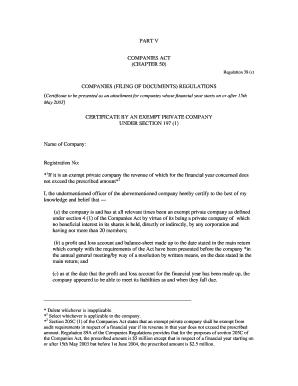

Exempt Private Company Form

What is the exempt private company?

An exempt private company is a specific type of business entity that meets certain criteria allowing it to operate with fewer regulatory requirements compared to other business structures. This designation is particularly relevant for small businesses and startups that may not have extensive resources. Generally, exempt private companies are characterized by limitations on the number of shareholders, restrictions on share transfers, and specific compliance exemptions that simplify operational processes.

How to use the exempt private company

Using the exempt private company structure involves adhering to specific guidelines that govern its formation and operation. Business owners must first ensure that their company meets the eligibility criteria, which typically includes having a limited number of shareholders and not publicly trading shares. Once established, the company can benefit from reduced reporting obligations and operational flexibility, allowing for streamlined decision-making and management.

Steps to complete the exempt private company

Completing the necessary documentation for an exempt private company involves several key steps:

- Determine eligibility based on the number of shareholders and other criteria.

- Prepare and file the Articles of Incorporation or equivalent documents with the appropriate state authority.

- Draft bylaws that outline the governance structure and operational procedures of the company.

- Obtain any required licenses or permits specific to the business operations.

- Set up a system for maintaining compliance with state regulations, including record-keeping and reporting.

Legal use of the exempt private company

The legal use of an exempt private company is governed by state laws that outline its formation, operation, and compliance requirements. To ensure that the company operates within legal boundaries, it is essential to adhere to the specific regulations that apply to exempt private companies. This includes maintaining accurate financial records, conducting regular meetings, and ensuring that all business activities align with the established bylaws and state laws.

Key elements of the exempt private company

Several key elements define an exempt private company, including:

- Limited number of shareholders, often capped at a specific figure, such as fifty.

- Restrictions on the transfer of shares to maintain control within a close group.

- Reduced disclosure and reporting requirements compared to public companies.

- Flexibility in management and operational decisions, allowing for quicker responses to market changes.

Eligibility Criteria

To qualify as an exempt private company, certain eligibility criteria must be met. These criteria typically include:

- A maximum number of shareholders, often limited to fifty.

- Restrictions on the public trading of shares, ensuring the company remains privately held.

- Compliance with specific state regulations regarding formation and operation.

Application Process & Approval Time

The application process for establishing an exempt private company generally involves submitting the necessary formation documents to the state. The approval time can vary based on the state’s processing speed and the completeness of the application. Typically, business owners can expect a turnaround of a few days to several weeks, depending on the jurisdiction.

Quick guide on how to complete exempt private company

Complete Exempt Private Company effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Exempt Private Company on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and electronically sign Exempt Private Company seamlessly

- Locate Exempt Private Company and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to submit your form, either by email, SMS, or via an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow caters to your document management needs in just a few clicks from your chosen device. Edit and electronically sign Exempt Private Company and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the exempt private company

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an exempt private company?

An exempt private company is a type of business structure that enjoys certain privileges under the law, typically concerning financial reporting and disclosures. This status is beneficial for small businesses as it allows them to operate with less regulatory burden, making it easier to manage operations and focus on growth.

-

How does airSlate SignNow support exempt private companies?

airSlate SignNow provides exempt private companies with a seamless solution for sending and eSigning documents. Our platform is designed to enhance efficiency and minimize paperwork, allowing these businesses to focus on their core operations while meeting compliance needs.

-

Are there specific features for exempt private companies in airSlate SignNow?

Yes, airSlate SignNow includes features tailored to exempt private companies, such as customizable templates, audit trails, and secure storage. These features help ensure smooth document management processes and compliance with regulatory requirements.

-

What are the pricing options for airSlate SignNow for exempt private companies?

Our pricing for airSlate SignNow is competitive and specifically designed to accommodate exempt private companies. We offer various plans that provide flexibility based on your company's needs, ensuring that you get the best value for your investment in document management solutions.

-

Can exempt private companies integrate airSlate SignNow with other tools?

Absolutely! airSlate SignNow offers numerous integrations with popular business tools that exempt private companies often use. This allows for streamlined workflows and enhanced efficiency, as you can easily connect with CRM, project management, and accounting software.

-

What are the benefits of using airSlate SignNow for an exempt private company?

Using airSlate SignNow allows exempt private companies to enhance their document workflow efficiency, reduce turnaround times, and ensure secure transactions. By leveraging our eSignature solution, businesses can save time and resources while maintaining compliance with industry standards.

-

Is airSlate SignNow easy to use for exempt private companies?

Yes, one of the key advantages of airSlate SignNow is its user-friendly interface designed for exempt private companies. The platform is intuitive, allowing users of all technical skill levels to easily send, receive, and sign documents without extensive training.

Get more for Exempt Private Company

Find out other Exempt Private Company

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself