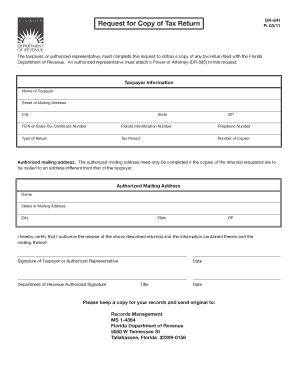

Dr 841 Form Department of Revenue Florida

What is the Dr 841 Form Department Of Revenue Florida

The Dr 841 form is a crucial document used by businesses in Florida to report and pay sales and use taxes. It is officially known as the "Sales and Use Tax Return." This form is essential for ensuring compliance with Florida's tax laws and is typically required for businesses that engage in selling goods or services subject to sales tax. Understanding the purpose and requirements of the Dr 841 form is vital for business owners to avoid penalties and maintain good standing with the Florida Department of Revenue.

How to use the Dr 841 Form Department Of Revenue Florida

Using the Dr 841 form involves several steps to ensure accurate reporting of sales and use tax. First, businesses must gather all necessary sales data for the reporting period. This includes total sales, taxable sales, and any exemptions. Next, the form must be filled out accurately, detailing the total sales, tax collected, and any adjustments. After completing the form, businesses can submit it online or by mail, ensuring they adhere to the filing deadlines set by the Florida Department of Revenue.

Steps to complete the Dr 841 Form Department Of Revenue Florida

Completing the Dr 841 form requires careful attention to detail. Here are the steps to follow:

- Gather sales records for the reporting period.

- Determine the total sales and taxable sales amounts.

- Fill in the required fields on the Dr 841 form, including your business information and sales figures.

- Calculate the total tax due based on the taxable sales.

- Review the form for accuracy and completeness.

- Submit the form either online through the Florida Department of Revenue's website or by mailing it to the appropriate address.

Legal use of the Dr 841 Form Department Of Revenue Florida

The Dr 841 form is legally binding and must be used in compliance with Florida's tax regulations. Filing this form accurately is essential for businesses to fulfill their tax obligations. Failure to submit the form or inaccuracies in reporting can lead to penalties, interest, and potential audits by the Florida Department of Revenue. Therefore, understanding the legal implications and ensuring correct usage of the Dr 841 form is critical for all business owners in Florida.

Filing Deadlines / Important Dates

Filing deadlines for the Dr 841 form vary based on the reporting frequency assigned to a business, which can be monthly, quarterly, or annually. Generally, businesses must file the form by the 20th day of the month following the reporting period. It is crucial for business owners to be aware of these deadlines to avoid late fees and ensure compliance with state tax laws. Keeping a calendar of important dates related to the Dr 841 form can help in timely submissions.

Form Submission Methods (Online / Mail / In-Person)

The Dr 841 form can be submitted through various methods to accommodate different business needs. Businesses can file the form online via the Florida Department of Revenue's e-Services portal, which offers a convenient and efficient way to report sales and use taxes. Alternatively, the form can be mailed to the designated address provided by the Department of Revenue. In-person submissions may also be possible at local tax offices, but it is advisable to check for availability and hours before visiting.

Quick guide on how to complete dr 841 form department of revenue florida

Prepare Dr 841 Form Department Of Revenue Florida effortlessly on any device

Online document organization has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to find the necessary form and securely save it online. airSlate SignNow equips you with everything required to create, alter, and electronically sign your documents quickly without delays. Manage Dr 841 Form Department Of Revenue Florida on any device with the airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign Dr 841 Form Department Of Revenue Florida with ease

- Find Dr 841 Form Department Of Revenue Florida and click Get Form to begin.

- Make use of the tools we offer to complete your paperwork.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs within a few clicks from any device you prefer. Alter and eSign Dr 841 Form Department Of Revenue Florida while ensuring exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 841 form department of revenue florida

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dr841 and how does it relate to airSlate SignNow?

dr841 is an innovative feature of airSlate SignNow that streamlines the document signing process. With dr841, users can easily send, sign, and manage documents electronically, enhancing workflow efficiency. This powerful tool simplifies eSigning for businesses of all sizes, making it an essential part of document management.

-

How much does airSlate SignNow with dr841 cost?

Pricing for airSlate SignNow with dr841 is designed to be affordable for all businesses. Plans vary based on features and user needs, providing options for startups to large enterprises. For specific pricing details, it's best to visit the airSlate SignNow website and explore their packages.

-

What features come with the dr841 plan?

The dr841 plan includes a range of features such as unlimited eSignatures, customizable templates, and secure cloud storage. These functionalities ensure a comprehensive signing solution suitable for any organization. Additionally, users benefit from integration capabilities with popular applications.

-

What benefits does dr841 offer for businesses?

dr841 enhances business operations by reducing turnaround times for document approvals and increasing overall productivity. With its user-friendly interface, teams can collaborate efficiently, leading to faster decision-making. This not only saves time but also reduces paper usage, contributing to sustainability efforts.

-

Can I integrate dr841 with other software solutions?

Yes, dr841 supports a variety of integrations with popular business software such as CRM systems and cloud storage platforms. This flexibility allows businesses to create a seamless workflow tailored to their existing tools. By integrating dr841, you can optimize document management across different platforms.

-

Is there a mobile app for airSlate SignNow with dr841?

Absolutely! airSlate SignNow offers a mobile app that includes the dr841 feature, allowing users to send and sign documents on the go. This accessibility ensures that your signing needs are met from anywhere, enhancing convenience for busy professionals. The mobile experience is designed to be user-friendly and efficient.

-

What security measures are in place with dr841?

Security is a top priority for airSlate SignNow using dr841, as the platform employs robust encryption protocols to protect sensitive information. Features include secure login, access controls, and document audit trails to ensure compliance and transparency. These measures push forward your business's commitment to data security.

Get more for Dr 841 Form Department Of Revenue Florida

- Montgomery county circuit court of alabama state of form

- In the united states district court michael e marciano form

- Body of memo here form

- Cv 99 form

- I received your notice of termination on 20 form

- State of alabama revised 3508 case no form

- United states district court northern district of alabama form

- Month to month lease agreement landlordocom form

Find out other Dr 841 Form Department Of Revenue Florida

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online