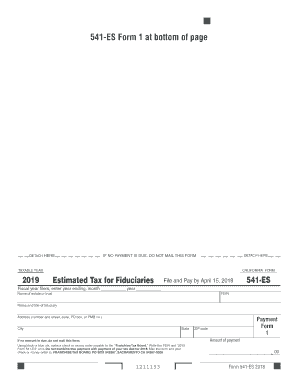

Form 541 ES Estimated Tax for Fiduciaries Form 541 ES Estimated Tax for Fiduciaries

What is the Form 541 ES Estimated Tax For Fiduciaries?

The Form 541 ES is a crucial document used by fiduciaries in the United States to report estimated tax payments. This form is specifically designed for estates and trusts, allowing them to calculate and pay estimated taxes on income generated during the tax year. The 2023 Form 541 ES ensures compliance with federal tax regulations, enabling fiduciaries to manage their tax obligations effectively.

Steps to Complete the Form 541 ES Estimated Tax For Fiduciaries

Completing the Form 541 ES involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents related to the estate or trust, including income statements and previous tax returns. Next, calculate the estimated income for the tax year, considering all sources of revenue. Once the income is determined, use the appropriate tax rate to compute the estimated tax liability. Finally, fill out the form accurately, ensuring all information is correct before submission.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form 541 ES is essential for fiduciaries. Typically, estimated tax payments are due quarterly, with specific dates set by the IRS. For the 2023 tax year, the deadlines are generally April 15, June 15, September 15, and January 15 of the following year. It is crucial to adhere to these deadlines to avoid penalties and interest on late payments.

Legal Use of the Form 541 ES Estimated Tax For Fiduciaries

The legal validity of the Form 541 ES hinges on its proper completion and submission. To be considered legally binding, the form must meet specific requirements set forth by the IRS. This includes accurate reporting of income, adherence to filing deadlines, and the use of a reliable eSignature solution when submitting electronically. Compliance with these regulations ensures that fiduciaries fulfill their tax obligations and maintain legal standing.

Key Elements of the Form 541 ES Estimated Tax For Fiduciaries

The Form 541 ES contains several key elements that fiduciaries must understand. These include the identification of the estate or trust, the calculation of estimated income, and the determination of tax liability. Additionally, the form requires fiduciaries to provide information on prior tax payments and any credits that may apply. Understanding these components is vital for accurate tax reporting and compliance.

Who Issues the Form 541 ES Estimated Tax For Fiduciaries

The Form 541 ES is issued by the Internal Revenue Service (IRS), which oversees tax regulations in the United States. This form is specifically tailored for estates and trusts, reflecting the unique tax obligations associated with fiduciary responsibilities. Fiduciaries must ensure they are using the most current version of the form, as updates may occur annually to reflect changes in tax law.

Quick guide on how to complete form 541 es estimated tax for fiduciaries form 541 es estimated tax for fiduciaries

Complete Form 541 ES Estimated Tax For Fiduciaries Form 541 ES Estimated Tax For Fiduciaries seamlessly on any device

Digital document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Form 541 ES Estimated Tax For Fiduciaries Form 541 ES Estimated Tax For Fiduciaries on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form 541 ES Estimated Tax For Fiduciaries Form 541 ES Estimated Tax For Fiduciaries effortlessly

- Locate Form 541 ES Estimated Tax For Fiduciaries Form 541 ES Estimated Tax For Fiduciaries and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Form 541 ES Estimated Tax For Fiduciaries Form 541 ES Estimated Tax For Fiduciaries and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 541 es estimated tax for fiduciaries form 541 es estimated tax for fiduciaries

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 541 es, and how is it used?

The form 541 es is an estimated tax payment form for partnerships and LLCs in California. It allows businesses to report and pay their estimated tax liabilities. Using airSlate SignNow, you can easily eSign and submit the form 541 es electronically, ensuring a seamless filing process.

-

How does airSlate SignNow simplify the filing of form 541 es?

airSlate SignNow streamlines the filing process for form 541 es by providing an intuitive platform for document management and eSigning. Users can quickly fill out the form, gather necessary signatures, and submit it directly from their device. This eliminates the need for printing and mailing, saving time and reducing the risk of errors.

-

Are there any costs associated with using airSlate SignNow for form 541 es?

Yes, airSlate SignNow offers various pricing plans to fit different business needs when filing form 541 es. Each plan includes features tailored for document preparation, storage, and eSigning. By investing in airSlate SignNow, you'll benefit from a cost-effective solution that simplifies your tax filing process.

-

What features does airSlate SignNow offer for managing form 541 es?

airSlate SignNow provides a robust set of features for managing form 541 es, including customizable templates, customizable workflows, and secure storage. Additionally, the platform allows for real-time collaboration with team members to ensure accurate completion. These features enhance productivity and make filing your forms more efficient.

-

Can airSlate SignNow integrate with other tools for handling form 541 es?

Absolutely! airSlate SignNow integrates seamlessly with various productivity tools and applications, which can be beneficial when working with form 541 es. Whether you use project management, CRM, or accounting software, these integrations ensure your workflows remain uninterrupted, enabling easier management of your tax documents.

-

Is airSlate SignNow secure for eSigning form 541 es?

Yes, airSlate SignNow prioritizes security, making it a secure platform for eSigning form 541 es. It employs advanced encryption and complies with industry standards to protect sensitive information. You can confidently eSign your tax documents, knowing that your data is safeguarded throughout the process.

-

How can I access airSlate SignNow for filing form 541 es?

You can easily access airSlate SignNow by signing up for an account on their website or through their mobile app. Once registered, you can start filing form 541 es right away using the platform's intuitive interface. Explore the features available to enhance your document management experience.

Get more for Form 541 ES Estimated Tax For Fiduciaries Form 541 ES Estimated Tax For Fiduciaries

- Property description if availableattach if necessary form

- Municipalcounty government the cost thereof shall be included as part of the work form

- Petition for commutation state of delaware division form

- Grant of lease lessor does hereby lease unto lessee and lessee does hereby rent from lessor the form

- By the laws of the state of delaware and any other agreements the parties may enter into form

- Control number de 006 d form

- State of delaware office of workers form

- If you do not have the file number you may form

Find out other Form 541 ES Estimated Tax For Fiduciaries Form 541 ES Estimated Tax For Fiduciaries

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF