Wisconsin Release of Mortgage Form

What is the Wisconsin Release of Mortgage Form

The Wisconsin release of mortgage document is a legal form used to officially terminate a mortgage agreement once the borrower has paid off their loan. This document serves as proof that the lender has relinquished their claim on the property, allowing the borrower to regain full ownership without any encumbrances. It is crucial for homeowners to obtain this release to clear their title and facilitate any future transactions involving the property.

Steps to Complete the Wisconsin Release of Mortgage Form

Completing the Wisconsin release of mortgage form involves several key steps to ensure accuracy and compliance with legal requirements. First, gather all necessary information, including the original mortgage details, borrower and lender information, and property description. Next, fill out the form with precise details, ensuring that all names and addresses are correctly entered. After completing the form, both parties must sign it in the presence of a notary public to validate the document. Finally, submit the signed form to the appropriate county office for recording.

Legal Use of the Wisconsin Release of Mortgage Form

The legal use of the Wisconsin release of mortgage document is essential for protecting the rights of both borrowers and lenders. Once executed, this form must be filed with the county register of deeds to be effective. This action ensures that the release is officially recorded in public records, which is vital for establishing clear title to the property. Failure to file the release may result in ongoing claims against the property, complicating future sales or refinancing efforts.

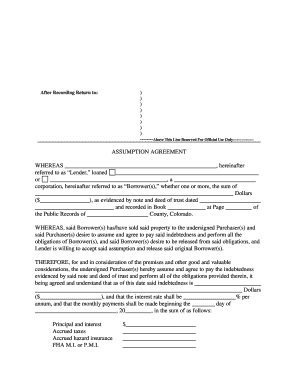

Key Elements of the Wisconsin Release of Mortgage Form

Several key elements must be included in the Wisconsin release of mortgage document to ensure its validity. These elements typically include:

- Borrower Information: Full names and addresses of the borrower(s).

- Lender Information: Full names and addresses of the lender(s).

- Property Description: A detailed description of the property, including the legal description.

- Mortgage Details: Information about the original mortgage, including the date it was executed and the amount.

- Signatures: Signatures of both parties, along with a notary's acknowledgment.

How to Obtain the Wisconsin Release of Mortgage Form

Obtaining the Wisconsin release of mortgage document is a straightforward process. Homeowners can typically request the form from their lender or download it from official state or county websites. It is important to ensure that the correct version of the form is used, as variations may exist based on specific lender requirements or county regulations. Once obtained, the form should be filled out carefully, following the necessary legal guidelines.

Form Submission Methods

The completed Wisconsin release of mortgage document can be submitted through various methods. Homeowners may choose to file the form in person at the county register of deeds office, which allows for immediate processing. Alternatively, the form can often be mailed to the appropriate office, though this may result in longer processing times. Some counties may also offer electronic submission options, streamlining the filing process for homeowners.

Quick guide on how to complete wisconsin release of mortgage form

Manage Wisconsin Release Of Mortgage Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, enabling you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without any waiting. Handle Wisconsin Release Of Mortgage Form across any platform with airSlate SignNow applications for Android or iOS and simplify your document-related tasks today.

The easiest way to modify and eSign Wisconsin Release Of Mortgage Form with ease

- Obtain Wisconsin Release Of Mortgage Form and click on Get Form to begin.

- Use the available tools to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign feature, which only takes a few seconds and has the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to submit your form, whether by email, SMS, or invite link, or download it to your computer.

Put an end to lost or mislaid files, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Modify and eSign Wisconsin Release Of Mortgage Form while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wisconsin release of mortgage form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a mortgage release form?

A mortgage release form is a legal document used to release the lien a lender holds on a property after the mortgage has been paid in full. This form is crucial for homeowners to maintain clear property titles and avoid potential disputes in the future. By using airSlate SignNow, you can easily create and eSign your mortgage release form quickly and securely.

-

How can I create a mortgage release form using airSlate SignNow?

Creating a mortgage release form with airSlate SignNow is simple and intuitive. You can use our customizable templates to generate the document effortlessly and send it for eSignature. With just a few clicks, you can have a legally binding mortgage release form ready for your needs.

-

What are the benefits of using airSlate SignNow for my mortgage release form?

Using airSlate SignNow for your mortgage release form offers numerous benefits, including improved efficiency, reduced turnaround time, and enhanced security. Our cloud-based solution allows you to track and manage your documents from anywhere, ensuring a seamless experience. Additionally, eSigning eliminates the need for printing, mailing, and physical storage.

-

Are there any costs associated with using airSlate SignNow for mortgage release forms?

Yes, airSlate SignNow offers various pricing plans designed to fit different business needs, including options for individuals and organizations. Each plan includes access to create and manage mortgage release forms, among other features. You can choose a subscription that best aligns with your budget and requirements for document management.

-

Can I integrate airSlate SignNow with other software for managing mortgage release forms?

Absolutely! airSlate SignNow integrates seamlessly with many popular applications, allowing you to manage mortgage release forms alongside your other tools. By connecting our platform with your existing software systems, you can streamline workflows and enhance overall efficiency while maintaining a single source of truth for document management.

-

Is my data safe when using airSlate SignNow for mortgage release forms?

Yes, security is a top priority for airSlate SignNow. We adhere to strict data protection measures to ensure that your mortgage release forms and other documents are safe from unauthorized access. Our platform uses encryption and complies with relevant regulations to protect your sensitive information.

-

How do I send a mortgage release form for signing?

Sending a mortgage release form for signing is quick and easy with airSlate SignNow. Simply upload your document, specify the signers, and send the request via email. You can also track the signing progress in real-time, ensuring that you stay updated on the status of your document.

Get more for Wisconsin Release Of Mortgage Form

- Ancillary financial report delaware family court legal forms

- Ancillary pretrial stipulation form

- Recent developments in federal income taxation william form

- The respondent hereby answers the numbered paragraphs in the pleading as form

- The date of the trust instrument execution is form

- Effective february 1 2019 the family court revised the delaware child support formula as stated within family court

- Type the name and birth date of your 1st adult child form

- Delaware communication portfolio summary and dynamic form

Find out other Wisconsin Release Of Mortgage Form

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself