B1 471 2015vt Tax Form

What is the Bvt Tax Form

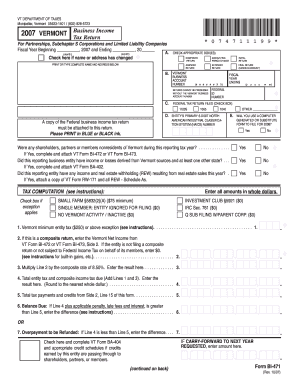

The Bvt Tax Form is a specific tax document used in the United States, primarily for reporting various tax-related information to state authorities. This form is essential for individuals and businesses to ensure compliance with state tax regulations. It serves as a formal declaration of income, deductions, and other pertinent financial details that must be reported annually. Understanding the purpose and requirements of this form is crucial for accurate tax filing.

How to obtain the Bvt Tax Form

To obtain the Bvt Tax Form, individuals can visit the official state tax authority website or contact their local tax office. Many states provide downloadable versions of tax forms in PDF format, allowing taxpayers to print and fill them out. Additionally, some tax preparation software may include this form, making it easier for users to access and complete their tax filings electronically.

Steps to complete the Bvt Tax Form

Completing the Bvt Tax Form involves several key steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other relevant income statements. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. After completing the form, review it for any errors or omissions. Lastly, sign and date the form before submitting it to the appropriate tax authority, either electronically or by mail.

Legal use of the Bvt Tax Form

The Bvt Tax Form must be used in accordance with state tax laws to maintain its legal validity. This includes ensuring that the form is completed accurately and submitted by the designated filing deadline. Failure to comply with these regulations can result in penalties or fines. Utilizing electronic signature solutions can enhance the legal standing of the form by providing a secure, verifiable method of signing.

Key elements of the Bvt Tax Form

The Bvt Tax Form contains several key elements that taxpayers must complete. These include personal identification information, income details, deductions, and credits. Each section is designed to capture specific financial data, which is critical for determining tax liability. Understanding these elements helps ensure that the form is filled out correctly and that all necessary information is provided to the tax authority.

Filing Deadlines / Important Dates

Filing deadlines for the Bvt Tax Form vary by state and can change each tax year. Generally, individual tax returns are due on April fifteenth, while businesses may have different deadlines based on their tax structure. It is essential to stay informed about these dates to avoid late filing penalties. Checking the state tax authority's website can provide the most current information on filing deadlines and any extensions that may be available.

Form Submission Methods (Online / Mail / In-Person)

The Bvt Tax Form can typically be submitted through various methods, including online filing, mailing, or in-person submission. Many states offer online filing options that allow for quicker processing and confirmation of receipt. For those who prefer traditional methods, mailing the completed form to the designated tax office is also acceptable. In-person submissions may be possible at local tax offices, providing an opportunity to ask questions and receive assistance if needed.

Quick guide on how to complete b1 471 2015vt tax form

Execute B1 471 2015vt Tax Form seamlessly on any device

Digital document management has gained traction among businesses and individuals. It presents a perfect eco-friendly substitute to traditional printed and signed documentation, as you can obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage B1 471 2015vt Tax Form on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign B1 471 2015vt Tax Form effortlessly

- Find B1 471 2015vt Tax Form and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing fresh document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and eSign B1 471 2015vt Tax Form and guarantee excellent communication at any step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the b1 471 2015vt tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the B1 471 2015vt Tax Form?

The B1 471 2015vt Tax Form is a specific tax document used for filing various state taxes. Understanding this form is crucial for compliance and ensuring that all necessary information is accurately submitted. Using resources like airSlate SignNow can simplify the eSigning process for this form.

-

How can airSlate SignNow help with the B1 471 2015vt Tax Form?

airSlate SignNow provides a seamless platform for sending and electronically signing your B1 471 2015vt Tax Form. With its user-friendly interface, users can quickly complete and return their forms without the hassle of printing or scanning. This saves time and increases efficiency in tax submissions.

-

Is there a cost associated with using airSlate SignNow for the B1 471 2015vt Tax Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs when managing the B1 471 2015vt Tax Form and other documents. These plans are designed to be budget-friendly while providing powerful features for document management and eSigning.

-

What features does airSlate SignNow offer for the B1 471 2015vt Tax Form?

airSlate SignNow provides multiple features to enhance the experience with the B1 471 2015vt Tax Form, including customizable templates, automated workflows, and secure eSigning. Additionally, users can track the status of their documents in real time. These features help simplify the tax filing process.

-

Can I integrate airSlate SignNow with other applications for managing the B1 471 2015vt Tax Form?

Absolutely! airSlate SignNow supports integrations with various applications, making it easy to manage the B1 471 2015vt Tax Form alongside your existing tools. Whether you use CRM software or accounting applications, integration options ensure a smooth workflow.

-

What are the benefits of using airSlate SignNow for the B1 471 2015vt Tax Form?

Using airSlate SignNow for the B1 471 2015vt Tax Form offers numerous benefits like increased efficiency, reduced paperwork, and enhanced security. Businesses can ensure compliance with tax regulations while benefiting from a fast eSigning process. This leads to quicker turnaround times for tax submissions.

-

Is airSlate SignNow secure for signing my B1 471 2015vt Tax Form?

Yes, airSlate SignNow prioritizes security when it comes to signing your B1 471 2015vt Tax Form. The platform utilizes advanced encryption and authentication methods to protect your documents. This commitment to security ensures that your sensitive information remains confidential and secure.

Get more for B1 471 2015vt Tax Form

- Form mo 1065 2019 partnership return of income

- Missouri permit driving log form

- Mo 8453 individual income tax declaration for internet or electronic dor mo form

- Mo 8453 form

- Child care w 10 i can fill in and print form

- Form 5092 application for online dealers monthly sales report filing

- Missouri dealer monthly sales report online form

- Realty transfer certificate form

Find out other B1 471 2015vt Tax Form

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast