Contribution Letter Form

What is the contribution letter?

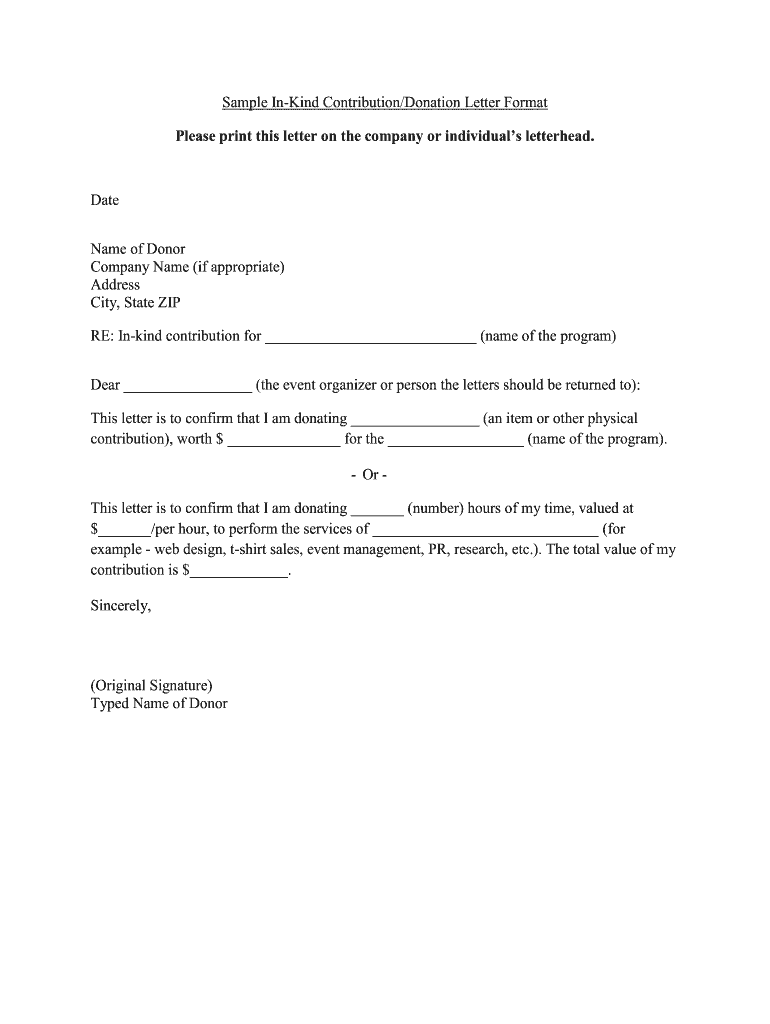

A contribution letter is a formal document that outlines a donation made to a nonprofit organization or charity. It serves as a record of the contribution, detailing the type of donation, its value, and the date it was made. This letter is essential for both the donor and the recipient organization, as it provides necessary documentation for tax purposes. For individuals making in-kind donations, such as goods or services, the contribution letter can help substantiate the value of the donation for tax deductions.

How to use the contribution letter

The contribution letter is primarily used for tax reporting and acknowledgment of donations. Donors should retain a copy of the letter for their records, especially during tax season. When filing taxes, the information contained in the contribution letter can be used to claim deductions for charitable contributions. It is important for the letter to be accurate and complete to ensure compliance with IRS guidelines.

Steps to complete the contribution letter

Completing a contribution letter involves several key steps:

- Identify the recipient organization and ensure it is a qualified charity.

- Detail the type of contribution, whether it is cash, property, or services.

- Assign a fair market value to the contribution, particularly for in-kind donations.

- Include the date of the contribution and any relevant transaction details.

- Obtain the signature of an authorized representative from the organization to validate the letter.

Key elements of the contribution letter

A well-structured contribution letter should include the following elements:

- The name and address of the donor.

- The name and address of the recipient organization.

- A description of the contribution, including its value.

- The date the contribution was made.

- A statement confirming that no goods or services were provided in exchange for the contribution, if applicable.

Legal use of the contribution letter

The contribution letter is legally significant, particularly for tax reporting purposes. It must comply with IRS regulations to be considered valid. For contributions exceeding a certain value, the IRS requires a written acknowledgment from the charity. This acknowledgment serves as proof of the donation and is necessary for the donor to claim a tax deduction. Understanding the legal implications of the contribution letter can help ensure that donors meet all requirements.

Examples of using the contribution letter

Contribution letters can be utilized in various scenarios, such as:

- A donor providing a cash donation to a local charity, receiving a letter acknowledging the amount.

- An individual donating clothing to a nonprofit organization, receiving a letter detailing the items and their estimated value.

- A business offering pro bono services to a community organization, documenting the value of those services in a contribution letter.

Quick guide on how to complete contribution letter

Complete Contribution Letter effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly and without interruptions. Handle Contribution Letter on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The simplest way to edit and electronically sign Contribution Letter effortlessly

- Find Contribution Letter and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as an authentic wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious searches for forms, or the need to print new document copies due to errors. airSlate SignNow meets your document management needs in just a few clicks from whichever device you prefer. Modify and electronically sign Contribution Letter and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the contribution letter

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a contribution letter?

A contribution letter is a document that outlines a donation or contribution made by an individual or organization. With airSlate SignNow, you can easily create, send, and eSign your contribution letter, ensuring a professional presentation and clear communication about the terms of the contribution.

-

How can airSlate SignNow help with managing contribution letters?

airSlate SignNow streamlines the process of creating and managing contribution letters by allowing users to easily draft, send, and track their documents. The platform’s user-friendly interface ensures that your contribution letters are customized quickly and sent securely to recipients, keeping your donations organized.

-

Is there a cost associated with using airSlate SignNow for contribution letters?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. The pricing is affordable and provides access to features that enhance the efficiency of creating and managing contribution letters, making it a cost-effective solution for businesses of all sizes.

-

What features does airSlate SignNow offer for contribution letters?

airSlate SignNow includes features that simplify the creation and signing process of contribution letters. Key features include document templates, real-time collaboration, electronic signatures, and document tracking, making it easy to manage your contribution letters efficiently.

-

Can I integrate airSlate SignNow with other tools for contribution letters?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, which can enhance your experience when managing contribution letters. Whether you use CRM systems, cloud storage, or email platforms, integration ensures all your documents are easily accessible and organized.

-

What benefits does airSlate SignNow provide for businesses sending contribution letters?

Using airSlate SignNow to send contribution letters signNowly improves efficiency and communication. The platform ensures that your letters are sent and signed promptly, reducing turnaround time and providing a secure method for handling sensitive donation information.

-

Is it easy to track the status of contribution letters with airSlate SignNow?

Yes, airSlate SignNow offers a robust tracking system that allows you to monitor the status of your contribution letters in real-time. You’ll receive notifications for document views and signatures, enabling you to stay informed throughout the process.

Get more for Contribution Letter

- Court appointed attorneys public defendersanoka form

- Request for administrative review of income tax offset form

- Colorado judicial branch self help appeals criminal appeal form

- Motion to determine factual innocence form

- Colorado circuit court number epsleecswsuedu form

- Colorado judicial branch 2nd judicial district co courts form

- A guide to small claims court legal aid of north carolina form

- Jdf 250 notice claims and summons for trial r01 17pdf form

Find out other Contribution Letter

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word