Rbl Bank Fatca Form

What is the RBL Bank FATCA Form

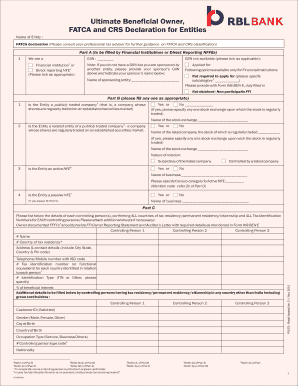

The RBL Bank FATCA Form is a crucial document used for compliance with the Foreign Account Tax Compliance Act (FATCA). This form is designed for U.S. citizens and residents who hold accounts with RBL Bank. It ensures that the bank reports relevant financial information to the Internal Revenue Service (IRS) as mandated by U.S. tax law. The form collects essential details about the account holder's tax status and helps in identifying any potential tax liabilities. Completing this form accurately is vital for maintaining compliance and avoiding penalties.

How to Use the RBL Bank FATCA Form

Using the RBL Bank FATCA Form involves several steps to ensure proper completion and submission. First, obtain the form from RBL Bank's official website or branch. Next, fill in the required information, including personal details, account information, and tax identification numbers. It is essential to review the completed form for accuracy before submission. Once filled out, the form can be submitted online, by mail, or in person at a local RBL Bank branch, depending on your preference and the bank's guidelines.

Steps to Complete the RBL Bank FATCA Form

Completing the RBL Bank FATCA Form requires careful attention to detail. Follow these steps:

- Download the form from the RBL Bank website or request a hard copy at a branch.

- Provide your personal information, including your name, address, and contact details.

- Enter your U.S. taxpayer identification number (TIN) and any other required identification numbers.

- Disclose the type of account you hold with RBL Bank and any relevant financial details.

- Review the form for any errors or omissions before signing and dating it.

- Submit the form through your chosen method: online, by mail, or in person.

Legal Use of the RBL Bank FATCA Form

The RBL Bank FATCA Form serves a legal purpose by ensuring compliance with U.S. tax regulations. By accurately completing and submitting this form, account holders fulfill their obligations under FATCA, which aims to prevent tax evasion by U.S. citizens holding assets abroad. The information provided on the form is used by RBL Bank to report to the IRS, thereby protecting both the bank and the account holder from potential legal issues related to tax compliance.

Required Documents

When filling out the RBL Bank FATCA Form, certain documents may be required to verify your identity and tax status. These documents typically include:

- A valid government-issued identification, such as a passport or driver's license.

- Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Proof of residency, which may include utility bills or lease agreements.

- Any previous tax documents that may be relevant to your financial situation.

Penalties for Non-Compliance

Failing to complete and submit the RBL Bank FATCA Form can result in significant penalties. Non-compliance may lead to the imposition of fines by the IRS, as well as potential legal action against the account holder. Additionally, RBL Bank may take measures to restrict account access or report the account holder to tax authorities. It is crucial to ensure that the form is submitted accurately and on time to avoid these consequences.

Quick guide on how to complete rbl bank fatca form

Manage Rbl Bank Fatca Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Handle Rbl Bank Fatca Form on any platform using airSlate SignNow apps for Android or iOS and streamline any document-related procedure today.

The simplest way to modify and electronically sign Rbl Bank Fatca Form with ease

- Find Rbl Bank Fatca Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of your documents or obscure sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, frustrating form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Rbl Bank Fatca Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rbl bank fatca form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RBL Bank stamp and how does it work with airSlate SignNow?

The RBL Bank stamp is a digital signature solution that simplifies the process of authorizing documents. With airSlate SignNow, users can easily integrate the RBL Bank stamp to speed up transactions, ensuring all electronic signatures are compliant and secure. This feature is particularly beneficial for businesses looking to streamline their workflow.

-

How can I create an RBL Bank stamp using airSlate SignNow?

Creating an RBL Bank stamp in airSlate SignNow is a straightforward process. After setting up your account, simply navigate to the 'Digital Signature' section, where you can customize your RBL Bank stamp with the necessary details. Once created, it can be used repeatedly on various documents.

-

What are the pricing options for using the RBL Bank stamp with airSlate SignNow?

airSlate SignNow offers competitive pricing plans that include access to the RBL Bank stamp feature. Depending on your business needs, you can choose from different tiers that provide various levels of features, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for RBL Bank stamp users?

airSlate SignNow provides a range of features for RBL Bank stamp users, including secure electronic signing, document tracking, and customizable templates. Additionally, users can collaborate in real-time, making it easier to manage document workflows with the RBL Bank stamp.

-

What are the benefits of using the RBL Bank stamp with airSlate SignNow?

The RBL Bank stamp integrates seamlessly with airSlate SignNow, offering numerous benefits such as faster document turnaround times and enhanced security. Businesses can also reduce paper usage and improve efficiency by utilizing digital signatures with the RBL Bank stamp.

-

Can I integrate RBL Bank stamp with other applications using airSlate SignNow?

Yes, airSlate SignNow allows users to integrate the RBL Bank stamp with various applications such as CRMs and workflow automation tools. This integration enhances productivity by allowing teams to manage their document signing processes alongside their existing software solutions.

-

Is the RBL Bank stamp secure when used with airSlate SignNow?

Absolutely, the RBL Bank stamp used in airSlate SignNow is built with robust security measures. The platform employs encryption and compliance with e-signature laws to ensure that your documents, along with the RBL Bank stamp, are safe and legally binding.

Get more for Rbl Bank Fatca Form

- New jersey department of health office of certificate of need form

- New jersey department of health office of emergency medical services form

- Department of health communicable disease service form

- New jersey department of health medical aid in dying njgov form

- Center address form

- Staff health examination form njgov

- New jersey health officer form

- Guidance for requesting a medical exemption from form

Find out other Rbl Bank Fatca Form

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast