T1 Form Cra

What is the T1 Form CRA?

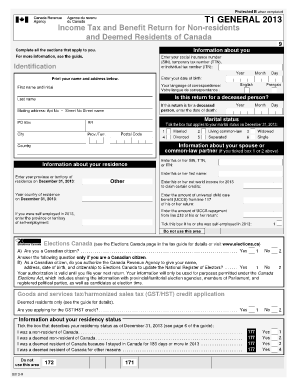

The T1 tax form, officially known as the Income Tax and Benefit Return, is a crucial document for individuals in Canada, including non-residents and deemed residents. This form is used to report income, claim deductions, and determine eligibility for various tax credits. The T1 form is essential for individuals to fulfill their tax obligations and is filed annually with the Canada Revenue Agency (CRA). It includes sections for personal information, income sources, deductions, and credits, ensuring a comprehensive overview of an individual's financial situation for the tax year.

Steps to Complete the T1 Form CRA

Completing the T1 tax form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documents, including T4 slips, receipts for deductions, and any other relevant financial information. Next, fill out your personal information accurately, including your name, address, and social insurance number. Then, report your income from various sources, such as employment, investments, and self-employment. After calculating your total income, apply any eligible deductions and credits to determine your taxable income. Finally, review the completed form for accuracy before submitting it to the CRA.

Required Documents

To successfully complete the T1 tax form, you will need several key documents. These typically include:

- T4 slips from employers, detailing your income and deductions

- Receipts for any eligible expenses, such as medical costs or charitable donations

- Investment income statements, such as T5 slips

- Records of any self-employment income and expenses

- Previous year’s tax return for reference

Having these documents ready will streamline the process of filling out the T1 form and help ensure that all income and deductions are reported accurately.

How to Obtain the T1 Form CRA

The T1 tax form can be obtained through various channels. Individuals can download the form directly from the Canada Revenue Agency's website, where it is available in PDF format. Alternatively, you can request a paper copy to be mailed to you by contacting the CRA directly. Many tax preparation software programs also include the T1 form, allowing for electronic completion and filing. Regardless of the method chosen, ensure you have the most current version of the form for the tax year you are filing.

Legal Use of the T1 Form CRA

The T1 tax form serves as a legally binding document once completed and submitted to the CRA. It is essential to ensure that all information provided is accurate and truthful, as any discrepancies can lead to penalties or audits. The form must be signed by the taxpayer, either electronically if filed online or physically if submitted by mail. Compliance with tax laws and regulations is critical, as the T1 form plays a significant role in determining tax obligations and potential refunds.

Filing Deadlines / Important Dates

Filing deadlines for the T1 tax form are crucial for compliance. Typically, individual taxpayers must submit their T1 forms by April 30 of the following year. If April 30 falls on a weekend or holiday, the deadline is extended to the next business day. Self-employed individuals have until June 15 to file, but any taxes owed must still be paid by April 30 to avoid interest charges. It is important to stay informed about these deadlines to ensure timely submission and avoid penalties.

Quick guide on how to complete t1 form cra

Complete T1 Form Cra with ease on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle T1 Form Cra on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign T1 Form Cra effortlessly

- Locate T1 Form Cra and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign T1 Form Cra and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the t1 form cra

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an income tax and benefit return?

An income tax and benefit return is a form that individuals and businesses must complete to report their earnings, calculate their tax owed or refunds, and claim benefits. It ensures compliance with tax regulations and helps in determining eligibility for various benefits. Submitting an accurate return is crucial for financial planning and maintaining good standing with tax authorities.

-

How can airSlate SignNow assist with my income tax and benefit return?

airSlate SignNow streamlines the process of filling out your income tax and benefit return by allowing you to eSign documents and send them securely. Its user-friendly interface makes it easier to manage your tax documents efficiently. With SignNow, you can save time and avoid errors during the filing process.

-

What features does airSlate SignNow offer for income tax and benefit return management?

AirSlate SignNow offers features such as document templates, secure eSignature capabilities, and real-time collaboration. These tools simplify the preparation and submission of your income tax and benefit return, making it easy for teams to work together. Additionally, the platform ensures that all your sensitive data is protected.

-

Is airSlate SignNow cost-effective for filing income tax and benefit returns?

Yes, airSlate SignNow provides a cost-effective solution for managing your income tax and benefit return process. With flexible pricing plans, you can choose the level of service that fits your business size and needs. This affordability can lead to signNow savings when compared to traditional filing methods.

-

Can I integrate airSlate SignNow with other accounting software for income tax and benefit returns?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting and finance software, enabling you to synchronize your income tax and benefit return data. This integration helps streamline the entire process from preparation to filing, enhancing accuracy and efficiency. It's an essential feature for modern businesses looking to optimize their workflows.

-

How does airSlate SignNow ensure the security of my income tax and benefit return data?

AirSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your sensitive income tax and benefit return information. These protocols guarantee that your data remains confidential and secure against unauthorized access. You can trust SignNow to prioritize your data privacy.

-

What benefits can I expect from using airSlate SignNow for my tax filing?

Using airSlate SignNow for your income tax and benefit return offers several benefits, including time savings, reduced paperwork, and enhanced accuracy in your filings. The platform's intuitive design makes it easier to manage documents and obtain signatures quickly. Overall, SignNow simplifies the entire tax filing experience.

Get more for T1 Form Cra

- Tulare county superior court forms fees ampamp rules

- Request for production of an income and expense declaration after judgment family 129215 fl 396 form

- Law forms fl 397

- Form n 1a sec

- Homesuperior court of california county of placer form

- Form fl 411 affidavit of facts constituting contempt

- Attorney for superior court of california county of 490110213 form

- Attachment to declaration of support arrearage 1285625 family law 1285625 fl 421 form

Find out other T1 Form Cra

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online