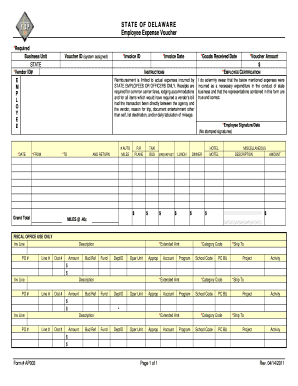

STATE of DELAWARE Employee Expense Voucher Form

What is the State of Delaware Employee Expense Voucher?

The State of Delaware Employee Expense Voucher is a formal document used by employees to request reimbursement for expenses incurred while performing job-related duties. This voucher serves as a record of expenditures and is essential for maintaining accurate financial records within an organization. It typically includes details such as the date of the expense, the nature of the expense, the amount spent, and any supporting documentation required for reimbursement.

Key Elements of the State of Delaware Employee Expense Voucher

Understanding the key elements of the State of Delaware Employee Expense Voucher is crucial for ensuring its proper completion. The main components usually include:

- Employee Information: Name, department, and contact details of the employee submitting the voucher.

- Expense Details: A breakdown of each expense, including date, description, and amount.

- Supporting Documentation: Attachments such as receipts or invoices that validate the expenses claimed.

- Approval Signatures: Required signatures from supervisors or department heads to authorize the reimbursement.

Steps to Complete the State of Delaware Employee Expense Voucher

Completing the State of Delaware Employee Expense Voucher involves several straightforward steps to ensure accuracy and compliance:

- Gather all relevant receipts and documentation for the expenses incurred.

- Fill out the employee information section accurately.

- List each expense in the designated area, providing a clear description and amount.

- Attach supporting documents, ensuring they are legible and organized.

- Obtain necessary approvals by having the form signed by the appropriate supervisor.

- Submit the completed voucher to the finance department for processing.

Legal Use of the State of Delaware Employee Expense Voucher

The legal use of the State of Delaware Employee Expense Voucher is governed by specific regulations that ensure compliance with state and federal laws. For the voucher to be considered valid, it must be completed accurately and submitted within the designated timeframe. Additionally, all expenses claimed must be legitimate and directly related to job responsibilities. Failure to adhere to these guidelines may result in delays or denials of reimbursement requests.

Who Issues the Form?

The State of Delaware Employee Expense Voucher is typically issued by the human resources or finance department of an organization. This department is responsible for providing employees with the necessary forms and guidelines for completing and submitting expense vouchers. It is important for employees to consult their organization's policies regarding the use of the voucher to ensure compliance with internal procedures.

Form Submission Methods

Employees can submit the State of Delaware Employee Expense Voucher through various methods, depending on their organization's policies. Common submission methods include:

- Online Submission: Many organizations allow employees to submit vouchers electronically via a secure online portal.

- Mail: Employees may also choose to send the completed voucher and supporting documents through traditional postal services.

- In-Person: Submitting the voucher directly to the finance department can be an option, especially for urgent requests.

Quick guide on how to complete state of delaware employee expense voucher

Complete STATE OF DELAWARE Employee Expense Voucher effortlessly on any device

Digital document management has become increasingly favored by companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without interruptions. Manage STATE OF DELAWARE Employee Expense Voucher on any device with airSlate SignNow Android or iOS applications and simplify any document-driven process today.

How to modify and eSign STATE OF DELAWARE Employee Expense Voucher with ease

- Obtain STATE OF DELAWARE Employee Expense Voucher and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to send your form, by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worries of lost or misplaced files, monotonous form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choosing. Modify and eSign STATE OF DELAWARE Employee Expense Voucher and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state of delaware employee expense voucher

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an expense voucher format, and why is it important?

An expense voucher format is a structured template that businesses use to document and request reimbursement for incurred expenses. It is important because it standardizes the reimbursement process, making it easier for both employees and finance departments to manage expense claims efficiently.

-

How can airSlate SignNow streamline my expense voucher format process?

airSlate SignNow provides an intuitive platform that allows you to create, send, and eSign customized expense voucher formats quickly. Its user-friendly interface ensures that your team can fill out and submit vouchers seamlessly, reducing processing time for reimbursements.

-

Are there any costs associated with using airSlate SignNow for expense voucher formats?

Yes, airSlate SignNow offers a variety of pricing plans tailored to different business needs and sizes. Each plan provides features relevant to managing expense voucher formats, ensuring you get value for your investment while simplifying your document workflow.

-

Can I customize the expense voucher format in airSlate SignNow?

Absolutely! airSlate SignNow allows you to fully customize your expense voucher format to meet your specific requirements. You can add fields, company branding, and instructions to ensure the voucher suits your organization's needs perfectly.

-

What benefits does using an electronic expense voucher format with airSlate SignNow provide?

Using an electronic expense voucher format with airSlate SignNow improves efficiency and accuracy. It reduces paperwork, speeds up the approval process, and provides tracking capabilities so you can easily monitor the status of expense claims in real-time.

-

Does airSlate SignNow integrate with other financial software for expense voucher formats?

Yes, airSlate SignNow offers numerous integrations with popular financial and accounting software. This allows you to sync data across platforms effortlessly, ensuring that your expense voucher formats are managed within your existing workflow.

-

How secure is the data when using airSlate SignNow for expense voucher formats?

airSlate SignNow prioritizes data security and employs advanced encryption methods to protect your information. When submitting and storing expense voucher formats, you can have peace of mind knowing that sensitive data remains confidential and secure.

Get more for STATE OF DELAWARE Employee Expense Voucher

- Graduate legal intern agreement indiana board of law form

- Alabama packet 575713498 form

- Ohio motion record form

- 73a535 2 11 report of destruction department of revenue form

- Brevard county permit department form

- Foc 109 motion regarding payment plandischarge of arrears form

- Wwwpdffillercom459837636 dealer title affidavit fillable online dealer title affidavit fax email print form

- Caps provider rate form

Find out other STATE OF DELAWARE Employee Expense Voucher

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online