Form N 15, Rev , State of Hawaii Non Resident Hawaii Gov

What is the Form N-15, Rev, State of Hawaii Non Resident

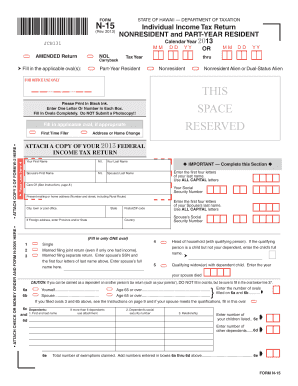

The Form N-15, also known as the Hawaii Non Resident Form, is a tax document used by individuals who are not residents of Hawaii but have earned income within the state. This form is essential for reporting income and determining the appropriate tax obligations for non-residents. It is specifically designed to ensure that non-residents comply with Hawaii's tax laws while accurately reflecting their income earned in the state. Understanding the purpose and requirements of this form is crucial for anyone who fits this category, as it helps avoid potential penalties and ensures proper tax compliance.

Steps to Complete the Form N-15, Rev, State of Hawaii Non Resident

Completing the Form N-15 involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2 forms, 1099s, and any other income statements. Next, fill out personal information such as your name, address, and Social Security number. Then, report your income earned in Hawaii in the appropriate sections of the form. Be sure to calculate your deductions and credits accurately, as these can significantly impact your tax liability. Finally, review the completed form for any errors before submitting it to the appropriate tax authority.

How to Obtain the Form N-15, Rev, State of Hawaii Non Resident

The Form N-15 can be obtained through the Hawaii Department of Taxation's official website. It is available for download in PDF format, allowing users to print it for completion. Additionally, the form may be available at local tax offices or through tax preparation services. Ensuring you have the most current version of the form is important, as tax regulations may change, impacting the information required on the form.

Legal Use of the Form N-15, Rev, State of Hawaii Non Resident

The legal use of the Form N-15 is governed by Hawaii tax laws, which require non-residents to report income earned in the state. When completed accurately, the form serves as a legal declaration of income and tax liability. It is essential to understand that submitting false information on the form can lead to serious legal consequences, including fines and penalties. Therefore, using the form correctly and in accordance with state regulations is critical for maintaining compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Form N-15 are typically aligned with federal tax deadlines. Non-residents must submit their completed forms by the due date specified by the Hawaii Department of Taxation, usually on or before April 20 of the following year for the previous tax year. It is important to stay informed about any changes to these deadlines, as late submissions can result in penalties and interest on unpaid taxes.

Eligibility Criteria

To be eligible to file the Form N-15, an individual must meet specific criteria. Primarily, the individual must be a non-resident of Hawaii who has earned income from sources within the state. This includes wages, salaries, and other forms of compensation. Additionally, individuals who meet the income thresholds set by the state tax authority may be required to file this form. Understanding these criteria is essential for determining whether the Form N-15 is applicable to your tax situation.

Quick guide on how to complete form n 15 rev state of hawaii non resident hawaii gov

Effortlessly Prepare Form N 15, Rev , State Of Hawaii Non Resident Hawaii gov on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools required to swiftly create, modify, and eSign your documents without delays. Manage Form N 15, Rev , State Of Hawaii Non Resident Hawaii gov across any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The Optimal Method to Modify and eSign Form N 15, Rev , State Of Hawaii Non Resident Hawaii gov with Ease

- Acquire Form N 15, Rev , State Of Hawaii Non Resident Hawaii gov and click on Get Form to begin.

- Utilize the tools we provide to submit your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with features that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and possesses the same legal validity as a traditional ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choice. Revise and eSign Form N 15, Rev , State Of Hawaii Non Resident Hawaii gov while ensuring exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form n 15 rev state of hawaii non resident hawaii gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the non resident form hawaii, and who needs it?

The non resident form hawaii is a tax document required for individuals who earn income in Hawaii but do not reside in the state. This form helps ensure compliance with Hawaii's tax laws. If you are conducting business or earning income as a non-resident in Hawaii, you'll need to complete this form.

-

How can airSlate SignNow assist with the non resident form hawaii?

airSlate SignNow provides a user-friendly platform that enables you to easily fill out and electronically sign the non resident form hawaii. Our solution streamlines the process, helping you avoid complications while ensuring your documents are secure and legally binding.

-

Is there a fee associated with using airSlate SignNow for the non resident form hawaii?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including options for individuals and businesses. Our plans are cost-effective, providing great value for your budget while allowing you to manage documents like the non resident form hawaii with ease.

-

What features are included when using airSlate SignNow for the non resident form hawaii?

When you use airSlate SignNow for the non resident form hawaii, you gain access to essential features like reusable templates, collaborative signing, and real-time tracking. Our platform ensures that your documents are processed efficiently while keeping a complete record of all actions taken.

-

Can I integrate airSlate SignNow with other applications for easier management of the non resident form hawaii?

Yes, airSlate SignNow offers integrations with several popular applications, allowing you to manage the non resident form hawaii seamlessly within your existing workflow. This flexibility enhances productivity by connecting with tools you already use, such as Google Drive and Dropbox.

-

What are the benefits of using airSlate SignNow for the non resident form hawaii?

Using airSlate SignNow for the non resident form hawaii simplifies the document management process. You can create, edit, and sign forms from anywhere, saving time and reducing the hassle of paper-based methods. Additionally, our platform ensures your documents remain secure and compliant.

-

How long does it take to complete the non resident form hawaii using airSlate SignNow?

Completing the non resident form hawaii using airSlate SignNow is quick and straightforward. Most users can finish the process in just a few minutes, thanks to our intuitive interface and pre-designed templates that minimize the time needed to fill out forms.

Get more for Form N 15, Rev , State Of Hawaii Non Resident Hawaii gov

- Robert j mckenna mdsanta monica ca providence form

- Health insurance application form generali healthcare

- Patient forms for website 2017

- Leave messages on my work voicemail answering machine form

- Energy pilates fitness yoga pilates phone number yelp form

- Questionnaire child or adolescent merritt speech form

- Fee agreement and psychological services contract form

- Eampampampo easy estimate questionnaire moagentorg form

Find out other Form N 15, Rev , State Of Hawaii Non Resident Hawaii gov

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form