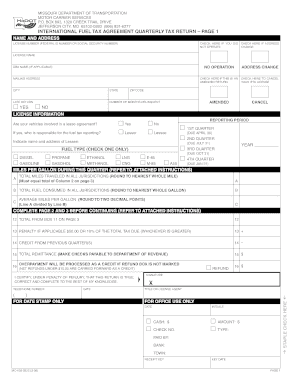

INTERNATIONAL FUEL TAX AGREEMENT QUARTERLY TAX Modot Mo Form

What is the INTERNATIONAL FUEL TAX AGREEMENT QUARTERLY TAX Modot Mo

The INTERNATIONAL FUEL TAX AGREEMENT QUARTERLY TAX Modot Mo is a tax form designed for commercial motor carriers operating in multiple jurisdictions. This form allows these carriers to report and pay fuel taxes based on the miles driven and fuel consumed in each participating state. The agreement simplifies the tax collection process, ensuring that carriers only pay taxes to the jurisdictions where they operate, thereby promoting fairness and efficiency in the taxation system.

Steps to complete the INTERNATIONAL FUEL TAX AGREEMENT QUARTERLY TAX Modot Mo

Completing the INTERNATIONAL FUEL TAX AGREEMENT QUARTERLY TAX Modot Mo involves several key steps:

- Gather necessary information, including mileage records and fuel purchase receipts.

- Determine the total miles driven in each jurisdiction during the quarter.

- Calculate the total fuel consumed in each jurisdiction.

- Fill out the form accurately, ensuring all figures are correct and supported by documentation.

- Review the completed form for any errors before submission.

How to use the INTERNATIONAL FUEL TAX AGREEMENT QUARTERLY TAX Modot Mo

The INTERNATIONAL FUEL TAX AGREEMENT QUARTERLY TAX Modot Mo can be used by motor carriers to report their fuel tax obligations. To use the form, carriers must accurately document their mileage and fuel consumption for the reporting period. This information is then entered into the form, which is submitted to the appropriate state tax authority. Utilizing electronic signature tools can streamline this process, ensuring that the form is submitted securely and efficiently.

Legal use of the INTERNATIONAL FUEL TAX AGREEMENT QUARTERLY TAX Modot Mo

The legal use of the INTERNATIONAL FUEL TAX AGREEMENT QUARTERLY TAX Modot Mo is governed by various regulations that ensure compliance with tax laws. It is essential for carriers to adhere to these regulations to avoid penalties. The form must be completed accurately and submitted on time to maintain compliance with the International Fuel Tax Agreement, which is recognized by participating jurisdictions as a valid method of reporting fuel taxes.

Filing Deadlines / Important Dates

It is crucial for carriers to be aware of the filing deadlines associated with the INTERNATIONAL FUEL TAX AGREEMENT QUARTERLY TAX Modot Mo. Typically, the form must be filed quarterly, with specific due dates that vary by state. Missing these deadlines can result in penalties and interest charges, making timely submission essential for compliance.

Required Documents

To complete the INTERNATIONAL FUEL TAX AGREEMENT QUARTERLY TAX Modot Mo, carriers need several supporting documents. These include:

- Mileage logs detailing the miles driven in each jurisdiction.

- Fuel purchase receipts to substantiate fuel consumption claims.

- Any previous tax returns that may be relevant for comparison.

Penalties for Non-Compliance

Failure to comply with the requirements of the INTERNATIONAL FUEL TAX AGREEMENT QUARTERLY TAX Modot Mo can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential audits by state tax authorities. It is important for carriers to understand these risks and ensure that they file their forms accurately and on time to avoid complications.

Quick guide on how to complete international fuel tax agreement quarterly tax modot mo

Prepare INTERNATIONAL FUEL TAX AGREEMENT QUARTERLY TAX Modot Mo effortlessly on any device

Managing documents online has gained increased traction among companies and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without any interruptions. Handle INTERNATIONAL FUEL TAX AGREEMENT QUARTERLY TAX Modot Mo on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign INTERNATIONAL FUEL TAX AGREEMENT QUARTERLY TAX Modot Mo with ease

- Find INTERNATIONAL FUEL TAX AGREEMENT QUARTERLY TAX Modot Mo and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant parts of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign option, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from your preferred device. Modify and eSign INTERNATIONAL FUEL TAX AGREEMENT QUARTERLY TAX Modot Mo and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the international fuel tax agreement quarterly tax modot mo

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the INTERNATIONAL FUEL TAX AGREEMENT QUARTERLY TAX Modot Mo.?

The INTERNATIONAL FUEL TAX AGREEMENT QUARTERLY TAX Modot Mo. refers to the necessary filing procedures and tax calculations for fuel consumption across different jurisdictions as outlined by the International Fuel Tax Agreement (IFTA). This agreement simplifies the reporting of fuel use by motor carriers operating in multiple states and provinces.

-

How does airSlate SignNow facilitate the INTERNATIONAL FUEL TAX AGREEMENT QUARTERLY TAX Modot Mo. process?

airSlate SignNow streamlines the INTERNATIONAL FUEL TAX AGREEMENT QUARTERLY TAX Modot Mo. process by allowing users to easily create, manage, and eSign necessary documents. Our platform ensures compliance with IFTA regulations through ready-to-use templates and automated workflows, making it a reliable solution for businesses.

-

What are the pricing options for using airSlate SignNow with INTERNATIONAL FUEL TAX AGREEMENT QUARTERLY TAX Modot Mo.?

airSlate SignNow offers several pricing plans tailored to different business needs, making it cost-effective for managing the INTERNATIONAL FUEL TAX AGREEMENT QUARTERLY TAX Modot Mo. requirements. Choose from monthly or annual subscriptions, with options that provide extensive features to ensure compliance and efficiency.

-

What features does airSlate SignNow offer for the INTERNATIONAL FUEL TAX AGREEMENT QUARTERLY TAX Modot Mo.?

Key features of airSlate SignNow for the INTERNATIONAL FUEL TAX AGREEMENT QUARTERLY TAX Modot Mo. include easy document creation, customizable templates, and automated reminders for tax filing deadlines. These tools enhance operational efficiency and ensure that all forms are completed accurately and on time.

-

How can I integrate airSlate SignNow with my existing systems for INTERNATIONAL FUEL TAX AGREEMENT QUARTERLY TAX Modot Mo.?

airSlate SignNow offers seamless integrations with various platforms such as accounting software and customer relationship management (CRM) systems to optimize the INTERNATIONAL FUEL TAX AGREEMENT QUARTERLY TAX Modot Mo. process. These integrations ensure that your data flows smoothly across systems, reducing manual entry and errors.

-

What are the benefits of using airSlate SignNow for INTERNATIONAL FUEL TAX AGREEMENT QUARTERLY TAX Modot Mo.?

Using airSlate SignNow for the INTERNATIONAL FUEL TAX AGREEMENT QUARTERLY TAX Modot Mo. gives businesses a competitive edge through improved efficiency and compliance. The user-friendly interface and robust features make it easy to manage tax documents, reducing stress during filing seasons and minimizing audit risks.

-

Is airSlate SignNow secure for handling INTERNATIONAL FUEL TAX AGREEMENT QUARTERLY TAX Modot Mo. documents?

Absolutely! airSlate SignNow prioritizes security, using advanced encryption and security protocols to safeguard all documents related to the INTERNATIONAL FUEL TAX AGREEMENT QUARTERLY TAX Modot Mo. You can trust that your sensitive financial information is protected throughout the eSigning process.

Get more for INTERNATIONAL FUEL TAX AGREEMENT QUARTERLY TAX Modot Mo

- Application for garage policy cgz app 6 7 17 form

- Gtar forms

- Tva 3595doc form

- International sale contract model this model of international sale contract is designed for the international sale of different form

- Ca statement income ontario form

- Entity name and type form

- Large quantity generator contingency plan form

- Health human services agency form

Find out other INTERNATIONAL FUEL TAX AGREEMENT QUARTERLY TAX Modot Mo

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online