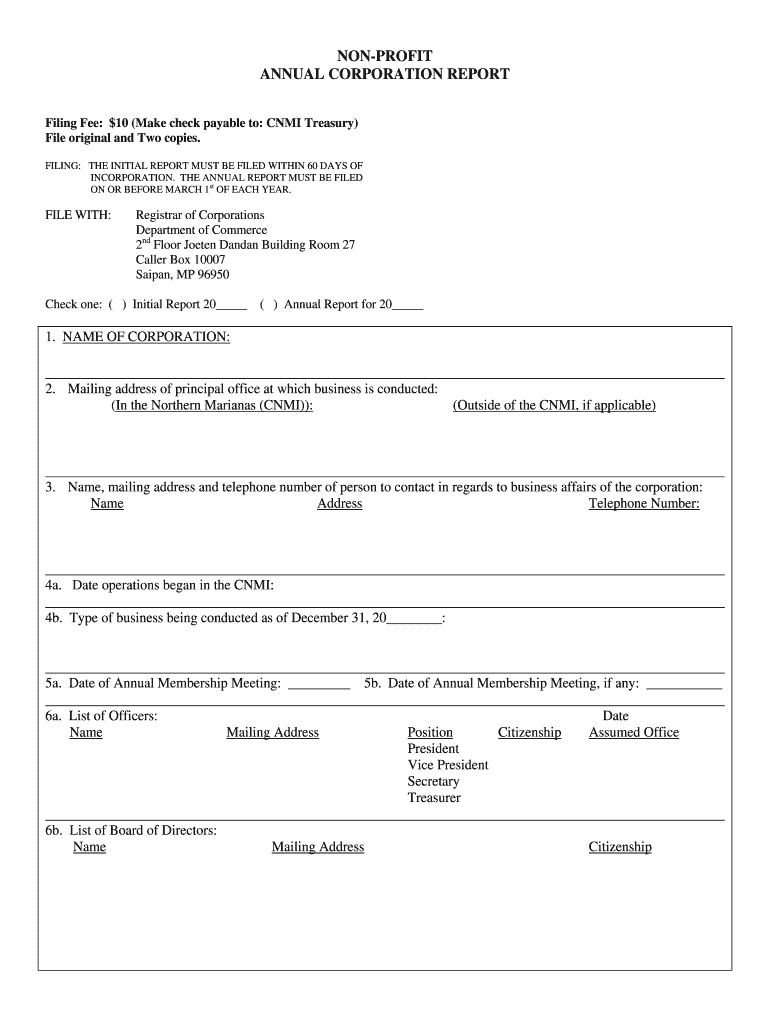

Annual Report for Nonprofit Corporation Form

What is the Annual Report for Nonprofit Corporation

The annual report for nonprofit corporations is a legal document that provides a comprehensive overview of an organization's activities, financial status, and governance for a specific fiscal year. This report is essential for maintaining transparency and accountability to stakeholders, including donors, members, and regulatory agencies. It typically includes information about the nonprofit's mission, programs, financial statements, and board of directors. Filing this report is often a requirement for maintaining tax-exempt status and ensuring compliance with state laws.

Steps to Complete the Annual Report for Nonprofit Corporation

Completing the annual report for a nonprofit corporation involves several key steps:

- Gather necessary financial documents, including income statements, balance sheets, and cash flow statements.

- Compile information about the organization’s programs and activities over the past year.

- Ensure that all board members and key stakeholders review the report for accuracy and completeness.

- Fill out the required forms, ensuring all sections are completed with accurate data.

- Submit the report by the specified deadline to the appropriate state agency.

Legal Use of the Annual Report for Nonprofit Corporation

The annual report serves a legal function by documenting compliance with state regulations governing nonprofit organizations. It is crucial for maintaining the nonprofit's status as a registered entity and ensuring that it adheres to the laws applicable in its state of operation. Failure to file the annual report can lead to penalties, including fines or loss of tax-exempt status. Therefore, understanding the legal implications of this report is essential for nonprofit organizations.

Filing Deadlines / Important Dates

Nonprofit organizations must adhere to specific filing deadlines for their annual reports, which can vary by state. Typically, the deadline falls on the anniversary of the organization's incorporation or on a designated date set by the state. It is important for nonprofits to track these dates to avoid late fees or penalties. Some states may also provide grace periods or extensions, but these should be confirmed with the appropriate state department.

Required Documents

When preparing the annual report for a nonprofit corporation, several documents are typically required:

- Financial statements, including the statement of activities and the statement of financial position.

- Details on the organization’s programs and accomplishments during the reporting period.

- Information about board members and key staff.

- Any additional attachments required by the state, such as IRS Form 990.

Form Submission Methods (Online / Mail / In-Person)

Nonprofit corporations can submit their annual reports through various methods, depending on state regulations. Common submission methods include:

- Online submission via the state’s official website, which is often the fastest and most efficient method.

- Mailing a physical copy of the report to the designated state office.

- In-person submission at the state office, which may be required for certain documents or in specific circumstances.

Quick guide on how to complete non profit company annual report form cnmi department of

Discover the simplest method to complete and endorse your Annual Report For Nonprofit Corporation

Are you still spending time preparing your official documents on paper instead of doing it digitally? airSlate SignNow presents a superior approach to complete and endorse your Annual Report For Nonprofit Corporation and similar forms for public services. Our advanced eSignature platform equips you with everything necessary to handle paperwork swiftly and in compliance with official standards - robust PDF editing, management, security, signing, and sharing tools are all available in an easy-to-use interface.

Only a few steps are needed to fill out and endorse your Annual Report For Nonprofit Corporation:

- Upload the fillable template to the editor using the Get Form button.

- Verify what information you need to include in your Annual Report For Nonprofit Corporation.

- Navigate between the fields with the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to complete the blanks with your details.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is signNow or Conceal details that are no longer relevant.

- Select Sign to generate a legally binding eSignature using your choice of method.

- Add the Date next to your signature and finish your task with the Done button.

Keep your completed Annual Report For Nonprofit Corporation in the Documents folder of your profile, download it, or transfer it to your preferred cloud storage. Our platform also offers versatile file sharing options. There’s no necessity to print your templates when you need to submit them to the appropriate public office - manage it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it now!

Create this form in 5 minutes or less

FAQs

-

What annual forms need to be filled in by a non-profit company (Section 8) in terms of the company act, 2013, before the ministry of corporate affairs?

A section 8 co. (Non Profit Entity) is required to do all compliances like public or private limited company with few exceptions available in various provisions.A section 8 company is required to hold Board meeting,get book of account audited and file the forms (e froms) to MCA as and when required under the Act.

-

How a Non-US residence company owner (has EIN) should fill the W-7 ITIN form out? Which option is needed to be chosen in the first part?

Depends on the nature of your business and how it is structured.If you own an LLC taxed as a passthrough entity, then you probably will check option b and submit the W7 along with your US non-resident tax return. If your LLC’s income is not subject to US tax, then you will check option a.If the business is a C Corp, then you probably don’t need an ITIN, unless you are receiving taxable compensation from the corporation and then we are back to option b.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the non profit company annual report form cnmi department of

How to generate an eSignature for your Non Profit Company Annual Report Form Cnmi Department Of in the online mode

How to generate an eSignature for your Non Profit Company Annual Report Form Cnmi Department Of in Chrome

How to create an electronic signature for putting it on the Non Profit Company Annual Report Form Cnmi Department Of in Gmail

How to create an eSignature for the Non Profit Company Annual Report Form Cnmi Department Of from your smartphone

How to make an eSignature for the Non Profit Company Annual Report Form Cnmi Department Of on iOS devices

How to create an eSignature for the Non Profit Company Annual Report Form Cnmi Department Of on Android OS

People also ask

-

What is the cnmi annual corporation report, and why is it important?

The cnmi annual corporation report is a mandatory filing for corporations operating in the Commonwealth of the Northern Mariana Islands. It provides detailed information about a company's activities, finances, and compliance status. Filing this report is crucial for maintaining good standing and avoiding penalties.

-

How can airSlate SignNow assist in filing the cnmi annual corporation report?

airSlate SignNow simplifies the process of preparing and electronically signing the cnmi annual corporation report. Our platform enables you to gather necessary signatures seamlessly, ensuring that your filing is completed promptly and accurately. This efficiency can save your business time and reduce the risk of errors.

-

What are the pricing options for using airSlate SignNow for the cnmi annual corporation report?

airSlate SignNow offers competitive pricing plans that accommodate businesses of all sizes looking to file the cnmi annual corporation report. With our subscription model, you can choose a plan that fits your needs, providing you with a cost-effective solution without sacrificing quality or functionalities.

-

Can I integrate airSlate SignNow with other tools for managing the cnmi annual corporation report?

Yes, airSlate SignNow integrates seamlessly with various productivity tools, allowing for efficient management of the cnmi annual corporation report. This includes integrations with cloud storage services and project management applications, making it easy to gather documents and ensure all stakeholders are involved in the process.

-

What features does airSlate SignNow provide to ensure compliance when filing the cnmi annual corporation report?

airSlate SignNow offers features such as secure eSignatures, audit trails, and customizable templates that ensure compliance when filing the cnmi annual corporation report. These tools safeguard your data and provide transparency throughout the filing process, helping you meet all necessary legal requirements.

-

Is airSlate SignNow suitable for small businesses filing the cnmi annual corporation report?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it an excellent choice for small businesses needing to file the cnmi annual corporation report. Our platform eliminates the complexities of document management and signature collection, so small businesses can focus on their core operations.

-

What benefits can I expect from using airSlate SignNow for the cnmi annual corporation report?

Using airSlate SignNow for the cnmi annual corporation report can signNowly streamline your filing process. Key benefits include reduced turnaround times, improved accuracy in document handling, and enhanced collaboration among team members. Overall, our solution empowers your business to stay compliant without unnecessary hassle.

Get more for Annual Report For Nonprofit Corporation

- Application for payment excel form

- Dsp 61 form

- Ipl consent form 43444046

- Rate lock agreement pdf form

- Ywamtyler expenditure form

- Store keeper experience certificate format pdf store keeper experience certificate format pdf the document has moved

- G7042017 certificate of substantial completion aia contract form

- Cover contract template form

Find out other Annual Report For Nonprofit Corporation

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe

- Sign South Carolina Vacation Rental Short Term Lease Agreement Now

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage