic signature Minnesota Rental lease agreement

- Electronic signature Arkansas Rental lease agreement template Computer

- Can I Electronic signature Mississippi Rental lease agreement

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online

- Electronic signature Florida Rental property lease agreement Free

- Can I Electronic signature Mississippi Rental property lease agreement