Form 8594 PDF

What is the Form 8594 PDF

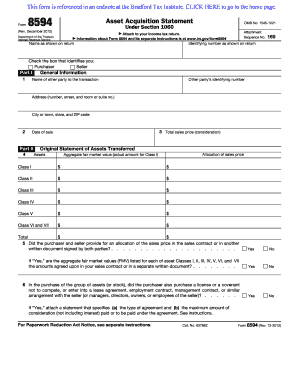

The Form 8594 PDF is a tax document used in the United States for reporting the sale of a business. This form is specifically designed for asset acquisitions, allowing buyers and sellers to report the fair market value of the assets transferred during the transaction. The form plays a crucial role in ensuring that both parties comply with IRS regulations regarding the allocation of purchase price among various assets. Proper completion of this form is essential for accurate tax reporting and to avoid potential disputes regarding asset valuation.

How to Use the Form 8594 PDF

Using the Form 8594 PDF involves several key steps. First, both the buyer and seller must agree on the allocation of the purchase price among the various assets. This allocation must reflect the fair market value of each asset involved in the transaction. Once the allocation is determined, both parties should complete their respective sections of the form, ensuring that all required information is accurately reported. After filling out the form, it should be submitted with the appropriate tax returns to the IRS. It is advisable to retain a copy for your records.

Steps to Complete the Form 8594 PDF

Completing the Form 8594 PDF requires careful attention to detail. Here are the essential steps:

- Gather all relevant information about the asset sale, including the purchase price and details of the assets involved.

- Determine the fair market value of each asset, ensuring that both parties agree on the allocation.

- Fill out the form, entering the necessary details in the designated sections for both the buyer and seller.

- Review the completed form for accuracy and completeness before submission.

- Submit the form alongside your tax returns to the IRS.

Legal Use of the Form 8594 PDF

The legal use of the Form 8594 PDF is governed by IRS regulations. To ensure that the form is legally binding, it must be filled out accurately and submitted in accordance with IRS guidelines. Both parties involved in the transaction should keep a copy of the completed form for their records. This documentation is essential in case of an audit or any future disputes regarding the transaction. Compliance with all applicable laws and regulations is critical to avoid penalties or legal issues.

Key Elements of the Form 8594 PDF

The Form 8594 PDF contains several key elements that are crucial for its proper use:

- Asset Allocation: A detailed breakdown of how the purchase price is allocated among the various assets.

- Buyer and Seller Information: Identification details of both parties involved in the transaction.

- Signature Section: Signatures of both parties to validate the agreement and allocation.

- IRS Compliance: Compliance statements ensuring adherence to IRS regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8594 PDF are typically aligned with the tax return deadlines for both the buyer and seller. It is essential to submit the form by the due date of the tax return for the year in which the asset sale occurred. Failure to file the form on time may result in penalties or complications with the IRS. Keeping track of important dates related to tax filings can help ensure compliance and avoid unnecessary issues.

Quick guide on how to complete form 8594 pdf

Complete Form 8594 Pdf seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without any delays. Handle Form 8594 Pdf on any device using airSlate SignNow's Android or iOS applications and streamline your document-based processes today.

The easiest method to modify and electronically sign Form 8594 Pdf effortlessly

- Find Form 8594 Pdf and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the issues of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 8594 Pdf to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8594 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8594 PDF and why is it important?

Form 8594 PDF is used in the sale or transfer of a business to report the assets sold. This form helps ensure both parties accurately disclose the allocation of the purchase price. It's crucial for tax compliance and preventing disputes post-sale.

-

How can I easily obtain a Form 8594 PDF?

You can easily obtain a Form 8594 PDF through our platform, airSlate SignNow. We offer a streamlined way to fill out and download the form digitally, ensuring you're using the most current version with the necessary fields.

-

What features does airSlate SignNow offer for managing Form 8594 PDF?

airSlate SignNow provides features such as customizable templates and eSignature capabilities specifically for Form 8594 PDF. You can collaborate in real-time with other stakeholders, making it easy to finalize and send your document securely.

-

Is there a cost associated with using airSlate SignNow for Form 8594 PDF?

Yes, there is a cost associated with using airSlate SignNow, but we provide various pricing plans to suit different business needs. The investment enables you to save time while ensuring compliance with Form 8594 PDF requirements.

-

Can I integrate airSlate SignNow with other tools for Form 8594 PDF management?

Absolutely! airSlate SignNow integrates seamlessly with various tools such as CRMs and cloud storage solutions. This integration helps simplify your workflow and enhances functionality when managing Form 8594 PDF.

-

How does airSlate SignNow ensure the security of my Form 8594 PDF documents?

Security is a top priority at airSlate SignNow. We implement advanced encryption protocols and secure cloud storage to safeguard your Form 8594 PDF documents from unauthorized access or data bsignNowes.

-

What benefits does using airSlate SignNow provide for handling Form 8594 PDF?

Using airSlate SignNow for Form 8594 PDF offers numerous benefits, including improved efficiency, reduced paperwork, and the ability to track document statuses. Our platform also helps streamline the signing process, enhancing overall productivity.

Get more for Form 8594 Pdf

- Rescissionserving california only 909 890 9192 ampampamp 925 form

- Control number ca 031 77 form

- New transfer on death deed in californiaa peoples choice form

- Tax law docsharetips form

- A family guide to conservatorship and involuntary treatment form

- Trust two trustees to three individuals form

- Individual to six individuals form

- California mineral deed formsdeedscom

Find out other Form 8594 Pdf

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT