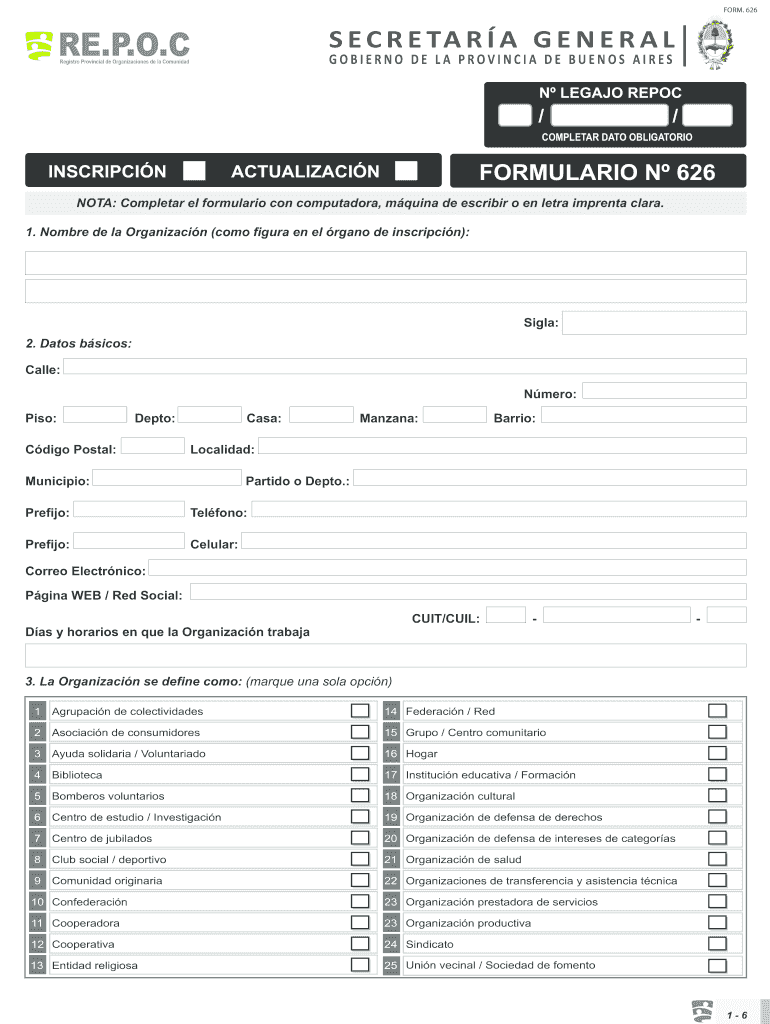

Formulario 626

What is the Formulario 626

The formulario 626 is a specific form used primarily for tax-related purposes in the United States. It is essential for individuals and businesses to accurately report their financial information to the Internal Revenue Service (IRS). This form is often associated with various tax claims and adjustments, making it a critical document for compliance with federal tax regulations. Understanding its purpose and requirements is vital for ensuring proper filing and avoiding potential penalties.

How to use the Formulario 626

Using the formulario 626 involves several key steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and previous tax returns. This information will help you fill out the form correctly. Next, follow the instructions provided with the form, which detail how to report income, deductions, and any applicable credits. It is advisable to review the completed form for accuracy before submission to prevent delays or issues with the IRS.

Steps to complete the Formulario 626

Completing the formulario 626 requires a systematic approach. Start by downloading the form from the IRS website or obtaining a physical copy. Fill in your personal information, including your name, Social Security number, and address. Next, accurately report your income sources and any deductions you are eligible for. Ensure that you double-check all figures for accuracy. Finally, sign and date the form before submitting it to the IRS, either electronically or by mail, depending on your preference.

Legal use of the Formulario 626

The legal use of the formulario 626 is governed by IRS regulations. To ensure that your submission is valid, it is crucial to adhere to all guidelines outlined by the IRS. This includes providing accurate information and submitting the form within the designated filing deadlines. Additionally, using a reliable electronic signature solution can enhance the legal standing of your submission, ensuring that it meets all requirements for electronic documentation.

Filing Deadlines / Important Dates

Filing deadlines for the formulario 626 can vary based on individual circumstances, such as whether you are filing as an individual or a business entity. Generally, tax returns are due on April fifteenth of each year. However, if you require an extension, be sure to file for an extension before the original deadline. Staying informed about these important dates is crucial for maintaining compliance and avoiding penalties associated with late submissions.

Required Documents

To complete the formulario 626 accurately, you will need several key documents. These typically include your previous year’s tax return, W-2 forms from employers, 1099 forms for any freelance or contract work, and records of any deductions you plan to claim. Having these documents readily available will streamline the process and help ensure that all information reported is accurate and complete.

Quick guide on how to complete formulario 626

Complete Formulario 626 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct template and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents quickly without any hold-ups. Handle Formulario 626 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

The simplest method to edit and electronically sign Formulario 626 with ease

- Obtain Formulario 626 and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important portions of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to deliver your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your preferred device. Edit and electronically sign Formulario 626 to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the formulario 626

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is formulario 626 and how can it benefit my business?

Formulario 626 is a powerful tool for managing digital forms efficiently. By utilizing formulario 626, businesses can streamline their document processes, enhance collaboration, and improve overall productivity while ensuring compliance and security.

-

Is there a cost associated with using formulario 626?

Yes, there is a cost to access formulario 626 through airSlate SignNow. Pricing plans are designed to be cost-effective and cater to businesses of all sizes, offering a range of features that enhance document workflow while staying within budget.

-

What features are included with formulario 626?

Formulario 626 includes features such as electronic signatures, document templates, and real-time collaboration. These tools help users save time, eliminate manual errors, and ensure that all necessary transactions are completed promptly.

-

How does formulario 626 integrate with other software?

Formulario 626 easily integrates with various third-party applications, enhancing its utility within your existing workflow. With seamless connections to CRM, project management, and cloud storage solutions, users can manage documents effortlessly across platforms.

-

Can formulario 626 be customized for different types of documents?

Absolutely! Formulario 626 is highly customizable, allowing you to tailor forms to meet your specific business needs. Whether you are creating contracts, agreements, or consent forms, you can easily modify the template to fit your branding and functional requirements.

-

How secure is formulario 626 for sensitive data?

Security is a top priority with formulario 626. The platform employs advanced encryption and authentication protocols to protect sensitive data, ensuring that your documents remain confidential and secure throughout the entire signing process.

-

Is training or support available for using formulario 626?

Yes, airSlate SignNow provides comprehensive support and training resources for users of formulario 626. Whether you need tutorials or live support, our team is committed to helping you fully leverage the platform’s capabilities.

Get more for Formulario 626

Find out other Formulario 626

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF