Il Schedule Nr Form

What is the IL Schedule NR?

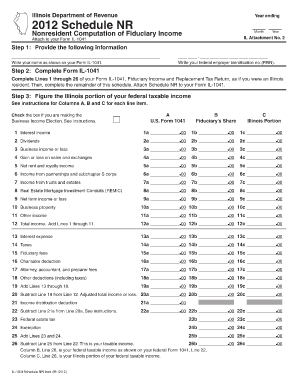

The IL Schedule NR is a tax form used by non-residents of Illinois to report income earned in the state. This form is essential for individuals who do not reside in Illinois but have received income from Illinois sources, such as wages, rental income, or business earnings. Completing this form accurately is crucial for ensuring compliance with state tax laws.

How to Use the IL Schedule NR

To use the IL Schedule NR effectively, taxpayers must first gather all relevant income documents, including W-2s and 1099s. Next, fill out the form by providing personal information, detailing income earned in Illinois, and calculating the tax owed. It is important to follow the instructions carefully to avoid errors that could lead to penalties or delays in processing.

Steps to Complete the IL Schedule NR

Completing the IL Schedule NR involves several key steps:

- Gather all necessary income documentation.

- Fill in personal details, including name, address, and Social Security number.

- Report all income earned from Illinois sources.

- Calculate the tax owed based on the income reported.

- Review the form for accuracy before submission.

Legal Use of the IL Schedule NR

The IL Schedule NR is legally binding and must be filled out in accordance with Illinois state tax laws. It is essential for non-residents to file this form to report their income accurately and pay any taxes owed. Failure to do so may result in penalties, interest on unpaid taxes, or legal consequences.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines for the IL Schedule NR to avoid late fees. Generally, the form must be submitted by the same deadline as the federal tax return, which is typically April fifteenth. It is advisable to check for any changes in deadlines or extensions that may apply for the current tax year.

Form Submission Methods

The IL Schedule NR can be submitted through various methods, including online filing, mailing a paper form, or delivering it in person to the appropriate tax office. Online submission is often the most efficient method, allowing for quicker processing and confirmation of receipt.

Quick guide on how to complete il schedule nr

Complete Il Schedule Nr effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily access the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents swiftly without delays. Handle Il Schedule Nr on any platform with airSlate SignNow's Android or iOS applications and enhance any document-oriented procedure today.

How to adjust and electronically sign Il Schedule Nr with ease

- Find Il Schedule Nr and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the concerns of lost or misplaced files, tedious form hunting, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Il Schedule Nr and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the il schedule nr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Illinois Schedule NR instructions for eSigning documents?

The Illinois Schedule NR instructions provide guidelines for residents filing their taxes using this specific form. They outline the required information and steps to fill it out correctly. With airSlate SignNow, you can easily eSign documents and ensure compliance with Illinois Schedule NR instructions, making your filing process seamless.

-

How can airSlate SignNow help with Illinois Schedule NR instructions?

airSlate SignNow streamlines the process of completing and signing documents by allowing users to fill out forms electronically. By using our platform, you can follow the Illinois Schedule NR instructions step by step, ensuring accuracy and reducing the chances of error. This convenience saves time and simplifies tax preparation.

-

Are there any costs associated with using airSlate SignNow for Illinois Schedule NR instructions?

airSlate SignNow offers competitive pricing plans that cater to different needs and budgets. You can access the platform at an affordable rate, which includes features specifically designed to assist with Illinois Schedule NR instructions. This cost-effective solution ensures that you get the best value while managing your eSigning requirements.

-

What features does airSlate SignNow include for following Illinois Schedule NR instructions?

With airSlate SignNow, you benefit from features such as customizable templates, secure eSigning, and real-time tracking. These tools help you adhere to the Illinois Schedule NR instructions effectively. Our user-friendly interface ensures that you can complete your tax documents accurately and efficiently.

-

Can airSlate SignNow integrate with other software for Illinois Schedule NR instructions?

Yes, airSlate SignNow offers integration with various software solutions to enhance your workflow. Whether you use accounting, tax preparation, or CRM software, you can effortlessly connect our platform for a smooth experience when following the Illinois Schedule NR instructions. This integration allows for efficient document management and collaboration.

-

What benefits does using airSlate SignNow provide for completing Illinois Schedule NR instructions?

Using airSlate SignNow to complete Illinois Schedule NR instructions offers numerous benefits, including improved accuracy and faster turnaround times. Our digital solution minimizes the risk of paperwork errors and delays. By eSigning your documents, you can enjoy a more organized and efficient tax preparation process.

-

Is airSlate SignNow user-friendly for eSigning Illinois Schedule NR instructions?

Absolutely! airSlate SignNow is designed to be intuitive and user-friendly, even for those who may not be tech-savvy. It allows you to easily follow the Illinois Schedule NR instructions and eSign your documents with just a few clicks. Our platform provides support materials to guide you through the process.

Get more for Il Schedule Nr

- Consumer complaint instruction sheet mva marylandgov form

- Form hsmv 83146 florida highway safety and motor vehicles

- Vtr 34 form

- Mv 80a form

- Dr 2219 122118 form

- Faqs pa vehicle registration pa drivers license pa notary form

- Form mv 82r ampquotvehicle registrationtitle applicationampquot new

- J23 conneticut dmv form pdf fill online printable fillable blank

Find out other Il Schedule Nr

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure