Form Ptax 323

What is the Form Ptax 323

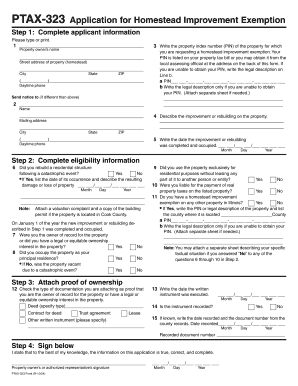

The Form Ptax 323 is a crucial document utilized for claiming a homestead improvement exemption in the United States. This form allows property owners to apply for tax relief by indicating improvements made to their property that enhance its value. By submitting the Ptax 323, homeowners can potentially reduce their property tax burden, making it an essential tool for those looking to benefit from tax savings associated with home renovations and enhancements.

How to use the Form Ptax 323

Using the Form Ptax 323 involves a straightforward process. First, ensure that you have completed any necessary improvements to your property. Next, obtain the form from your local tax authority or their website. Fill out the required information, including details about the property and the specific improvements made. Once completed, submit the form to the appropriate tax office by the designated deadline to ensure your eligibility for the homestead improvement exemption.

Steps to complete the Form Ptax 323

Completing the Form Ptax 323 involves several key steps:

- Gather necessary documentation, including proof of property ownership and details of improvements made.

- Obtain the Form Ptax 323 from your local tax authority.

- Fill out the form accurately, providing all required information about the property and improvements.

- Review the completed form for accuracy and completeness.

- Submit the form to your local tax office by the specified deadline.

Legal use of the Form Ptax 323

The legal use of the Form Ptax 323 is governed by state tax laws regarding property exemptions. To be considered valid, the form must be filled out completely and submitted within the required timeframe. It is essential to provide truthful information, as any discrepancies can lead to penalties or denial of the exemption. Understanding the legal implications ensures that homeowners can confidently utilize the form to maximize their tax benefits.

Key elements of the Form Ptax 323

Several key elements are essential for the Form Ptax 323 to be processed effectively:

- Property Information: Details about the property, including address and ownership status.

- Improvement Details: A description of the improvements made, including dates and costs.

- Signature: The homeowner's signature is required to certify the accuracy of the information provided.

- Submission Date: The date of submission must be recorded to ensure compliance with deadlines.

Form Submission Methods

The Form Ptax 323 can typically be submitted through various methods, depending on local regulations. Common submission methods include:

- Online: Many jurisdictions allow electronic submission through their tax authority's website.

- Mail: The completed form can be mailed to the local tax office.

- In-Person: Homeowners may also choose to submit the form in person at their local tax office.

Quick guide on how to complete form ptax 323

Effortlessly Prepare Form Ptax 323 on Any Device

Digital document management has become increasingly popular among enterprises and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Form Ptax 323 on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

Edit and eSign Form Ptax 323 with Ease

- Obtain Form Ptax 323 and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to secure your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form Ptax 323 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ptax 323

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form ptax 323?

The form ptax 323 is an essential document used for property tax assessment purposes. It facilitates the assessment process by collecting necessary information about property ownership and valuation. Understanding how to properly fill out the form ptax 323 can signNowly streamline your property tax management.

-

How can airSlate SignNow assist with the form ptax 323?

airSlate SignNow simplifies the process of completing and signing the form ptax 323. With our user-friendly interface, you can easily upload, edit, and eSign the form, ensuring a quick and secure submission. This allows you to focus more on managing your properties rather than paperwork.

-

Is there a cost associated with using airSlate SignNow for form ptax 323?

Yes, airSlate SignNow offers various pricing plans to suit different needs, all of which provide the features necessary to handle the form ptax 323 effectively. Each plan includes access to our eSignature capabilities, document storage, and integration options. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the form ptax 323?

airSlate SignNow includes several features that enhance the management of the form ptax 323. Some key features are customizable templates, collaboration tools, and cloud storage, all designed to improve efficiency. Additionally, our platform supports integrations with popular tools, making it easier to incorporate into your existing workflow.

-

Can I integrate airSlate SignNow with other software for handling form ptax 323?

Absolutely! airSlate SignNow offers integration options with various software platforms, allowing you to streamline your workflow when dealing with the form ptax 323. Whether you're using CRM systems or document management tools, our seamless integrations ensure a smoother process across your applications.

-

What are the benefits of using airSlate SignNow for the form ptax 323?

Using airSlate SignNow for the form ptax 323 provides numerous benefits, including time savings, reduced paperwork, and increased accuracy in document handling. Our eSignature technology ensures that your documents are signed quickly and securely, reducing delays in property tax processing. This means you can manage your property affairs more efficiently.

-

Is airSlate SignNow secure for handling sensitive information on form ptax 323?

Yes, airSlate SignNow prioritizes the security of your sensitive information when handling the form ptax 323. Our platform employs industry-standard encryption and compliance measures to safeguard your data. You can confidently complete and submit the form, knowing that your information is protected.

Get more for Form Ptax 323

Find out other Form Ptax 323

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free