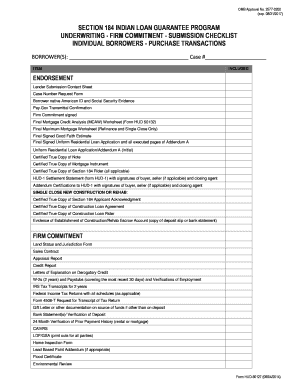

Underwriting Audit Checklist Form

Understanding the Underwriting Audit Checklist

The underwriting audit checklist is a crucial tool in the mortgage approval process. It serves as a comprehensive guide for underwriters to evaluate a borrower's financial profile and ensure that all necessary documentation is in order. This checklist typically includes items such as income verification, credit history, debt-to-income ratios, and asset documentation. By following this checklist, underwriters can systematically assess the risk associated with a mortgage application, ensuring compliance with lending guidelines and regulations.

Steps to Complete the Underwriting Audit Checklist

Completing the underwriting audit checklist involves several key steps that ensure thorough evaluation and compliance. Begin by gathering all necessary documentation, including:

- Proof of income, such as pay stubs or tax returns

- Credit reports from all three major credit bureaus

- Bank statements to verify assets

- Employment verification letters

Once the documents are collected, review each item on the checklist to confirm that all required information is present and accurate. It is essential to double-check for any discrepancies or missing documents, as these can delay the underwriting process. After verification, submit the completed checklist along with the mortgage application for review.

Key Elements of the Underwriting Audit Checklist

The underwriting audit checklist consists of several key elements that are vital for a successful mortgage application. These elements typically include:

- Borrower identification and credit history

- Income and employment verification

- Asset documentation and bank statements

- Debt-to-income ratio calculations

- Property appraisal and title report

Each of these components plays a significant role in assessing the borrower's ability to repay the loan and the overall risk for the lender. Ensuring that all elements are thoroughly reviewed can streamline the underwriting process and enhance the likelihood of approval.

Legal Use of the Underwriting Audit Checklist

The legal use of the underwriting audit checklist is essential in maintaining compliance with federal and state regulations. Electronic signatures and digital documentation must adhere to the standards set forth by the ESIGN Act and UETA, which validate the legality of eDocuments. Utilizing a reliable electronic signature solution ensures that the checklist is executed properly, providing an audit trail and maintaining the integrity of the documents involved. This legal framework protects both lenders and borrowers, facilitating a smoother transaction process.

How to Obtain the Underwriting Audit Checklist

Obtaining the underwriting audit checklist can be done through various channels. Many lenders and financial institutions provide their own versions of the checklist, tailored to their specific requirements. Additionally, industry organizations and regulatory bodies may offer standardized templates that can be adapted for use. It is advisable to consult with a mortgage professional or lender to ensure that the correct version of the checklist is being used, as requirements may vary based on the type of mortgage and the lender's policies.

Examples of Using the Underwriting Audit Checklist

Practical examples of using the underwriting audit checklist can illustrate its importance in the mortgage process. For instance, a borrower applying for an FHA loan would follow a specific checklist that includes items unique to FHA guidelines, such as additional documentation for lower credit scores. Another example is a self-employed borrower who must provide additional proof of income, such as profit and loss statements, which would be highlighted on the checklist. These examples demonstrate how the checklist can guide borrowers through the documentation process, ensuring that all necessary information is submitted for underwriting review.

Quick guide on how to complete underwriting audit checklist

Complete Underwriting Audit Checklist effortlessly on any platform

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Underwriting Audit Checklist on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

The simplest way to modify and eSign Underwriting Audit Checklist with ease

- Find Underwriting Audit Checklist and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would like to send your form—via email, SMS, invite link, or download it to your computer.

Eliminate worries about missing or lost files, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Edit and eSign Underwriting Audit Checklist and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the underwriting audit checklist

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a mortgage underwriting checklist template?

A mortgage underwriting checklist template is a structured document that outlines the necessary steps and documents required for underwriting a mortgage. It helps streamline the process, ensuring all essential information is gathered efficiently. By using this template, lenders can minimize errors and expedite loan approvals.

-

How can airSlate SignNow help with the mortgage underwriting checklist template?

airSlate SignNow allows users to create, send, and eSign mortgage underwriting checklist templates easily. Our platform provides an intuitive interface that simplifies document management, ensuring that loan officers can collaborate seamlessly with clients. This leads to faster processing times and improved customer satisfaction.

-

What features are included in the mortgage underwriting checklist template?

The mortgage underwriting checklist template includes customizable sections for property details, borrower information, and required documentation. Users can also add checkboxes, comments, and tags to enhance communication and clarity. These features enable better organization and tracking of the mortgage application process.

-

Is your mortgage underwriting checklist template customizable?

Yes, the mortgage underwriting checklist template offered by airSlate SignNow is fully customizable. Users can tailor the template to suit their specific needs and requirements, ensuring all relevant details are captured efficiently. This flexibility allows lenders to address unique client situations effectively.

-

What are the benefits of using a mortgage underwriting checklist template?

Using a mortgage underwriting checklist template helps streamline the underwriting process, reduce errors, and increase efficiency. It provides a comprehensive guide for loan officers to follow, ensuring all necessary information is gathered. This ultimately leads to quicker decisions and improved service for borrowers.

-

Can I integrate airSlate SignNow with other systems to use the mortgage underwriting checklist template?

Yes, airSlate SignNow offers integration capabilities with leading CRM and document management systems. This enables users to seamlessly incorporate the mortgage underwriting checklist template into their existing workflows. Integrating platforms enhances collaboration and ensures all documents can be accessed in one place.

-

What is the pricing structure for using airSlate SignNow with a mortgage underwriting checklist template?

airSlate SignNow offers flexible pricing plans to accommodate different business needs, including those utilizing the mortgage underwriting checklist template. Customers can select from monthly or annual subscriptions that best fit their budget. Our cost-effective solutions provide high value for businesses looking to streamline their documentation processes.

Get more for Underwriting Audit Checklist

Find out other Underwriting Audit Checklist

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now