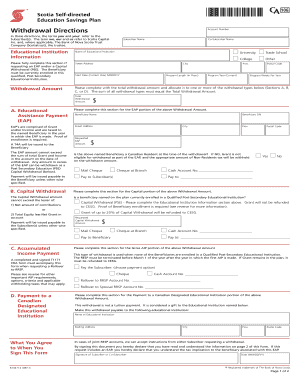

*CA106* 106 Scotia Self Directed Education Savings Plan Form

What is the CA106 106 Scotia Self directed Education Savings Plan

The CA106 106 Scotia Self directed Education Savings Plan is a financial product designed to help individuals save for educational expenses. This plan allows account holders to contribute funds that can grow tax-free until they are needed for qualified education costs. It is specifically tailored for families looking to invest in their children's future education, providing flexibility in investment choices and potential tax advantages. The plan is governed by specific regulations to ensure that contributions and withdrawals align with educational purposes.

How to obtain the CA106 106 Scotia Self directed Education Savings Plan

To obtain the CA106 106 Scotia Self directed Education Savings Plan, individuals must first identify a financial institution that offers this plan. Typically, this involves contacting the institution directly or visiting their website to gather necessary information. Applicants will need to provide personal details, including identification and beneficiary information. After completing the required documentation, the application can be submitted either online or in person, depending on the institution's procedures.

Steps to complete the CA106 106 Scotia Self directed Education Savings Plan

Completing the CA106 106 Scotia Self directed Education Savings Plan involves several key steps:

- Gather necessary personal information, including Social Security numbers for both the account holder and the beneficiary.

- Review the plan's terms and conditions to ensure it meets your educational savings needs.

- Fill out the application form accurately, providing all required details.

- Submit the application along with any required documentation, such as proof of identity.

- Monitor the account regularly to track contributions and investment performance.

Legal use of the CA106 106 Scotia Self directed Education Savings Plan

The legal use of the CA106 106 Scotia Self directed Education Savings Plan is defined by regulations that govern education savings accounts. Funds must be used exclusively for qualified educational expenses, which may include tuition, fees, books, and other related costs. Withdrawals for non-educational purposes may result in penalties and tax implications. It is important for account holders to maintain accurate records of expenditures to ensure compliance with legal requirements.

Eligibility Criteria

Eligibility for the CA106 106 Scotia Self directed Education Savings Plan typically includes the following criteria:

- Account holders must be legal residents of the United States.

- The beneficiary must be a qualified student, often defined as someone who will attend an accredited educational institution.

- There may be age limits for the beneficiary, usually requiring them to be under a certain age when the account is established.

Required Documents

When applying for the CA106 106 Scotia Self directed Education Savings Plan, several documents are generally required:

- Proof of identity for the account holder and beneficiary, such as a government-issued ID.

- Social Security numbers for both parties.

- Completed application form, which may require additional information based on the financial institution's requirements.

Quick guide on how to complete ca106 106 scotia self directed education savings plan

Complete *CA106* 106 Scotia Self directed Education Savings Plan effortlessly on any device

Web-based document management has become increasingly popular among companies and individuals. It offers a fantastic eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and safely store it online. airSlate SignNow equips you with everything necessary to create, modify, and electronically sign your documents swiftly without delays. Manage *CA106* 106 Scotia Self directed Education Savings Plan on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign *CA106* 106 Scotia Self directed Education Savings Plan with ease

- Find *CA106* 106 Scotia Self directed Education Savings Plan and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight signNow sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you prefer to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhausting form navigation, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign *CA106* 106 Scotia Self directed Education Savings Plan and maintain effective communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ca106 106 scotia self directed education savings plan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the *CA106* 106 Scotia Self directed Education Savings Plan?

The *CA106* 106 Scotia Self directed Education Savings Plan is a flexible and tax-advantaged savings account designed to help you save for your child's educational expenses. With this plan, you can choose your investments and manage them according to your financial goals and risk tolerance.

-

What are the benefits of the *CA106* 106 Scotia Self directed Education Savings Plan?

One of the key benefits of the *CA106* 106 Scotia Self directed Education Savings Plan is its ability to grow your savings tax-free until they are withdrawn for educational purposes. Additionally, you can receive government grants that can signNowly boost your investment, making it a valuable tool for funding education.

-

How much does the *CA106* 106 Scotia Self directed Education Savings Plan cost?

The cost of the *CA106* 106 Scotia Self directed Education Savings Plan can depend on various factors such as management fees and the types of investments you choose. It’s essential to review the fee structure outlined by Scotia to understand any potential costs involved in maintaining the plan.

-

Can I change my investments within the *CA106* 106 Scotia Self directed Education Savings Plan?

Yes, the *CA106* 106 Scotia Self directed Education Savings Plan allows you to change your investments as your financial needs and market conditions change. This flexibility helps you align your investment strategy with your education savings goals.

-

Are there any contribution limits for the *CA106* 106 Scotia Self directed Education Savings Plan?

Yes, the *CA106* 106 Scotia Self directed Education Savings Plan has annual and lifetime contribution limits set by the government. It is crucial to be aware of these limits to maximize the benefits without incurring penalties.

-

How does the *CA106* 106 Scotia Self directed Education Savings Plan impact my taxes?

Contributions to the *CA106* 106 Scotia Self directed Education Savings Plan may qualify for tax credits, and any income earned within the plan grows tax-free until withdrawal. Understanding tax implications is vital for effective planning and maximizing savings.

-

Can I set up automatic contributions for the *CA106* 106 Scotia Self directed Education Savings Plan?

Yes, setting up automatic contributions for the *CA106* 106 Scotia Self directed Education Savings Plan is a convenient feature that allows you to invest steady amounts over time. This strategy helps ensure consistent savings without requiring manual intervention.

Get more for *CA106* 106 Scotia Self directed Education Savings Plan

- The small claims court a guide to state of california form

- Promissory note form fill out and sign printable pdf

- It has come to form

- Big leaking hole in the ceiling landlord has been form

- Overview of landlord tenant laws in north carolinanolo form

- Landlord giving notice to vacate consumer affairs victoria form

- We have a sfr in ca rented to tenants soon after end of 1 form

- The heater does not work andor is in form

Find out other *CA106* 106 Scotia Self directed Education Savings Plan

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe