Kettering Ohio Annual Withholding Reconciliation Form Kw 3

What is the Kettering Ohio Annual Withholding Reconciliation Form Kw 3

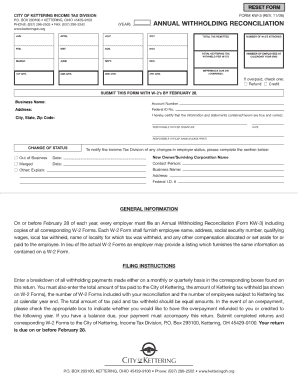

The Kettering Ohio Annual Withholding Reconciliation Form Kw 3 is a crucial document for employers in Kettering, Ohio, designed to report the total amount of local income tax withheld from employees throughout the year. This form ensures compliance with local tax regulations and provides a summary of withholding activities, helping both employers and the local tax authority maintain accurate records. It is essential for employers to complete this form accurately to avoid potential penalties and ensure that employees' tax contributions are correctly accounted for.

Steps to Complete the Kettering Ohio Annual Withholding Reconciliation Form Kw 3

Completing the Kettering Ohio Annual Withholding Reconciliation Form Kw 3 involves several key steps:

- Gather Employee Information: Collect all relevant data regarding employee wages and the amount of local taxes withheld throughout the year.

- Calculate Total Withholdings: Sum the total local taxes withheld from all employees to ensure accuracy in reporting.

- Fill Out the Form: Enter the required information in the designated fields of the form, including total withholdings and employer details.

- Review for Accuracy: Double-check all entries on the form to confirm that the information is complete and correct.

- Submit the Form: Follow the submission guidelines to send the completed form to the appropriate local tax authority.

How to Obtain the Kettering Ohio Annual Withholding Reconciliation Form Kw 3

Employers can obtain the Kettering Ohio Annual Withholding Reconciliation Form Kw 3 through several channels. The form is typically available on the official Kettering city government website or can be requested directly from the local tax office. Additionally, many tax preparation software programs may include the form as part of their offerings, providing a convenient option for employers to access and complete the document electronically.

Legal Use of the Kettering Ohio Annual Withholding Reconciliation Form Kw 3

The Kettering Ohio Annual Withholding Reconciliation Form Kw 3 serves a legal purpose by ensuring that employers comply with local tax laws. Proper completion and submission of this form are essential for maintaining accurate tax records and fulfilling legal obligations. Failure to submit the form or inaccuracies in reporting can lead to penalties, including fines or audits by tax authorities. Therefore, it is vital for employers to understand the legal implications associated with this form and to ensure its accuracy and timely submission.

Filing Deadlines / Important Dates

Employers must be aware of specific filing deadlines for the Kettering Ohio Annual Withholding Reconciliation Form Kw 3 to avoid penalties. Typically, the form is due by the end of January for the previous calendar year's withholdings. It is important to check for any updates or changes to deadlines, as local tax authorities may adjust these dates. Keeping track of these deadlines helps ensure compliance and avoids unnecessary complications.

Form Submission Methods (Online / Mail / In-Person)

The Kettering Ohio Annual Withholding Reconciliation Form Kw 3 can be submitted through various methods, providing flexibility for employers. Options typically include:

- Online Submission: Many employers prefer to submit the form electronically through the local tax authority's online portal, which often streamlines the process.

- Mail: Employers can also print the completed form and send it via postal mail to the designated tax office.

- In-Person: For those who prefer direct interaction, submitting the form in person at the local tax office is another option.

Quick guide on how to complete kettering ohio annual withholding reconciliation form kw 3

Streamline Kettering Ohio Annual Withholding Reconciliation Form Kw 3 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Kettering Ohio Annual Withholding Reconciliation Form Kw 3 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Kettering Ohio Annual Withholding Reconciliation Form Kw 3 effortlessly

- Find Kettering Ohio Annual Withholding Reconciliation Form Kw 3 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Kettering Ohio Annual Withholding Reconciliation Form Kw 3 and ensure excellent communication at any point in the document preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kettering ohio annual withholding reconciliation form kw 3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Kettering Ohio Annual Withholding Reconciliation Form Kw 3?

The Kettering Ohio Annual Withholding Reconciliation Form Kw 3 is a crucial document for employers in Kettering, Ohio, to report their annual withholding tax. It consolidates the tax withheld from employee wages and ensures compliance with local tax regulations. Properly filing this form is essential to avoid penalties and ensure accurate tax reporting.

-

How can airSlate SignNow help with the Kettering Ohio Annual Withholding Reconciliation Form Kw 3?

airSlate SignNow streamlines the process of completing and submitting the Kettering Ohio Annual Withholding Reconciliation Form Kw 3 by allowing users to eSign documents securely and efficiently. With our user-friendly interface, you can quickly fill out, sign, and send the form, minimizing errors and saving time during tax season. Our platform simplifies the tax preparation process for businesses.

-

What are the pricing options available for using airSlate SignNow for the Kettering Ohio Annual Withholding Reconciliation Form Kw 3?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes. You can choose from monthly or annual subscriptions, each providing access to essential features for managing documents like the Kettering Ohio Annual Withholding Reconciliation Form Kw 3. Visit our pricing page for detailed information on each plan and its benefits.

-

Is airSlate SignNow secure for handling sensitive tax documents like the Kettering Ohio Annual Withholding Reconciliation Form Kw 3?

Yes, airSlate SignNow prioritizes security and uses advanced encryption protocols to protect your sensitive documents, including the Kettering Ohio Annual Withholding Reconciliation Form Kw 3. Our platform ensures that your information remains confidential and secure throughout the entire signing process, giving you peace of mind while handling essential tax documentation.

-

Can airSlate SignNow integrate with other software for managing tax forms like the Kettering Ohio Annual Withholding Reconciliation Form Kw 3?

Absolutely! airSlate SignNow offers integrations with various accounting and HR software systems, making it easy to manage your Kettering Ohio Annual Withholding Reconciliation Form Kw 3 alongside other financial documents. This seamless integration simplifies your workflow and allows for better organization and efficiency in document management.

-

What benefits does airSlate SignNow provide for businesses filing the Kettering Ohio Annual Withholding Reconciliation Form Kw 3?

Using airSlate SignNow for the Kettering Ohio Annual Withholding Reconciliation Form Kw 3 provides several benefits, including faster processing times, reduced paper use, and improved accuracy. Our platform also facilitates easy collaboration among team members, ensuring everyone involved can review and approve documents effectively. Overall, it enhances the efficiency of your tax filing process.

-

How does eSigning with airSlate SignNow work for the Kettering Ohio Annual Withholding Reconciliation Form Kw 3?

eSigning with airSlate SignNow is simple and intuitive for the Kettering Ohio Annual Withholding Reconciliation Form Kw 3. Users can upload their completed forms, initiate the signing process, and invite signers via email. Once the document is signed, all parties receive a final copy, ensuring that the form is ready for submission without delay.

Get more for Kettering Ohio Annual Withholding Reconciliation Form Kw 3

- This letter is to inform you that the cancellation of the subject deed of trust has been filed of

- County case no form

- Mortgage loan trust form

- City n a m e form

- Judgmentgarnishment form

- Company loan no form

- Of n a m e county no form

- Enclosed herewith please find a stamped quotfiledquot copy of the agreed order lifting the stay in form

Find out other Kettering Ohio Annual Withholding Reconciliation Form Kw 3

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple