GST Registration Certificate IndiaFilings Form

What is the GST Registration Certificate IndiaFilings

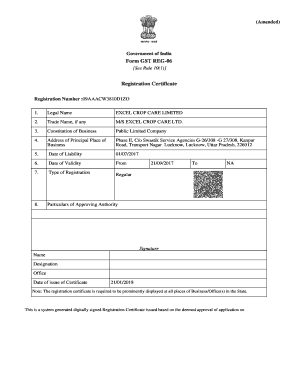

The GST Registration Certificate is an essential document for businesses operating in India, signifying compliance with the Goods and Services Tax (GST) regulations. This certificate is issued by the Goods and Services Tax Network (GSTN) upon successful registration of a business under GST. It serves as proof that the business is registered and authorized to collect GST from customers. The certificate contains vital information, including the GSTIN (Goods and Services Tax Identification Number), the name of the business, and the address of the registered office.

How to Obtain the GST Registration Certificate IndiaFilings

To obtain the GST Registration Certificate, businesses must follow a structured application process. This typically involves several steps:

- Gather necessary documents, such as PAN card, proof of business address, and bank account details.

- Visit the official GST portal and fill out the GST registration application form.

- Submit the application along with the required documents.

- Receive an acknowledgment receipt, which will be used to track the application status.

- Once the application is verified, the GST Registration Certificate will be issued.

Key Elements of the GST Registration Certificate IndiaFilings

The GST Registration Certificate includes several key elements that are crucial for identification and compliance. These elements are:

- GSTIN: A unique identification number assigned to the business.

- Business Name: The registered name of the business entity.

- Address: The physical location of the business.

- Type of Business: Indicates the nature of the business entity, such as sole proprietorship, partnership, or corporation.

- Effective Date: The date from which the GST registration is valid.

Steps to Complete the GST Registration Certificate IndiaFilings

Completing the GST Registration Certificate involves a series of steps that ensure all necessary information is accurately provided. Here’s a breakdown of the process:

- Access the GST registration portal and create an account.

- Fill in the application form with details about the business and its owners.

- Upload required documents as specified by the GST portal.

- Review the application for accuracy before submission.

- Submit the application and note the reference number for tracking.

Legal Use of the GST Registration Certificate IndiaFilings

The GST Registration Certificate is legally binding and must be displayed prominently at the business location. It serves multiple legal purposes, including:

- Validating the business's tax compliance status.

- Allowing the business to collect GST from customers.

- Enabling the business to claim input tax credit on purchases.

- Facilitating smooth transactions with suppliers and customers.

Eligibility Criteria for GST Registration IndiaFilings

To be eligible for GST registration, businesses must meet specific criteria set by the GST authorities. These criteria include:

- Businesses with a turnover exceeding the prescribed threshold limit.

- Entities engaged in inter-state supply of goods or services.

- Individuals or businesses required to pay tax under reverse charge mechanism.

- Non-resident taxable persons and casual taxable persons.

Quick guide on how to complete gst registration certificate indiafilings

Effortlessly Complete GST Registration Certificate IndiaFilings on Any Device

Digital document management has gained traction among both enterprises and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed forms, allowing you to locate the necessary document and securely store it online. airSlate SignNow equips you with all the resources required to generate, modify, and electronically sign your files promptly without interruptions. Manage GST Registration Certificate IndiaFilings on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

How to Modify and Electronically Sign GST Registration Certificate IndiaFilings with Ease

- Obtain GST Registration Certificate IndiaFilings and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your files or redact sensitive information with tools specifically offered by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Select how you want to send your document, via email, SMS, or invitation link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form searching, or errors requiring new copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign GST Registration Certificate IndiaFilings to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gst registration certificate indiafilings

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a GST Registration Certificate from IndiaFilings?

A GST Registration Certificate from IndiaFilings is an official document issued by the Goods and Services Tax (GST) department in India, confirming that a business is registered under GST. This certificate is crucial for compliance and allows businesses to collect tax on behalf of the government, helping them operate legally in India.

-

How can I obtain a GST Registration Certificate through IndiaFilings?

You can obtain a GST Registration Certificate through IndiaFilings by providing the necessary documents and information about your business. Their team will assist you in preparing the documentation and submitting it to the GST portal, ensuring a hassle-free registration process tailored to your needs.

-

What is the cost associated with obtaining a GST Registration Certificate via IndiaFilings?

The cost of obtaining a GST Registration Certificate through IndiaFilings varies based on the type of business and services required. However, IndiaFilings is known for offering competitive pricing and transparent fee structures, making it a cost-effective option for businesses looking to register their GST.

-

What are the benefits of using IndiaFilings for GST registration?

Using IndiaFilings for your GST registration ensures a seamless experience, thanks to their expertise in handling documentation and compliance. Additionally, they provide ongoing support to help you navigate any regulatory requirements, making it easier for businesses to focus on growth while remaining compliant.

-

How long does it take to receive my GST Registration Certificate from IndiaFilings?

The time it takes to receive your GST Registration Certificate from IndiaFilings typically ranges from 3 to 7 business days, depending on the completeness of your submitted documentation. Their team works diligently to expedite the process and ensure that you receive your certificate promptly.

-

Can I integrate the GST Registration process with other services offered by IndiaFilings?

Yes, IndiaFilings offers a range of services that can be integrated with your GST registration process, such as accounting, compliance, and legal support. This comprehensive approach ensures that you not only obtain your GST Registration Certificate but also manage your business effectively in compliance with all regulations.

-

Is it necessary to have a GST Registration Certificate for my business?

Yes, having a GST Registration Certificate is essential for businesses that meet certain turnover thresholds or engage in inter-state sales. It allows you to bill customers with GST and claim input tax credits, making it an important part of operating legally in India.

Get more for GST Registration Certificate IndiaFilings

Find out other GST Registration Certificate IndiaFilings

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe